The article is by Chriss W Street who is a pretty reliable columnist at Breitbart. His comment of breakeven at a much lower price is interesting. Non-Saudi OPEC countries may continue to flood the market for the sake of revenue. I haven't seen much of a gasoline price hike getting into the summer driving season so far.

I am hoping Rock Man will weigh in on the subject. If $32 is the magic number, it doesn't seem like the rig count and permitting would be drastically down.

Oil Demand and Well Decline Rates Ensure Strong Outlook for Oil Industry

Oilfield Decline Rates

Is the Permian Basin Seeing the End of the Oil Boom?

"Edwards says, even in these low prices, there can still be a positive return, "So, if you take 40% lower cost, then you get 40% less for your oil. Really, the oil and gas companies, if you go back to drilling today, we're getting the same economics we got at $100 oil, because the wells will pay out, in the same period of time."

A couple of comments - the diagram on "oil field decline rates" misses one big point as to these unconventional reservoirs, i.e. there is an almost instantaneous and rapid decline after peak rate is achieved - there is no "plateau" of stable production for these types of reservoirs. So to maintain and grow production in these types of plays, a lot of wells have to be drilled (using a ton of capital) to over rule the steep individual well declines.

Second comment is to the $32 oil magic number - I have seen a lot of economic runs lately - until operating costs come down a LOT more than they have to date, this number makes no sense to be as to being a "break even" number. Add in the cost of capital for many companies (e.g. private equity with a yearly vig of 8-10%), marginal economics make no sense to drill to attain. Better to sit an leave the funds with the PE group.

Just my opinion, as usual

Thank you, Rock Man. Yours is much more than opinion. I thought the $32 figure was far-fetched.

Thanks

Now if you can drop D&C costs plus monthly operating costs and SWD by 60-70% from the "old" $100 oil days, you may be able to do something at those lower numbers.

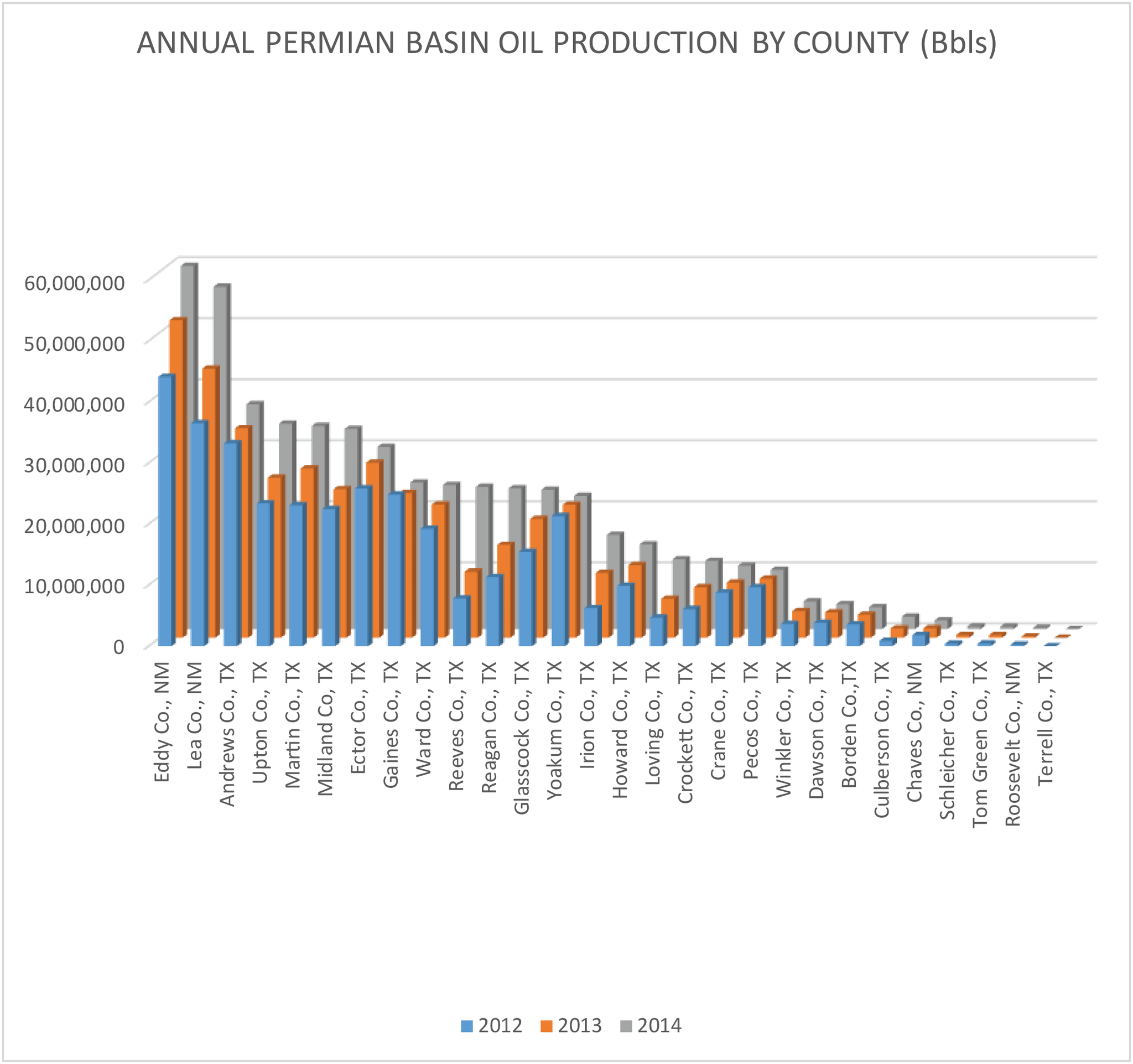

Good info - it is interesting to see the rig county by county (at least for Midland Basin)

For horizontal activity:

Midland, Martin, Reagan all up

Andrews, Glasscock and Upton all down

Dawson (1 rig) and Howard flat

For Vertical activity

Upton, Reagan and Martin all up

Midland, Glasscock, Howard and Andrews all down

Borden flat

These up/down patterns are over last 2-3 months

Do you think vertical wells are being permanently replaced by horizontal wells, or will vertical wells be the ones left standing if the oil price environment stays around $50? How often are horizontal wells used in non-tight oil/gas plays?

It all comes down to economics and the various operators' cost of capital and related situations.

On the norm, horizontals normally used for unconventional tight rock plays. But verticals can also tap these types of reservoirs using multi stage fracs - just much lower rate wells (and potentially more marginally economic depending on rate).

Just saw some numbers the other day for recent 4 stage frac vertical wells costing $1.2$1.3 MM drilled and completed (including surface facilities). Pipeline hook up extra,

Russia Says Shale Will Affect Oil Prices More Than Iran’s Return

"The minister noted that, on average, the cost of producing shale is now between $50 and $65 per barrel, about the same market price of a barrel of oil today. For now, at least, that leaves many shale producers in the United States will little or no profit margin.

But if the price of oil rises, U.S. shale drilling would increase. So far, Novak said, the low price of crude has cut the number of drilling rigs in the United States by nearly two-thirds, from 1,600 to 650. But he noted that shale drilling is becoming more efficient and less expensive thanks to improvements in technology. For many drillers, he said, “shale is feeling very well” even at today’s low prices."

Dicker Tells Cramer: This Will Be the Last Trip Down for Oil Prices

Long-Predicted U.S. Shale Production Collapse May Not Materialize YetThe picture from the producer side of the fence is rather different. Sub-$60 will mean that many conventional oil producers are in great difficulty. Many shale producers are arguably already insolvent. High debt levels are secured against assets, i.e. oil and gas reserves. Reserves in turn vary with oil price and as the price goes down so arguably does the volume and value of those reserves. It is widely believed that for the oil price to recover, OECD companies must pump less oil. Pumping less oil for lower price will be route 1 to bankruptcy for many highly leveraged companies producing high cost oil. I believe the industry may face a crisis unparalleled in recent decades.The future is just about to begin.

The Core Labs Q2 July 23, 2015 earnings calls is an interesting listen/read.

http://finance.yahoo.com/news/edited-transcript-clb-earnings-conference-231337813.html

"...Core believes that worldwide crude oil supply and demand markets are well on their way to a balance at year end, 2015. On the crude oil supply side, US production peaked in April of this year.

One only needs to look at Bakken production, which peaked in December, and Eagle Ford production, which peaked earlier this year. With respective decline curve rates of 70%, 40% and 20%, for the first three years of production in these tight oil plays, significant in year-over-year declines will manifest themselves, as 2015 progresses. And, into sharp declines if activity levels remain at constant levels into 2016.

Ditto this analysis is for the Permian, Niobrara and all the liquids rich unconventional plays. From peak US oil production numbers earlier this year of 9.5 million barrels, Core believes that US production will decline over 500,000 barrels through year end 2015, equating to a US decline curve rate, on an annual basis, of 10.5 net. The highest of any major production area in the world.

These activity levels persist in North America. North America will remain in decline, going into 2016, maybe dropping an additional 500,000 barrels of production. Moreover, internationally, Core does not believe the recent increases in production from the Middle East and Russia are sustainable over the long run. Decline curves in Russia will be greater than the 2.5% net, used by Core lab on a worldwide basis."

They Sold For HOW Much?? Japanese Corp. Sells US Shale Stake For Ju...

US Shale: How Smoke And Mirrors Could Cost Investors Millions

Wonder if any management fell on their swords as to this US investment failure?

Another failed Asian foray into the US shale markets - Osaka (Cabot / Pearsall), Sumitomo (Devon / Cline)

I'm guessing golden parachutes are more likely outcomes. Unless continuing to hold the interest had liabilities and required ongoing inputs, I can't see selling for one dollar.

If true, would this be primarily due to drilling cost reductions for vertical drilling? Or would the vertical drillers be targeting different formations which are less expensive to drill? The quote below is from the original story. It appears to have been edited out of the updated story.

Oil Prices Allowing Smaller Companies More Vertical Drilling

Landmen tell CBS 7 News right now some larger oil companies are not renewing leases for horizontal drilling which allows smaller companies to lease the lands to drill more vertical wells.

Not all acreage related to horizontal plays is prone to be able to be drilled vertically for either single targets or multi zone targets.

$40 oil makes this even tougher