We signed a lease last October with Rebellion Energy on 80 NMA in Section 11-6N -7W in Grady County. In April I was told they had spud the well and were in the horizontal phase. Fracking would begin after that. I then got a notice from OCC stating Camino Natural Resources is wanting to drill and produce a multi unit horizontal well targeting the Woodford. Can anyone tell me the status of this well? I have looked on the OCC’s website and can’t find anything on it.

The Michael 0607 11-2 well has a surface location in 13, so that is why it is hard to find. It was spud by Rebellion on 4/17/18. Two section wells usually take about 4-5 months to drill and complete, so it is probably just about finished. I checked on the OTC site and do not see it as active yet, so no news on first sales date. The interim order is a hint that it is finished with 50% in 2 and 50% in 11.

Can you post the case number for the Camino case? I don’t see them in 11, but do see a new set of cases in 10 from them.

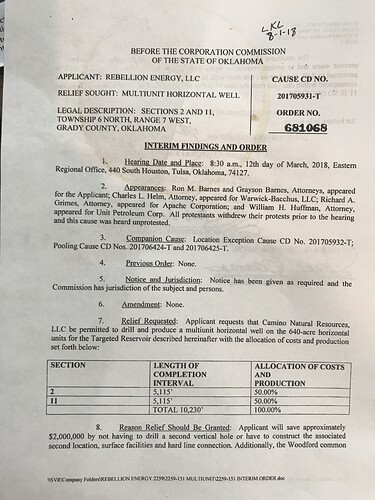

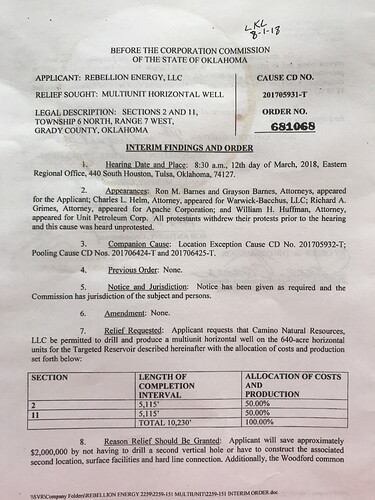

This case 201705931-T/681068 says Rebellion. It is already drilled. You mentioned a Camino case. That is the one I was trying to find.

On the order it says Relief Requested is for Camino Resources to drill and produce the horizontal well on the 640 acre horizontal units for the targeted Reservoir describes hereafter…

The order i just received was referring to Camino. Don’t have a different case number. That’s what i was referring to.

Got it. I read further down. Odd that the top says Rebellion and the middle says Camino. Rebellion actually drilled the well. This particular order is an interim order. It is effectively saying that the well has been drilled and the split between the two sections is 50/50. The Division Order will come out next. Eventually, they may come out with a final order. Doesn’t look like there is a second well yet.

Ok, Great! Praying it’s a good one! I have other minerals in Grady county that are already leased years ago and are barely or are NOT producing. How can i find the status of production and if the lease is still in effect. I just inherited all these and have no clue what I’m doing!!! ![]()

![]()

![]()

![]()

Since i do not know how this actually works and just going off my common sense, would we have been ahead to pool instead of leasing? Looks like any proceeds from this well are going to be split between Mineral owners in section 2 and section 11.

There are some very good resources to help you get started in learning. Don’t let anyone push you into selling anything until you get your feet under you. Some of your sections may have low production, but pending activity.

Read over the last few months on the forum for Grady and see what other folks have been asking and you will learn a great deal from them.

You can check your production at the Ok Tax Site. https://www2.oktax.onenet.net/GrossProduction/gp_PublicSearchPUNbyLegal.php

Thank you, M_ forbthe info on 18-7-6. A friend accessed Unit’s June 22nd app to OCC for a density change. The two-hole well will be 40% in Sec. 18 and 60% in Sec. 7. The App mailing list had my sister me as recipients but the addresses were wrong for both of us. I contacted Unit’s law firm’s number and had them correct the addresses. No way to know where they are time-wise on drilling. I may have to drive out there to see if there’s any activity.

Again, thanks

Mike Mager

18-7N-6W Just spud. Steelman 2-18-7XHS http://imaging.occeweb.com/OG/Well%20Records/1DD8111B.pdf

New today although I’ve been selectively reading the forum for months so now my question - please bear with me - it may be disjointed.

I inherited some minerals in 20-10N-08W that my Dad signed a lease with Payrock in 2015. The primary term is expiring in September. I am aware that Payrock sold assets to Marathon. With all that is going on in Grady County should I contact Marathon and ask if they intend extend to the 2nd or contact the original landman or ? FYI I received a copy of order 674480 for drilling and spacing units and it appears it included a pooling share of 1/8th but my Dad’s lease was 3/16ths.

Thank you

Marathon spud the Myers 1008 1-17-20MXH in September 2017. It became active with first sales as of May 5, 2018. You should be getting a Division Order in about September. That means that you have moved from the primary term of the lease and into the secondary term of production. You do not need to worry about an extension. You probably need to contact Marathon and make sure that they have a copy of your Dad’s lease with the correct 3/16ths amount now. If your dad lived in OK and the will was probated in OK, then you will have less hassle. You need to make sure your name and address and the mineral descriptions are filed in the county courthouse in Grady. Contact the attorney listed in the pooling documents to get that error corrected. Do it quickly since they are working on the Division Order title opinion now.

Hi Martha, in 10-6n6w Marathon and CLR have been proposing/protesting wells and operations. Don’t find anything finalized on the occ website. Can you tell what the latest is?

Thanks, John

Also, I was contacted last year by Stamps Brothers Oil and Gas about my interest in 2-5N-6W, that is currently held by weak production. They were supposedly protesting at the OCC. No word in months.

Considering selling 30 NMA in Grady 32-6N-6W. It belongs to my 85-year old mother who is getting hardly anything in royalties from the LINTON well. She has what I would consider a substantial offer from CLR. She is healthy now (with diminishing memory) but considering her age, the proceeds could be beneficial for her during end of life care that may be needed. Otherwise, she may never realize any significant royalty payments in her lifetime. I am a novice and learning every day, but advice is welcomed, as well as what may be considered a “good offer” per NMA in this area. Thanks.

What is the royalty rate in her lease?

Stephen, Two sections next door to her to the east have five wells each, so the potential for more wells in her section exists. She has a different operator which may make a difference, or that operator could sell to a more active operator. Timing may be the important factor.

Jeffrey can give good financial advice on what is being offered in the area. One thing to consider is the capital gains tax that she would incur by selling vs the step up reset of the value if she passes it on to her children in a will. Another thing to consider is she can sell part and keep part to pass on or sell all or keep all. Lots of choices. If she need the funds for ongoing care, that could be important. If you really think you need to sell, get more than one offer as the first ones can be quite low in my experience. I have seen offers of $14,000-32,000/ac in the northern part of the township where both the Woodford and the Springer reservoirs exist.