When you say “ If you took depletion, then you must reduce your basis for determining the taxable gain on the sale”, that sounds like it will reduce the capital gain and be a good thing….more of a “you’re entitled to reduce your basis….?” My taxes are very simple, I understand them very well, (with the obvious exception being depletion). I am in contact with my accountant and will be meeting with him to discuss this. I do not want to downplay his knowledge - he may be one step ahead of me and already have taken all of this into account. Unfortunately here in rural Utah, we do not have the resources you do in Texas.

Your original basis was the value at the time of death of your parents’ death. Let’s suppose it was $10,000. If you took $1,000 of depletion over the years, then you reduce your basis by that amount - so your basis would now be $9,000 (being $10,000 original basis less $1,000 depletion). If you took no depletion, then your basis would still be $10,000. Now you sell your minerals for $25,000. Your gain is the difference between the sales price and the basis. So it would be $15,000 ($25,000 sales price less $10,000 original basis) if you took no depletion. It would be $16,000 ($25,000 sales price less $9,000 current basis) if you took depletion. Since you have owned the minerals for years this is long-term capital gain. It is reported on Schedule D and the tax rate is lower than short-term capital gains. This is for federal income taxes. You will also have to report on your Utah state tax return which may have different rules.

That spells it out very clearly. Thank you for your help!

As for determining the potential value of your minerals your Accountant could also help you to come up with a discounted present value of the income stream produced by your minerals over the last twenty years with a factor for decline in production. This will not account for production from any future wells, new discoveries, or new technologies, but it is a starting point.

Our Dad bought a ranch 677 acres in Bastrop County Texas. He left us 50 % of 543 and 100% of 123 acres of mineral rights. The survey A.Culling we are trying to sell. We were offered 2000.00 Total that a low number?

Thanks so much for any help

Caroline and Robert

Think you’ll have a better chance getting an answer to your question if you’ll go to the Counties section at the top of this page, work your way down to the section for Bastrop County, Texas and post it again there.

You might also make clearer…was the offer you got for $2,000 total or that much per net mineral acre? Is your mineral interest currently leased?

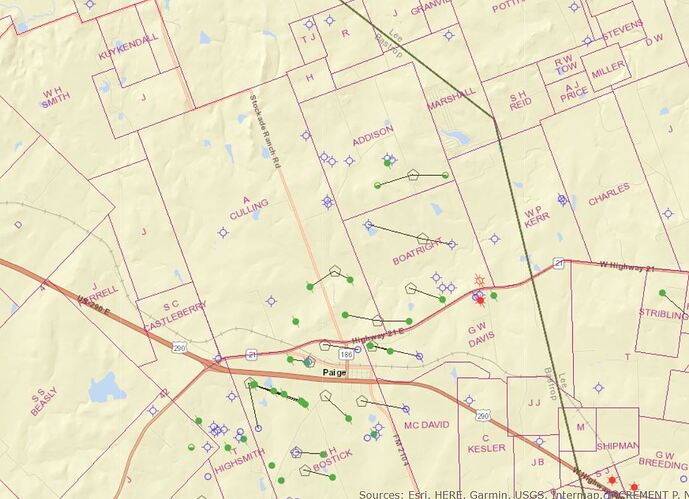

For what it’s worth, below is what the Railroad Commission’s map for that area is currently showing. Looks like the only thing that hasn’t been plugged are the short lateral horizontal wells in the southeast corner of the survey that were originally drilled by Geosouthern but may have later been acquired by Magnolia. It looks like they’ve produced for a long time but haven’t shown volume in last five years, which may mean they are also plugged but not updated on the map. If someone is making you an offer it may indicate activity is moving your direction but at this point I don’t see any new permits nearby.

Thanks for the information. What do the green dots on our property mean? Thanks

Green dots are oil wells, red ones are gas. If there is a slash through the symbol, they are not longer producing.

It looks like the wells are on A. Culling land? What do we do? No one has contacted us? How do I know who to contact. Thank you for your patience with folks who don’t have a clue.

This topic was automatically closed after 90 days. New replies are no longer allowed.

I have share of land and minerals in dueschene county and uintha county. Not a lot though. It was bought by my great grandfather and passed on to his children, my grandfather to his children to me. It’s complicated

There are others who also went in on the purchase of this property, because the law said he could not win that much by himself.

I’m trying to untangle the legalities of ownership.

Could you tell me who the producers are.

Please post this question in the correct state and county. You also need to give more specific locations such as section, township and range as both counties are large and values will vary. This topic is closed.