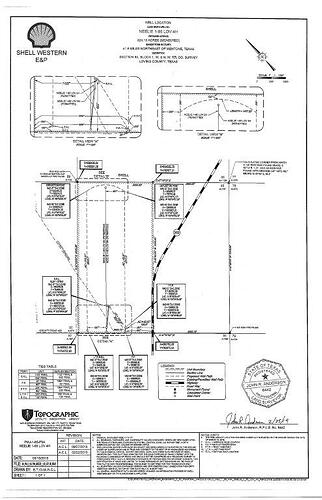

Operators starting to drill horseshoe shaped horizontals to be able to drill two wells through one borehole. See the attached plat in Loving County. They drill down to the end of the section, make a 180 turn, and drill back up the other side.

Thanks, was wondering when we’d see multiple lateral wellbores from common vertical shaft.

This well API 301-34156 spudded Feb-19, first production June-19, peaked 22,256 bbl month-2, only 196,000 bbl in two years cumulative plus associated gas. TVD 11,134 MD 22,135. Wolfcamp ceiling 10,791, this well is Wolfcamp B? Doesn’t seem too impressive, imho.

FYI, Shell is reportedly trying to sell its Permian (Delaware Basin) acreage for extravagant price. .

Targa building one cryo plant and relocating another in the Midland Basin. 450 MMcfd capacity total.

Roy: Tough for me to make out the schematic, but looks like they went vertical, then horizontal, then stayed horizontal and just “went around the corner-if you will” and continued in the same formation back in the direction they started from. More of an increased density wellbore, without having to drill a new vertical hole. I could be wrong but impressive, none the less.

Thx, regarding Shell’s “horseshoe horizontal”, I didn’t know a lateral wellbore could turn 180-degrees, I suppose it results in a long lateral folded inside one section, instead of the conventional long lateral spanning two sections. This well is two years old, have not noticed any E&P companies bragging about such techniques. In fact, many Delaware Basin public E&P companies in recent quarterly webcasts boast about just two drilling accomplishments: drilling a few long laterals more than 2 miles horizontal, plus wider spacing that produces almost as much oil as their previous tighter spacing (fewer wells, greater productivity per well). In other words, this Shell “horseshoe horizontal” may be an anomaly, and Shell plans to exit the Permian.

Maybe an anomaly as I am sure they would rather just drill 2 miles + in a straight line. Roy is also correct that the trend is for less density on wells to reduce parent/child well interference. However, I thought this was an interesting option if you are hemmed in to a single section and have room for two more wells. It also raises some issues about what spacing the horseshoe bend has to use away from the adjacent lease line. It would seem to save money and allow the strip along the section ends to be fully developed. It also is a way to drill a “lease line” well along the section line by using the horseshoe as the lease line well.

Rosy article about the Permian. The question is whether consolidation is being confused as a sign of growth.

Solaris Midstream may be going public.

Article about the new capital discipline lenders are showing operators.

Pin Oak completed their crude pipeline from Taft to Ingleside. Mare export capacity for Permian crude.

Appalachian Basin reporting record production. With nearly $5 gas, they could have a big year there.

Drumbeat continues for regulating methane emissions through the EPA. There is a lot of concern over the accuracy of these satellite data studies. Also, most media is ignorant of the distinction between a flare and a vent. Flares are burning off gas you cannot sell. Vents are burning off side products from tank batteries and refineries that cannot be processed. I am not sure because the photo is cut off in the article, but I bet that is a vent.

Other studies have shown Permian flaring has declined substantially since the pipeline capacity has caught up. Most operators would be pretty foolish to unnecessarily flare gas toady with it being near $5/mcf. In short, the accuracy of this article is suspect, but that usually does not get in the way of putting out the narrative.

California had to seek a waiver from the US Government to operate its gas powered electricity generators without pollution controls due to electricity shortages. Similarly, Europe has seen huge spikes in electricity prices due to slack wind periods and low wind generation.

In short, a series of good press about why natural gas is needed to make for a stable electricity market.

Pioneer wanting to sell its Delaware Basin assets for around $2 billion. Not to be confused with its Midland Basin assets, which are the bulk of its acreage.

Waterbridge purchased Colgate’s water distribution assets.

A big one. Shell selling its Delaware acreage to Conoco Phillips for $9.5 billion. The map in the article says it all as to why.

Great pick up for C-P. Shell had been indecisive for quite a few years as to what is was going to do after their initial splash.

They did not really compete against each other much, so competition for leases should not be impacted that much. However, a more determined operator is taking over.

Will be interesting to see what C-P sheds to help pay for this.

Forbes article on earthquake issues in the Delaware.

Sabalo got another $300 million from Encap and sold $715 million in Midland Basin properties to Laredo.

BP’s attempts to rapidly shift to renewables.

Summary of production growth in the Permian and other basins.