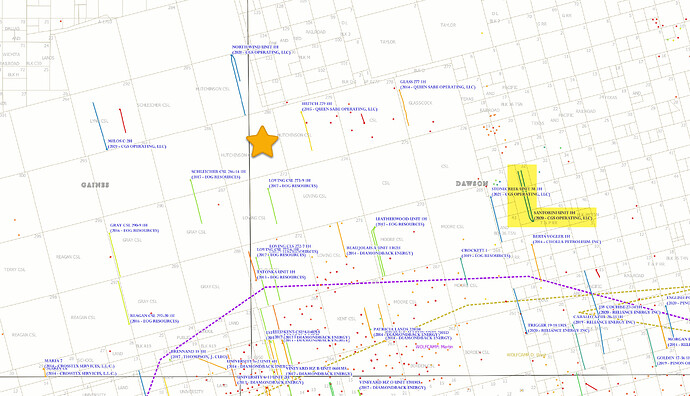

From what I can tell, it looks like CGS has a working relationship with EOG, such as possibly a DrillCo where they drill the wells then turn them over to EOG (thanks, forum! Link: CGS Operating LLC = EOG and EOG - 3000 leases in Gaines and Dawson County, Texas), and looking at the data shows CGS is playing their cards close to their chest. Their drilling, completions, and production reporting all look like they’re trying to hide either how good or how bad the production is in the North extension of the Wolfcamp play.

My biggest question would be why they haven’t produced, or at least reported production on, the North Wind Unit. There’s one month of production back in May and Aug of 2020 for those two wells (1H & 2H) and it’s terrible. So bad it has to be just a few days of flowback (where the well is cleaning up after production and makes mostly water) that must have been produced and reported. But either it’s A) producing and they’re strategically “behind” on reporting production, B) not producing because it’s so good they want to hold off until they can get more acreage and better commodity pricing, or C) so bad they don’t want to produce it and disprove the productivity acreage before offloading it. I guess D) would be if there was a mechanical or logistical issue with the wells (the 2H survey is cut short in public records…that could be a bad sign for the integrity of the well).

The Santorini Unit is the only one producing on public record and is rockin’ it. My guess is CGS is milking this for all they can hoping investors speculate that all the wells are that good.

The two wells EOG operates South of you are not terribly great wells. Your acreage value 100% depends on the North Wind Unit producing well. The buyer offering the $3600 is probably speculating (or has inside info) on the productivity of those wells.