That was some pretty dramatic commentary… Prices go up and down. I feel we are in a oil bull market once again. Anybody that was offering to buy acreage is planning on making many times the purchase price to start with.

I received an offer 3 weeks ago from Southwest Energy Partners. Their offer was $6000-$9500 per acre. They are the company that reports the gas on the Whetstone well. Sure wish I knew what they know.

Very grateful for this forum, overwhelmed by the mineral right process due to mistakes made in contacting wrong individuals creating the same feeding frenzy one would encounter when executing the estate of family, i.e.: “You better do something quick or you will blow it!” “Sell your rights; the taxes will eat you alive on royalties!” Etc., etc. etc.

Question mineral rights: How long and what happens when you sit on offers?

• Information for comparison is my offer for section 14 in McClain County: $2000 per acre for 3-year term with 2-year extension option at $2000 per net acre providing an 18.75% (3/16) royalty. Variations from this offer are limited to one reduction to $1600 per acre.

• For reference, please note:

Notice of hearing for Horizontal spacing sought by Native Exploration Operating, LLC. CD No. 201808347, which includes the 232 names of mineral right holders and exhibit B for sections 14 & 23, land affected.

From Native Exploration comes Rock Creek Land & Energy if that is any help in referencing offers.

Great question. First, by your posting the CD number we can see that the land involved is Section 14 6N 3W, and that Marathon and Roan Resources have protested the application. If there is a fight for operations, values can sometimes go way up. Also a local lawyer in Purcell, James Blevins, has also filed an objection to service on his client. You can see the documents by using: http://imaging.occeweb.com/imaging/OAP.aspx to search for the documents in the CD #.

That said, there is always a chance, even if it is a small chance, that all of the parties will walk away. But as a business decision, if it were mine, I would try to contact the protesting parties to see if they are interested in leasing your minerals.

Educate yourself on lease terms that you need to have. There is lots of good info on this site.

Yup, that observation applies to EVERY offer you receive.

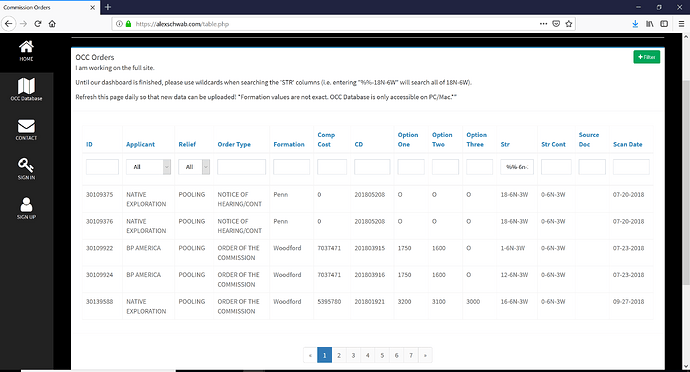

I would recommend checking the CD’s and pooling offers attached

and look them over in detail on the OCC website. Pooling amounts are rising in surrounding sections. Section 16 was pooled at $3000/acre @1/5 on a well that costs approximately $5,395,780 in September of this year. There are lower pooling amounts in 6n-2w and higher in 6n-4w etc., so it really just depends on the specific section.Mr. Pfisch:

How do you thank someone for so much knowledge and the piece of advice I would have never contemplated. Thank you so much for the knowledge, which, like a sharp knife, can cut through, the …. Sludge? (Yes, a stab at oil humor.)

Having downloaded each of the 7 documents from the Oklahoma Corporation Commission to study at length am amazed at how immediate these applications, motions, entry of appearance, affidavit and protest have been initiated, 10-15 thru 11-7-2018, reference initial filing of 10-12-2018. With that the question: If Marathon Oil Company or Roan Resources were to hold the mineral rights, what effect to the Multi-unit horizontal well wherein more your logic to contact parties becomes impeccable and I thank you again for so much help.

In reference to lease terms, have read many references in this forum to having the knowledge of terms and stipulations generated in a lease agreement ARE more important, not “can be” but ARE more important than the income or royalty gleaned from leasing/selling.

Will take time for me to absorb the information I can pull from occeweb.com (OAP) not to mention one can even access forms, logs, unit names, Planned Unit Development (they have a tax for that one? LOL) available and add to my amazement of information available.

Thank You Very Much Frank Pfisch!

You are welcome Elvis.

If you are number(s) oriented, you might want to look at:

This document has a fairly comprehensive list of risk factors and formulas. It shows just how complicated purchasing oil and gas income property can be. Many buyers simply apply a high to very high discount rate to give themselves a wide margin for error.

Alex Schwab: Did not see your response immediately thus let me Thank You for your insight as with Frank Pfisch. Invaluable is the only way to describe your insight and I thank you for that, which is an effort to answer not only my questions but also that of so many in questions posed to this forum.

Am able to coordinate the data in this document’s reference table you have provided me/us/ most of all Court Document numbers to reference, with date of offers thus identify expediency of systematic legal applications seen in my case. Although a visual to show activity, the information presented is an example of what you make available to this forum and I thank you.

Frank, thank you for the portable document file 96-1703, which in the beginning demonstrates the equation for the Discounted Cash Flow and three techniques for estimating a discount rate in the DCF wherein I think I peed myself a little.

Yep, I’m old school Dr. Deming: Statistical Process Control, three sigma but this information treats me like a baby treats a diaper.

YES I will examine the yet more information tangent to money in my pocket you would create for me but please also be aware you dealing with a man, with a map in the truck, showing me how to get home from Walmart! (Insert big happy face here.)

Thank you Frank for your respect and need to help us.