My highest offer was $14,000 per acre and to whomever might be reading this…that is too low. My Dad kept this asset his entire life and I once told him not to sell so unless selling is to my benefit I shouldnt sell either. I like $50,000…believe the capital gains tax is 20%?? My last offer was from Titanium

Federal Capital Gains depends on your income and filing method Single 0% up to $38,600 income 15% $38,601-$425,800 20% $425,800

Joint, Head of House, and Married filing separately changes these numbers.

Considerably less than the income tax on the Royalty interest payments.

Section 7-6N-6W … 3/16th royalty … last offer was $26,500 up from $25,500 up from $23,500 up from $20,000 up from I forget all in the last 30 days. All from CLR. Echo’s top offer was $24,000. Tempting, but no, not yet.

And I wonder what those folks who sold out for $7,500/acre 1-2 years ago are thinking now? Seemed like a nice offer back then. Doesn’t seem so nice now. ![]()

Don…if we could just see into the future we could make much better decisions. I was just thinking of the year 1991 when my dad sold out his well service business. The amount was 8 times less than he was offered only a few years before and turned down because oil prices were high and work was pouring in. His top offer was during one of the oil booms and by the time he felt the need to sell because of his age and health and because the bust made it so as we could work all the rigs all the time and still not make enough money to operate. We were having to take money out of CD’s to operate on. So I’m saying sure we want to hold on for the best offer but it could also cause us to miss out on some really good profits by getting greedy. Decisions, Decisions???

We have rights in

East Half of the Northeast Quarter (E/2 NE/4) of Section 31, Township 7 North, Range 5 West,

Grady County, Oklahoma;

AND

West Half of the Northwest Quarter (W/2 NW/4) of Section 32, Township 7 North, Range 5

West, Grady County, Oklahoma

What ever that means.

10 acres with 3/16. My Brother got an offer for $23,000.

Anyone know if this area is any good.

gdjoslin, If the offer was $23,000 / ac, then it might be reasonable to keep talking. If it was $23,000 for the whole ten acres, then it it quite low. Since Continental just filed for increased density for more wells, that is why you are getting the offers. I would keep my rights unless you need to sell. First offers are usually low.

That price is per acre. A few months back they were offering $16,000. It has gone up quickly. Extra month is always nice. However we can afford to sit pat and see where it goes. I believe the highest price was offered by someone other than Continental My sister and half brother sold. My other brother and myself are holding on.

Does anyone know how many wells they plan on drilling here?

Thanks.

Right M, 30-7-5 has some great wells.

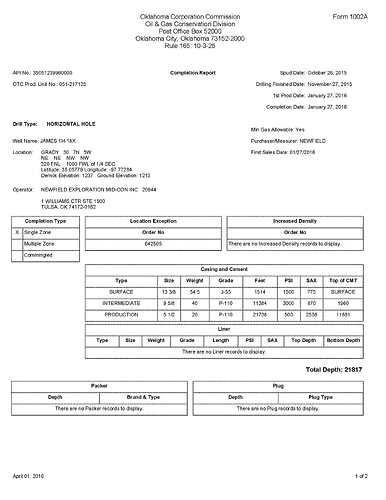

A couple by Newfield, including this one at 1442 bpd.

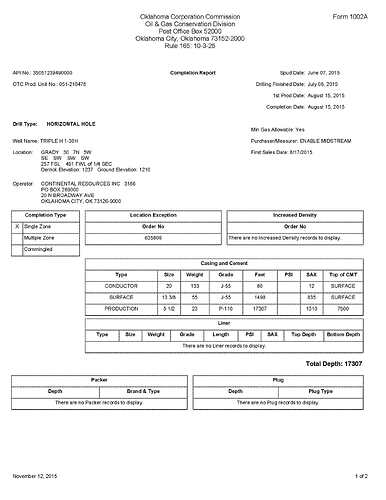

And one by Continental.

That’s the first time I have seen 2 oil companies in the same section.

You should have gotten the paperwork. Section 31 201806254 Mississippi Lime “applicant is proposing to drill a number of wells …” this order asked for at least one more.

201806257 Woodford Asking for at least four more. I see you on the list. Better check your address if you did not receive the paperwork. They have many OCC cases filed for the well locations already. Some of the surface locations will be in 30.

I suspect 32 will get its own set of additional wells eventually.

Yes I did get paperwork. As did my brother. I am not use to all this legal stuff. It looked to me like 8 are getting drilled.

How does that work when two different companies drill. Do we get checks from each of them?

Trying to read the pay stud is a challenge of it’s own.

Thanks.

You will get the check from the operator usually. Sometimes a working interest owner will take their share “in kind” and sell it separately and then pay you if you leased to them.

Yes, those stubs are a challenge, but once you get used to them, they have about the same information.

Congrats on the new wells!

This is just one guy’s opinion and he does not have a crystal ball but it is POSSIBLE.

Edit: And he doesn’t say how long it would stay there IF it gets there.

Thank you, Rick H…good to know as I’ve been offered $14,000…but still holding out–hope is eternal!

Section 12-4N-6W … 3/16th royalty … August 26, 2018 offer is $23,000 per acre. Applications for 6 new wells for a total of 8 horizontal wells has stirred some interest.

Hear anything more about 12 4N 7W ?

gulfstream 12X13 well is finished no division order yet.

Now these guys say the oil price will go to $80 but NOT in the next 2 years.

“Though we expect that a price range above $80 will become the new norm next decade, our market balances do not justify those price levels in the next one to two years,” Barclays argued.

One guy says oil could be $100 by the end of the year and the other guys say oil won’t be $80 for 2 years.

I think it is important that both guys say there are going to be some higher oil prices in the future and not many people are predicting an oil crash like we have had in the past.

That is good news for us.

But sometimes I think opinions are like belly buttons: everybody has one and they all STINK!

One thing is certain. Oil is not going to get any cheaper. So, get all you can while you can. You will need it.

Phyllis, Do you mean the Cleburne well by Gulfport? http://imaging.occeweb.com/imaging/OGWellRecords.aspx If so, then type in 1204N07W in the legal box and you can look everything up on it.

Thanks Martha you are always a help appreciate it

i received a buy offer of $9500 per acre for Section 31, 8N 6W