Just found 2 permits issued today 9/5/2018 for Cash3-26-23XHS and Cash 4-26-23XHS

be very very VERY careful with microcaps, especially ones that pay for promotional pieces and trade on lower level exchanges. They can be prone to pump and dump schemes.

Jeffrey, I invested in Jericho. I didn’t buy much. I’ve heard of “pump and dump” stock and now see Jericho is on some “black mark” lists. I suppose this is part of why smart investors warn against penny stock. I felt like taking a risk, and didn’t invest more than I could afford to lose. I’ll feel pretty stupid for not doing more research on Jericho if I lose my $250 investment, though.

I’m not saying anything about them specifically one way or another. General statement/warning.

I used to analyze microcaps, and found most to be sketchy. The honest ones face an uphill battle to raise capital that’s not dilutive.

CLR has a new presentation out http://investors.clr.com/phoenix.zhtml?c=197380&p=irol-irhome

Thanks Jake!

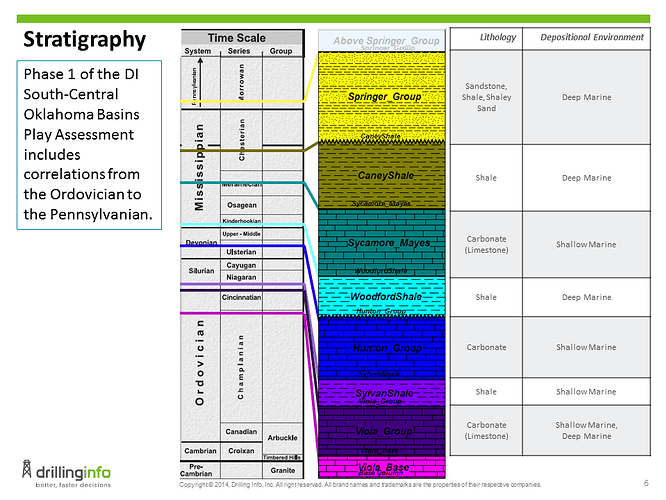

_SCOOP: Project SpringBoard Phase I and Phase II Underway _

_The Company’s SCOOP production averaged 64,786 Boe per day in second quarter 2018, up 6% versus second quarter 2017. The Company completed 16 gross (13 net) operated wells with first production in second quarter 2018. _

_The Company previously announced Project SpringBoard, which is a massive, multi-year, stacked pay, oil development project that covers approximately 70-square miles and includes 45,000 gross (31,000 net) contiguous acres. SpringBoard holds up to 400 MMBoe of gross unrisked resource potential, with wells expecting to average 70%-85% oil across both phases. The Company estimates up to 100 Springer and 250 Woodford and Sycamore potential locations and will operate SpringBoard with an average working interest of approximately 75%. In addition, SpringBoard is expected to benefit from the Company’s row development operational efficiencies and production will benefit from access to premium markets through existing pipeline infrastructure. _

Drilling is underway in both Phase I and Phase II of Project SpringBoard, with 7 rigs targeting the Springer reservoir (Phase I) and 4 rigs, ramping up to 6 rigs by year end, targeting the Woodford and Sycamore reservoirs (Phase II). The Company expects first production from the Springer wells in Project SpringBoard to begin late third quarter 2018, with up to 18 Springer wells producing by year end 2018. First production from the Woodford and Sycamore wells is expected to begin in first quarter 2019.

“Project SpringBoard is an outstanding, high impact oil project for Continental and its shareholders,” said Jack Stark, President. “This project alone has the potential to increase Continental’s oil production by as much as 10% over the next 12 months.”

Thanks Jake!!! Did I read Page 15 correctly… CLR believes the potential value of the minerals they are buying may be worth 4 times the purchase cost?

yea I saw that Don. Keep in mind however they are not putting up all the money so the return might be less than that and include the “carried interest”. never the less, it makes the point they look to make serious money on the mineral purchases.

Can you believe it?

New Mexico produces more oil (657,000 bpd) than Oklahoma (526,000 bpd).

Once Oklahoma really gets Springboard, Stack, and Sohot going, we’re going to catch up fast.

Or at least I hope so!

Deborah: Don’t hold you breath. Our pay zones are thinner than the zones found in NM & have much steeper decline rates.

Would be nice, but don’t think so.

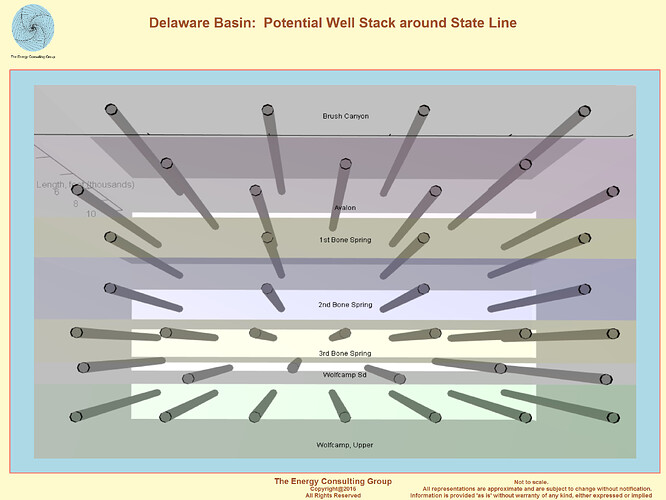

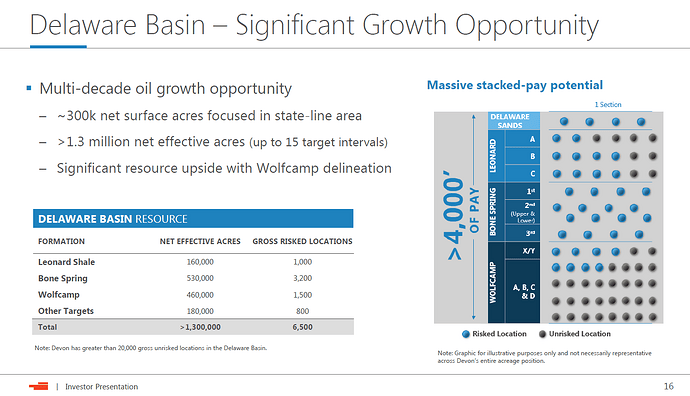

Also in certain spots in the ‘Delaware Basin’ in South Eastern NM, there are 6+ different productive formations stacked on top of each other. Each with strong economics.

Cimarex is a company with assets in both the Mid-Con and the Delaware, they tend to emphasize the Delaware more than the Mid Con.

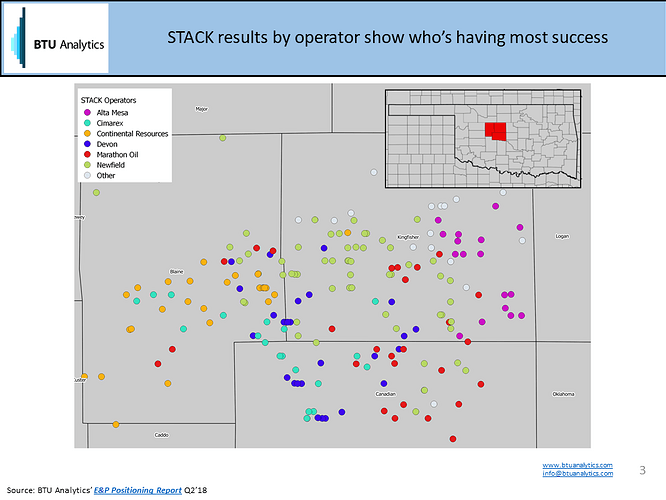

BTU Analytics just publish an article on thier blog about the STACK and break even points of various wells. Some good maps and information in the article

i beg to differ Todd. The oil and gas columns found in scoop up into stack are several hundred feet thick with some of the best economics found anywhere according to numerous sources. While I don’t think it is much use to compare one state to another I expect in time Oklahoma can easily double its oil production from here. CLR stated Springboard alone can increase their production by 10% (30,000bopd) within the 1 year. “High Impact Project with Potential to Increase CLR Oil Production 10% Over Next 12 Months”. Of course Springboard represents a fraction of the productive area leased by CLR. Other large leaseholders, Devon, Marathon, Newfield are also ramping up their own projects for full field development. Time will tell but I am betting OKLAHOMA will be OK🇺🇸

The New Mexico Permian is 100 years old.

The Permian Basin oil field in southeast New Mexico and west Texas first started producing shortly after World War I. But almost 100 years later, it seems to keep getting better, and may become the world’s biggest oil field

But Scoop is new and just started 4 years ago.

There’s good reason why much of the world is focused on the Permian. The field represents almost one-third of total U.S. production, and some estimates show production in the area will double over the next five years.

Oklahoma’s SCOOP and STACK fields are still young. The first test horizontal wells in the area are less than four years old, and operators are just beginning full-field development, with plans in some cases for up to 20 wells to be drilled in multiple layers and directions from a single well pad.

And the Permian has big pipeline problems, particularly in New Mexico, that Scoop doesn’t have.

_But major obstacles loom in the booming Permian Basin, at least in the short run. Because of hyper growth, the Permian is quickly running out of pipelines to move oil out of the region……. _

More pipelines are coming, but they will take time. Clay Seigle, managing director of oil at research firm Genscape, warned of “significant challenges” for transporting oil out of the Permian until the second half of next year.

Everybody always touts the “6 layers of production” stacked on top of each other in the Permian in New Mexico.

But Scoop has plenty of layers too.

So to New Mexico, all I say on behalf of Oklahoma is…….BRING IT ON!

We’re close on oil production and we’ve got the Permian beat on gas.

And Scoop doesn’t cost billions more to get it to market!

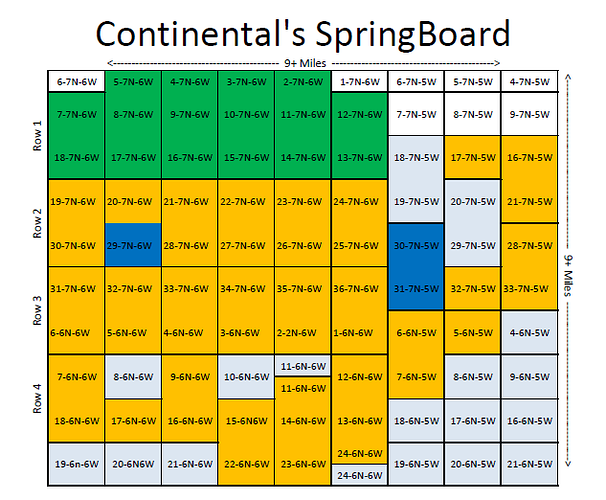

I’ve gone back to view the CLR Springboard graphic posted in May c/o Don_Bray. (thank you Don and Rick both!) The graph posted is showing black & white. Is there a link somewhere to show the actual original color chart? I can’t tell which is color coded for “Units in Progress vs Planned, Not Planned” etc. to identify what is planned for my sections in that project. Assuming the darkest shade is the Green=Units in Progress, next darkest is the Orange=Planned Units…but not sure of the 2diff blues.

Go to Don Bray’s map on May 28. it is in color

Thank you M.Barnes!!!

Great chart, Don!

Green = Units in Progress

Orange = Planned Units

Light Blue = Non-Op Units or Not Planned

Blue = Developed Units

Oklahoma Scoop oil price $65.00 per barrel.

_Oklahoma crude oil prices as of 5 p.m. Tuesday: _ Oklahoma Sweet: Sunoco Inc. —$65.00 _Oklahoma Sour: Sunoco Inc. —$53.00 _ Oil prices rose sharply Tuesday on forecasts that U.S. crude oil inventories could remain relatively low into the fall season if exports surge and shale production remains steady.

Light, sweet crude for October delivery ended 2.5% higher at $69.25 a barrel on the New York Mercantile Exchange. Brent crude, the global benchmark, was 2.2% higher at $79.06 a barrel.

Permian oil selling at $18.00 discount down to $51 per barrel.

This week, West Texas Intermediate (WTI) in Midland, Texas, traded at a more than $18-a-barrel discount to the U.S. benchmark, its lowest level since August 2014 WTC-WTM. Back then, local oil prices also sank because there were not enough pipelines to carry away production.

Some West Texas producers have said they will pull back on activity and delay well completions as a result of falling local oil prices.

Take THAT New Mexico!