If your name was on the pooling respondents list and you did not reply to the pooling within 20 days, they assigned you the lowest royalty and highest bonus amount. Done deal. No negotiation allowed. If you have not received that bonus amount, then you need to contact the operator listed on the pooling order. Actually, you may need to contact both Casillas and Continental to see who is holding your bonus.

Is your name and address properly filed in the counties where you have minerals is the next question. If they cannot find you, they cannot pay you.

The distribution of royalties is based upon an equation. net acres/actual spacing acres x royalty x % of perforations in your section.

An example would be 2.5/640 x .125 x .5=.00024414. So every dollar that is paid out on the well has this decimal minus any taxes and post production charges if they do those. I picked the 1/8th royalty since that is probably the minimum from the order. Your decimal will be calculated from how many net acres you have. The last term assumes a 50/50 split with the two sections. Usually, that is corrected once the survey is run and may not be exactly 50% in each section.

The first check you get will be for about five or six months of production, so the biggest one. Every check after that will be monthly in size. Active date for the Bowery is 11/5/21 so first checks should go out at about May 2022. They have hundreds of mineral owners to check title on.

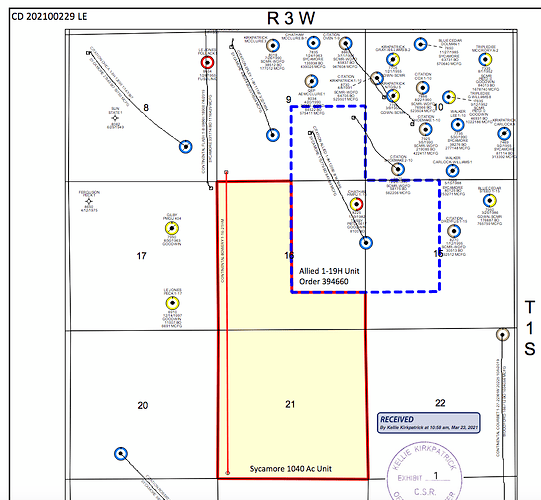

Another item to consider is that Casillas had already filed for increased density, so that may entail another well. Notice in the picture below that the first well is hugging the easement along the west side of the section. There is room for several more wells to line up like cigars before they run into the spacing of the other well in 16. Also note that they have a 1040 ac unit. I did not go back to read all of the cases, so am not sure if you have a 640 in 21 and 400 in 16 or if they pulled them both together. That could change the equation listed above if it is 1040, but the last term would be 1.0 as the whole well would be considered.

As Todd mentioned, there are other companies out there that would possibly offer more. Continental likes to buy up acreage where they have good wells, so that is an indicator that the well is good (and you might have more wells). I would think longer term than just Q1-Q2 2022 as the potential for longer term income is already indicated by the number of OCC cases that have hearings still pending. No promises that future ones will be drilled. Casillas posted the cases, but Continental bought them out. Not sure what their plans are, but they are drilling the first horizontal in multiple sections all around you. They drill the first well to hold the acreage and then come back to drill the additional wells in sections where the economics work. Oil and gas prices are more favorable this year than they were last year, so that is good.

Another tidbit is that in one of their investor presentations a while back, Continental posted that they were buying acreage and planned to make 4X profit on it. Personally, I would rather have the 4X profit to my family, so that would lean me a certain direction. You have to decide what is best for your situation.