A couple of questions that I hope the very knowledgeable group here can help me with…

Received last week a “Notice of Continuance” for the captioned sections (“Relief Requested: Multi-Horizontal Well” also noted on this sheet). CD numbers 201803775, 776, & 777. Previous documents include the “permit to drill” on 5/28/18 and “notification of well spud” on 6/10/18. Well site in section 14, with anticipated 50/50% split between sections 11 & 14.

Question is… what does the latest “continuation” document mean? Good or bad news?

Also, my cousin(s) have received a $10,000 per NMA offer to buy the rights. They have a current lease (I believe at 3/16). Is this a good offer or is this likely a high offer that will likely be pulled? They are considering the offer. I think I received a similar call but I’m not interested in selling.

In my opinion that is way too low! M. Barnes is a woman of great knowledge and I am thinking she might agree.

What’s that based on Debra? Why do you feel that $10,000/acre is too low for 8N7W?

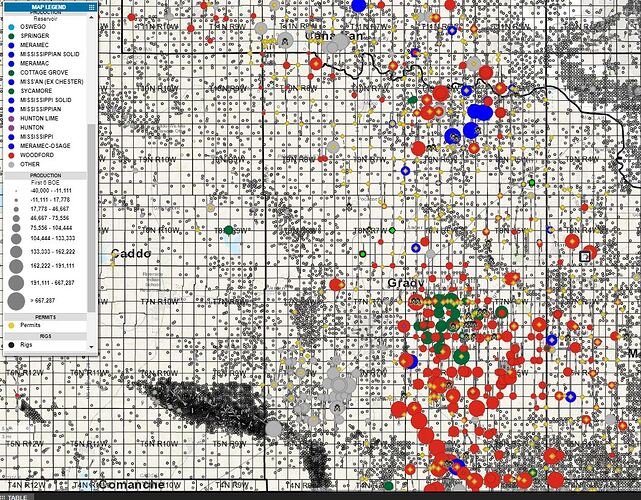

A review of the area production results shows that well performance in 8N 7W has been abysmal. Their lease is at 3/16th’s not 1/5 or 1/4 and there is only a single HZ proposed. None of the offsetting or near by sections have more than a single well bore, probably due to the poor well performance.

Maybe the newer wells will have better results, but currently anyone acquiring that acreage is no only betting that performance will be materially better than any of the near by wells, but that there will be multiple additional wells drilled within the unit in the near future. So if you have a nice diverse portfolio of assets, and want and can accept the risk that the acreage works, and that they will develop multiple additional wells in the near future, then sure..maybe $10k/acre is too low. On the other hand, if you don’t prefer going to Vegas for investments, maybe cashing out some or all of your mineral value makes sense.

Production map - size of circle indicative of amount of first 6 months BOE

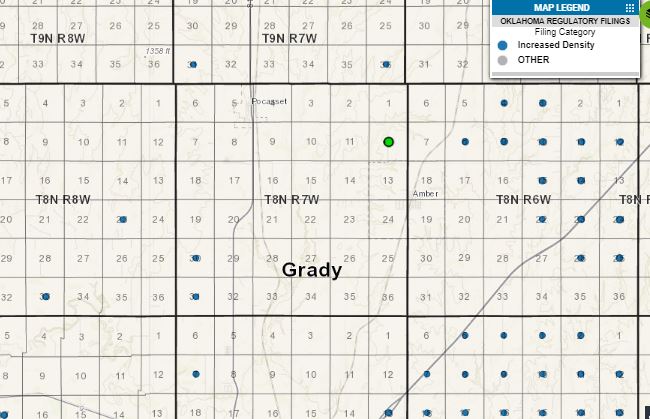

Map of increased density filings.

You could be right. They hit a pretty good well in June in 25-8-7 at 335 bod but it’s not really that good. You haven’t missed many Jeffrey and you could be right on this one. I’d like to see what Mbarnes says too.

that area of grady is interesting, just north of there the formation is significantly more gassy than to the east.

Linn/Road’s July investor presentation has an API map for the woodford - gives an idea of the liquid vs gas content. The challenge with gas heavy wells is the blow out in basin differentials lately.

I think the “Notice of Continuance” is related to the interim orders they issue to allow the oil company to drill and complete the well. They are probably bumping up against a set date in the interim order and, therefore need a “Continuance”. When the well is completed they will come back and issue the final order when they determine what percentage of the well’s production goes to each section.

As far as the offer to buy your cousins minerals I would refer anyone thinking of selling their minerals to the last presentation given by Continental Resources… they project their future returns to be 4X’s their initial investment.

I would be willing to buy in this area at $10k per acre also!

Do their projected returns cover the area in question?

Thanks Don & everyone else who has replied. Still appears to be a difference of opinion in regards to the potential for this area. Any further thoughts by others?

While Continental’s mineral purchases are predominately in the SpringBoard there have been some purchases that have been outside that area…

Section 2-5N-7W - 11.6775 acres @ $11,000/per NMA - March 2018 - (Rawlings 1-35-2XH well spud in July 2017 - Continental is the operator - No completion report filed as of this date, however well was active as of May 2018 classified as a gas well)

Section 14-4N-7W - 1.86 acres @ $20,000/per NMA - March 2018 - (no permit or well spud to date)

Section 35-8N-6W - 40 acres @ $15,000/per NMA - April 2018 - (MCEVOY 1-2-35XH well completed in February 2014 - Continental is the operator)

There are a few more that I know of and I suspect they will be adding more.