Hello, first time posting in this forum. I own 20 acres at an eighth royalty in Kingfisher. Section 20, Township 17N, Range 8W. I have received tons of offers since the beginning of the year. I know there have been 3 wells drilled recently so I should have royalties coming in sometime early next year I would guess. My question is more about selling a few acres for much needed cash now & the impact that would have on taxes & my disability check. Anyone have any knowledge in these areas? Thanks very much in advance!

Certainly this would impact your taxes. This could also impact your disability if you are on SSI (as opposed to SSDI). This is because SSI is a needs based program which takes into account your countable resources and your income. SSDI is disability that is based upon your (or a relative’s) contributions to social security while working and therefore should not impact those benefits. If you are on VA’s “aid and attendance”, the income may lower your benefits.

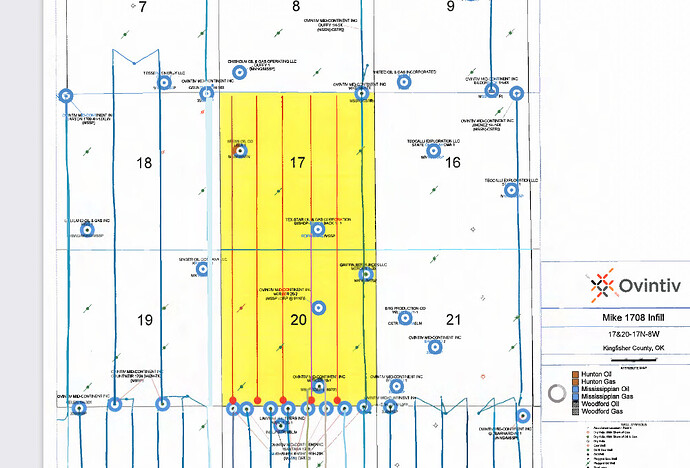

Richard can certainly speak to the legal side of the issue. I can only speak to the drilling side. You have received offers because of the increased density request from Ovintiv to do the infill drilling for the Mike 1709 horizontal drilling in 17&20. Estimated recoverables for the five new wells are 6.6 MM bbls oil and 26.5 BCF of gas (take those with a grain of salt)

Three of the wells have been spud. Mike 1709 2H-17X, 3H-17X and 4H-17X. They have surface locations in section 29 just about 360’ from the northern border and drilling to the north. They were spud in late March. It may take out four-five months to drill and complete so that takes through July or August. Then it would take another six months until your first check. Maybe by next February as a general estimate.

Depending upon your situation, you would need excellent elder care legal and accounting advice. You do not have to sell all or none. You perhaps could sell partial or there are some companies that essentially do a loan against your royalties for a period of time and you keep your mineral rights. Essentially, they give you the royalties up front for a period of time (for a fee) That would be an option that needs careful consideration and good professional advice.

I used and still use Trevor Henson. Oil and gas is his specialty.

Thank y’all. I appreciate the insight.

This topic was automatically closed after 90 days. New replies are no longer allowed.