I am in the process of purchasing a home in Texas. The owner wants to retain mineral rights. I am not comfortable with this. I am coming from an area and know nothing about this. Should I get the rights. Is this a deal breaker? It is on 3.8 acres. Thanks so much for any input.

First thing any of us need before giving an answer is to know where in Texas you are buying the home. Is there activity in the area?

You can counter with 50% retention by the seller, any other percentage or, ask the seller lower the asking price since he is retaining a part of the property for himself.

The property is in Burleson.

I an buying in Burleson. Thanks

Dear Reginac: welcome to the forum! You are wise to be cautious. I tell my clients never to buy property without buying a portion of the mineral rights. The reason is that, in Texas, the mineral estate is dominant to the surface estate. That means that if a lease is signed, the mineral owner and oil company can make reasonable use of the surface without your consent and without any compensation to you. Reasonable use is interpreted very broadly by Texas courts. That can include drilling sites, pump jacks, tanks, roads, heater treaters, etc. Especially on a small tract, a drilling unit and later a well and tanks nearby can make your life miserable if you are going to reside on the property. Some oil companies try to reach a surface use agreement with the surface owner and pay a bit of compensation, but never enough in my view. Many do not and they are not required to. If the seller will not part with any mineral rights, then I try to negotiate a “no surface use” clause for my client with the seller, which must be in both the contract and the deed. The Texas Real Estate Commission has a standard form for this in their “Mineral Addendum” which you can find on their website.

The negotiating approach Larry suggested is worth a try but, whether you obtain any of the mineral interest or not, as a condition of buying it I’d insist that the seller’s deed to you include a full waiver of the surface rights to the property. In that way the seller could retain control of the mineral interest, be able to lease it and benefit from any future production, but you would be assured that drilling or production could only be done by directional drilling, or pooling, and not involve the surface of the property you are buying.

I would have that deed wording drafted or reviewed by an attorney, and keep in mind that the seller can only waive the surface rights regarding the share of the mineral interest they actually own. If part of the mineral interest was reserved when your seller acquired the property, or at some earlier point in the chain of title, the waiver from your seller wouldn’t fully protect you. Title company’s review and issue of an owner’s title insurance policy doesn’t cover the mineral interest unless specific riders are added to the policy. The title report you receive prior to closing may disclose prior leases or inclusion in producing units but it typically won’t verify the ownership of the mineral interest.

Thank you so much. I appreciate your advice.

Does not having mineral rights affect the value of your home ?

In an area with proven production each acre of mineral rights definitely has value apart from the value of the surface or the improvements. But if you get full surface control I don’t think not owning the mineral rights should effect the value of the home.

In Texas homes in subdivisions typically don’t include mineral rights, and even in areas with production that is probably common for homes that are on small acreage tracts like you are considering, The home buyers aren’t buying them to acquire the mineral rights. If the mineral rights had been reserved years ago rather than by the person you are buying from they would still be important from the standpoint of surface control but I doubt you would be questioning the potential value difference.

The only way a real estate agent could factually say whether it effects the value of the home you are considering would be by making a market study of recent sales of “comparable” homes, with and without mineral rights, which would be very difficult to do. You might try to use the fact your seller insists on keeping all the minerals as negotiating leverage to get concessions from them in other areas but as long as the surface rights are protected I wouldn’t make it a deal killer.

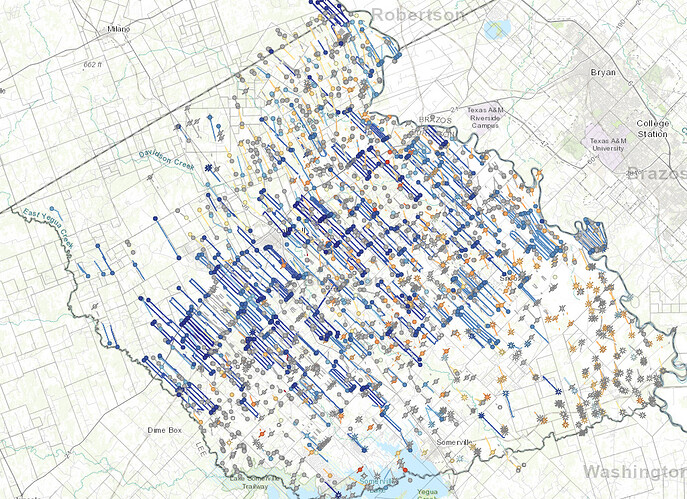

One thing to consider is WHERE in Burleson county matters quite a bit. The center line of county is the Eaglebine play which is the type of wells that can have GIANT surface locations and have dozens of 18-wheelers parked on location. That said, the surface locations of these big wells are relatively easy to move around to a surface owner who is happy to take a check for the damages, but can be quite a disturbance (at least short term). Any landman or engineer will tell you an unhappy surface owner can make an already difficult job miserable, so it’s generally avoided if possible.

Purchasing these minerals could be $5,000 or more per acre depending on the area. And the current owner might not even own all of the minerals under their property (it might be the owner, plus their brother and all their cousins, for example).

Darker blue = more recent drilling of these bigger wells.

Darker red = older wells. These are the smaller surface locations. Not many being drilled these days. Year 2000 and up is blue.

The other areas may have some drilling that could happen but it’d be much smaller scale, less invasive, and you might actually get a new road or water well (plus paid for any damages) from it if you’re ok with the small inconvenience. It’s not all bad being a surface owner with minerals under.

Are you talking about Burleson County or the City of Burleson? The City is in Johnson County that was initially quite active. Burelson County is still very active.

Johnson country Thanks so much

Good catch, @Larry_W_Love!

The area around the City of Burleson and, most of Johnson county, was leased and drilled heavily from late 2005 to 2012. The chance of any property not having a lease would be slim. I have been mistaken in the past but not, about my 2nd and present wife and my decision to retire the third time!

So if the homesite is indeed under lease, the site will be subject to the terms of the covering lease negotiated years ago.

Lol. It is under lease. I was able to negotiate for 50%. Thanks so much. Not sure what all this means.

Glad Larry got everybody straight on the part of Texas you’re talking about.

If you are saying you were able to negotiate for 50% of the mineral interest, as long as the current lease is in effect you’ll have no say on what happens regarding potential surface use. But when it expires, either due to expiration of the term of the lease or if it is currently in a producing unit when production in the unit ends, you should be able to protect your surface regarding future leasing. I’d prefer to also have a waiver of surface use from the owner of the other 50% mineral interest but controlling 50% will definitely help.

Assume the folks you bought the land from are the party who negotiated the previous oil lease, you might ask them if they would let you have a copy of it. The lease would have been recorded in the county deed records but in most cases that is only a memorandum that doesn’t show the full details of the lease.

If you want to post the name of the survey your property is in someone here can pull up the Railroad Commission’s map showing the activity in your area.

This topic was automatically closed after 90 days. New replies are no longer allowed.