I am hoping to find clarification on how to calculate decimal royalty interest specifically for a pooled unit consisting of allocation/stacked lateral wells. I am finding different unit sizes on various documents and was not sure which value I need to use for a correct calculation. Our 3 tiny tracts are part of the Marienfeld pooled unit all with 25% royalty. Details below—

- 100% of minerals in 0.145 gross acre tract = 0.145 nma

- 100% of minerals in 0.417 gross acres tract = 0.417 nma

- 100% of minerals in 1.269 gross acres tract = 1.269 nma

Unit size*?*: what unit size number should I use for the calculation?

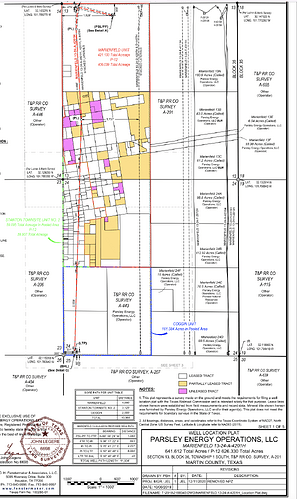

- 367.38- listed on the declaration of pooled unit, where our 3 tracts are listed

- 421.133- listed as the total acreage for the Marienfeld unit on the well location plat

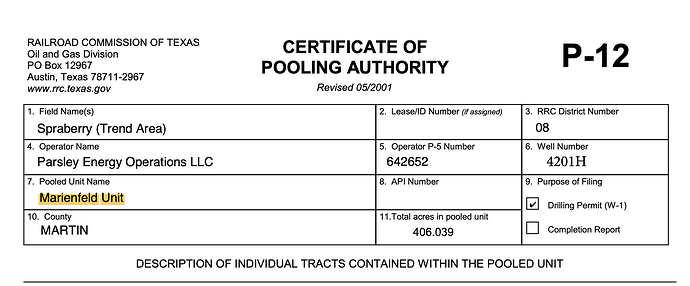

- 406.039- listed as P-12 total acreage for Marienfeld unit on the well location plat

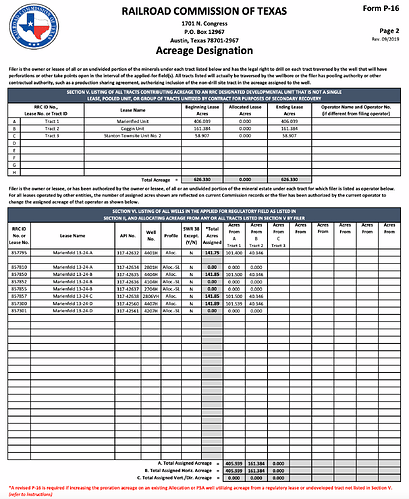

- 626.330- listed as P-16, total acreage for all 3 units

- 641.612 Total acres as listed on the well location plat

- 405.939- on the P-16 this is total assigned horizontal acreage from the Marienfeld unit

I have also read that there are 2 different ways to calculate based on whether or not the well is pooled or an allocation well but I am confused because I have seen documentation suggesting that our tracts are involved as both a pooled in the DPU but see the wells listed as allocation wells not pulled so I’m not sure how to determine which calculation approach would be correct.

Thank you for any help/clarification and for taking the time to read my post!

Well Log Main API 31742633 .pdf (175.5 KB)