I received a check from Camino but Enverus does not show what wells it is for and for what period of time. I left a message with customer service at Camino. I don’t understand since I do not have a division order yet. My decimal point is showing the same as the last check I got on the original Black Mesa well drilled in 2020. According to the paperwork I received most recently I should have a higher percentage of several of the wells. Will I get separate amounts for each well and therefore different checks?

Some companies will send a first check before the 180 day limit is up so they don’t have to pay interest. They will usually true up on the next check after they finish all the title work. You will usually only get one check per operator with all wells on the same check statement. Camino is on Enverus so your statement may be listed with them.

I did look on Enverus and they have August listed but no well numbers and payment should be going back to June. I think you are right that they are trying to avoid the interest. Thank you! So I will get a new division order for the new wells? I think they used the old well information to pay on this check I just got.

It can take a couple of months to get it all straightened out.

I did just get a division order for the new Black Mesa wells. I want to verify the formula for figuring the decimal point. I need to know where the percentage of the sections allocated to my section 10 fits in the equation. Also, on two of the wells they show the acreage covered by these wells (1281.78) The other two just shows the section number. Does that mean the acreage drilled on is 640 acres? Thanks for your help!

Hi Grace. The formula is your net acres, divided by the gross acres of the unit where your minerals are, times your royalty percentage, times the perforations percentage for the unit where your minerals are. I believe your wells are part of sections 3 &10, but don’t remember the township or range. Section 10 is 640 acres. Based on your figure of 1281.78 acres, Section 3 is 641.78 acres.

Thank you, Todd. I am not getting anything like what they show on the Division Order. Please figure this for me and see what you come up with. 10.5 Acres (I own) x 1284.78 (this is the acreage shown on DO) x .1875 x 58.8004%. Thank you.

you should be dividing your net acres by the gross acreage. so 10.5/1284.78x.1785x.58004.

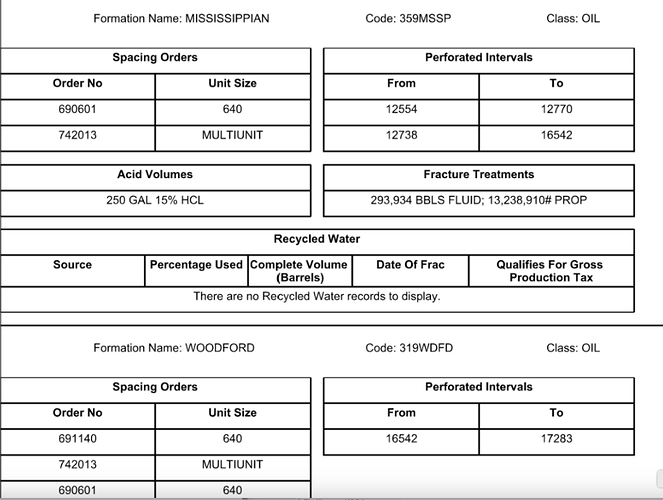

The acreage covered by the wells is not necessarily the actual spacing. OK tends to space at “640 acres” but the DO is for the actual section acreage. Which section are you in? That makes a difference due to the 640 or 641.78 as the denominator. And the percentage of perforations is probably different for each well. (OK does have some rare other spacing units. The OCC case that goes with the reservoir of interest for that section will list the spacing.). You can often find the spacing on the completion report. Black Mesa 0505 3-10-2MXH has it on page 2.

Here is an example for a 640 acre section.

It should be your net acres/actual spacing acres x royalty x percentage of perforations in your section. An example: 10 acres at 640 acre spacing with 3/16ths royalty and 50% perfs would be : 10/640 x .1875 x .50=0.00146484. You can substitute your acreage, royalty and percentage if you are in the section with 640 acres (sec 10). If you are in section 3, then use the other acreage and your numbers.

Your royalties will change from month to month based upon the volumes produced and the product price. For every dollar that the operator makes from selling the produces, you will multiply by your decimal. Using the above example, for every $1 million dollars that the company receives, the 10 acres would get $1464.84. Horizontal wells start off with a big volume and that rapidly declines. Your first check will be the largest that you will get since it has five-six months of production included. The following checks will be for monthly totals.

You do not need to sign a DO in OK. I do not as the DO potentially gives away some of my rights. I send back a Letter in Lieu of Division Order and my W-9 if my decimals are correct. You can use the search magnifying glass to get a copy of it from a former post.

The Bureau of Land Management has section 3 as 641.76 acres.

That is not correct.

Grace: There appear to be 4 new wells: The Black Mesa 2MXH, 3WXH, 4MXH & 5WXH. Each well has different percentages of perforations for Section 10. There is no need to worry about the total unit size as Section 10 is spaced 640 acres. Section 3 is only a part of the “multi-unit” designation. Your formula will be 10.5 acres/640.00 (unit size) X 0.1875 (3/16ths royalty) X unit percentage for Section 10. So 2MXH=67.3292% or 0.0020711; 3WXH= 57.4834% or 0.0017682; 4MXH= 58.8004% or 0.0018087; and 5WXH= 51.7854% or 0.0015929. I didn’t double check these numbers so you might do that. But they should be close. Let me know if that helps.

I was only using the numbers provided, but huge thanks to the members like you that dig deeper into the situation.

Thank you Martha and Todd! I was using the 1,281.78 acres instead of 640 when the DO showed Section 03; acreage1,281.78. They are also using 641.76 acreage for Section 3.

I am not going to sign the DO. Just sending the letter and W-9.

Kind of exciting! Thanks again.

Nope.

0.5 (assuming section is allocated at 50%, can sub out 0.5 for any allocation values) x 10(net acres)/640(section owned in) x 0.1875(royalty)

or

(0.5 x 10/640 x 0.1875)

This topic was automatically closed after 90 days. New replies are no longer allowed.