We keep getting contacted by a landman saying he represents Bayswater. He wants to lease our minerals just north of Coahoma but wants US to offer the terms. He keeps emailing the typical landman pressure points that they want to drill but it’s “risky”. We currently have a lease expiring this Spring so he wants a top lease with the typical 3 years plus 2 year extension. His bonus is also outdated. Can anyone share what they are being offered? We are in no hurry. Thanks very much!

What’s the legal description of where your minerals are located? The farther you go East in Howard (especially Southern) the thinner the formations are. You could always explore the unleased non consenting owner option. I’ve seen that workout well for owners in Howard.

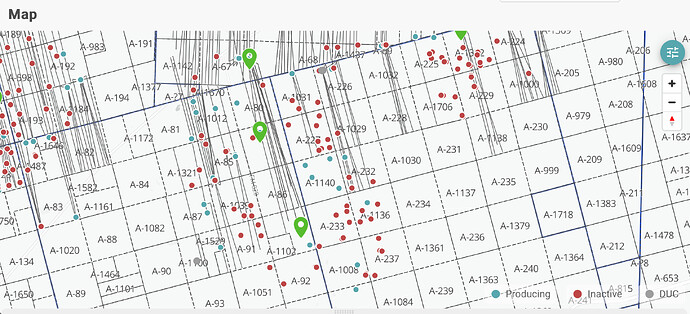

Blk 30, Section 30: 237 acres in the NW4 and W2NE4 - undivided 50% interest - 118.5000 net acres* Blk 30, Section 30: 237 acres in the SW4 and W2SE4 - undivided 40% interest - 94.8000 net acres* Blk 30, Section 29: 160 acres in the NE4 - undivided 16.665% interest- 26.6666 net acres*

I’m assuming that’s T1N? You’ve got a nice sized acreage position. If the bonus is low, I’d wait. Yeah, it’s definitely on the East side of the fairway. But, I personally wouldn’t top lease, especially considering your the size of your position. What do you feel is “outdated” bonus wise?

$500 per acre. Our current lease is more.

Our unit is abstract A-1008. It’s our cotton farm. The current well on it, Brooks 30 is vertical to 9k feet and not producing much (not our minerals) Bayswater wells to the north are horizontal around 6k feet and producing.

Yeah, that’s gonna be “no” if I were you. Bonus is way too low, 25% royalty rate is non negotiable. If they don’t move on their offer and don’t go up, I’d go non consenting and risk payout being made at that $ bonus for all depths.

Btw, what’s a “ unleased non consenting owner option”?. Is that for horizontal wells passing through your unit? In other words, just a DO only without having a lease?

That’s situation that happens when you don’t agree to an OGL, but also don’t enter into a JOA. You’ll get paid your proportionate share of royalties as a working interest owner after payout on the wells is reached. Hopefully someone else can chime in on here a better explanation.

My two cents:

Read this paper: What happens if I do not sign a lease in Wheeler County, TX? - #8 by AJ11

Remember there is a chance the well(s) could produce oil but never pay out.

Consult an oil and gas attorney before signing a lease and especially before top leasing.

Communicating with other owners in your unit / section is important. Props to you for already having that connection in place. You have an acreage position large enough it definitely justifies spending money on an attorney to draft an OGL or Addendum to OGL on your behalf.

Don, If you choose not to lease, don’t sign a Joint Operating Agreement (JOA), and your minerals are part of a Drilling and Spacing Unit (DSU) you would have ownership in the well(s) that are drilled. The operator would have to pay your proportionate share of the drilling and completion expenses as well as additional operating expenses until your ownership in the well is paid out. If and when the well pays out you would begin receiving revenue from your proportionate share of the revenue from the well(s) without any royalty taken from it. You would be a Working Interest (WI) Owner in the well and have a 100% Net Revenue Interest (NRI). If the bonus money they are offering is not acceptable and you are willing to wait a while on the revenue this can be a great option. It is a bit more risky for you than leasing because you are not receiving up front bonus money and the well may not ever pay out. However, if you can wait and the well does pay out it can be well worth the limited additional risk.

For what it’s worth I have gone unleased on several wells in SE Texas. It’s my understanding that you’re an Unleased Co-Tenant under Texas law, and there are statutes relating to your rights (you can go online and search the statutes related to co-tenants). The experiences on balance have been positive and I will do it again in the right circumstances. In addition to not getting any bonus money on two wells that didn’t payout, the companies that I delt with were very hostile to my doing this and it was difficult to get realistic information about the expenses related to payout and required me hiring an attorney and filing a lawsuit on the first wells drilled by two of the companies. Another option is to lease a part of your minerals and have the company carry you as unleased on the balance of your interest. Then you would get some money regardless of what happened. In that case your lease should require that your furnished with all information relating to the drilling, completing and operating of the well(s). Good luck.

As to your original post, extensions are not typical to an OGL. They are a method of limiting the future cost to the Company. If the terms for leases have increased after the initial 3 year period, then they will exercise the option. If there is a decrease in terms, then they will not exercise the option and possibly offer a new OGL at lower terms. Companies do not typically top lease in areas they consider risky since a top lease indicates a higher amount of competition for leases. Finally, patience generally leads to better offers.

This topic was automatically closed after 90 days. New replies are no longer allowed.