How can I compare RRC for production and disposition for a well with my operator’s monthly statement concerning production and disposition? They are obviously not the same.

In general, the oil barrels should match the RRC disposition volume for a specific production month. Gas is processed through a plant and any liquids are separated and sold separately from the remaining reduced ‘dry’ gas volume which is measured at the tailgate of the plant. Many operators report the gas and liquids sales and volumes separately on the check detail. Also, the operator reports the gas volume which enters the pipeline to the RRC. The pipeline will have periodic compressors to essentially push the gas through to the plant. These compressors consume part of the gas. As gas is processed in the plant, more gas is consumed and so reduces the ultimate sales volumes. You can look at the Texas Comptroller CONG to find the oil and gas sales values reported for severance tax purposes and those values should be reflected on your check detail. Sometimes, the volumes will not match if your royalty decimal is calculated on a tract basis rather than the unit basis. For example, if your tract is 100 acres at 15% royalty, then your DOI would be 0.1500. But if the unit is 200 acres, then your unit DOI would be 0.0750. If you are paid on unit basis of 200 acres at 0.0750, and the well produces 1000 bbl, then the volumes on the check would be 1000. If you are paid on the tract basis of 100 acres at 0.1500 DOI, then the check will only report 500 bbl. If you want more specific response, then you should post the well name and RRC lease number and the oil and gas volumes for a specific month as reported on your check detail.

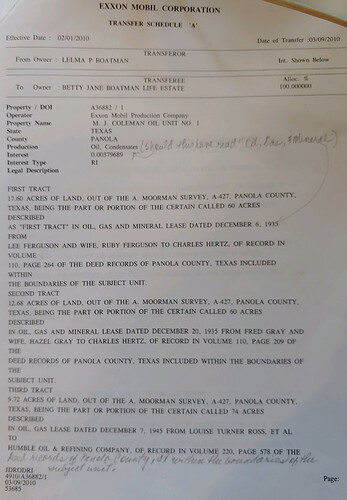

So, I am thinking from the GREAT INFO you just sent me, that I need to figure out if I am being paid on a tract or unit basis. Right? (By the way thank you so much for responding so quickly!) I am looking at the transfer Schedule by EXXON from by Grandmother to my Mother and it describes the M.J. Coleman Oil Unity No.1 Panola County, Texas as being part of 3 Tracts within the boundaries of the subject unit. The allocation % was 100.00000. RI :.00379689. My question to you, now, how do I know if it is on a tract or unit basis?

You need to look at all of the language in several documents to understand what you own. First, the lease describes the gross acreage of the tract and your royalty rate. Then you need to know what your fractional interest is, such as 1/2 or 1/20, to get to your net mineral acres. With this information, you can figure out the unit vs tract royalty rate. If you own 1/5 of 100 acres = 20 net acres. At 1/10 royalty, your tract decimal is 1/10 royalty x 20 net acres / 100 gross acres = 0.0200. If the unit is 200 acres, then your unit decimal is 1/10 royalty x 20 net acres x 200 gross acres = 0.0100. The transfer document and 1970’s era division orders (if you still have all the paperwork from your grandmother) or even the Unit Agreement may contain this detail. Is the description in your document more detailed than you have posted? Does it tell you which tract you own a part of and the breakdown of acreage in each tract. I am assuming that if you add the acreage of the tracts, then that will be the unit acreage.

I think this will be the information that will help me determine whether this is a “Unit” Well or a “Tract” Well. Hope this helps you help me.

Babby

This topic was automatically closed after 90 days. New replies are no longer allowed.