Lanier well 1.3 miles from Marquez, Texas drilling progress information from anyone current?

Would love to know more info on this!

Been hoping for an update from Alan Herrington. He seems to be the most knowledgeable person on here, or that I’ve talked to elsewhere.

Very little to report as of now on Comstock’s four Leon County Bossier/Haynesville wells. No completion reports have been filed and no production has shown up in the RRC or CONG reports.

JG Dinkins 1H permit approved 12/8/2022. Spud date: 1/10/2023 Should see a completion report soon.

CW Lanier 1H permit approved 1/26/2023 Spud date: 4/17/2023

RT Glass 1H permit approved 4/18/2023

Neyland HRM 1H permit approved 5/12/2023

Thanks Alan! Watching for word the Lanier well with interest.

What tracts make up the RT Glass new drilling permit that Comstock has been granted in June, 2023?

jburt

RRC shows the permit for the Comstock RT Glass 1H was approved 4/18/23 not June but I’m assuming that’s the well you are asking about.

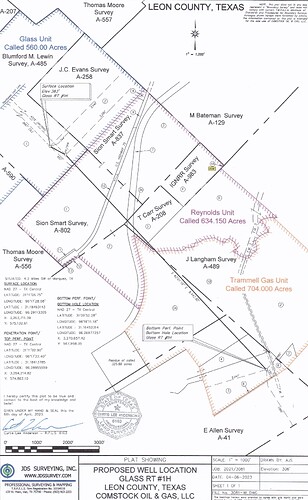

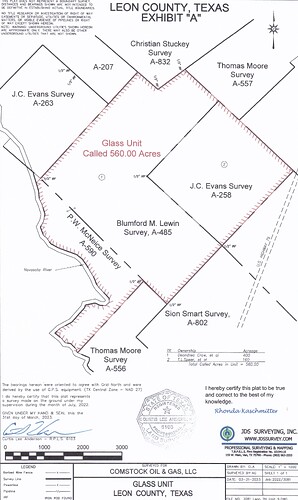

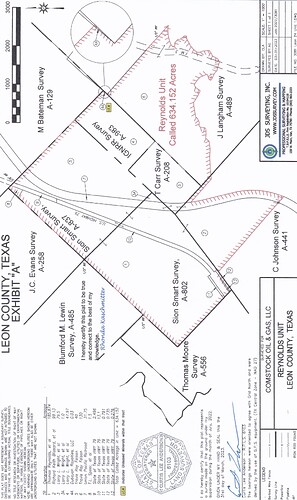

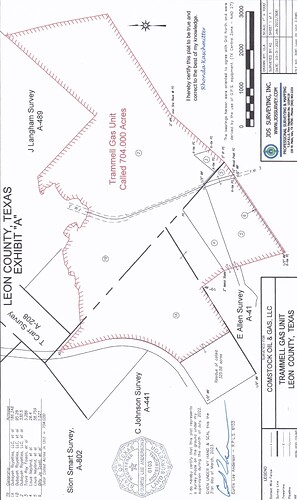

It’s being drilled as an allocation well crossing three pooled units Comstock formed, the 560 acre Glass Unit, 634 acre Reyonolds Unit and 704 acre Trammell Gas Unit.

Below are the plats filed with the permit. The first shows the three units with the proposed path for the horizontal leg of the RT Glass 1H. The individual unit plats that are attached below it show the ownership breakdown of each unit.

I was told that these wells cost $25 Million to drill. What do you people know about this Cost?

$20 to $25 million seems in the ball park. Given the TVDs and lateral lengths, tremendous heat and pressure to deal with. I assume the frac jobs require ceramic sand. More than five miles of pipe plus all the casing.

These wells seem to produce about 400 mcf. At today’s prices that comes to about 32-34 million per year. Minus a 20% payback as well as maintenance and pipe line expenses, looks like a 1 year recoup.

Unfortunately, low gas prices and a glut of gas are currently killing the economics of these recent wells. For example, consider Comstock’s Campbell EOB 2H well:

April Production: 1,025, 532 MCF

Henry Hub Spot Price: $2.16 per MCF

Comstock’s actual price obtained: $1.53 (29% discount from Henry Hub)

Comstock’s marketing cost (treatment and pipeline): $0.79 per MCF

Comstock’s royalty cost (assume 20%): $0.31 per MCF

Comstock’s net revenue after royalties and marketing: $0.43 per MCF

So the well produced more than a billion cubic feet of gas in April, but Comstock’s net revenue was only $440,979. It’s a long payback period at current prices when a well costs $20 to $25 million.

The NYMEX spot gas price today was $2.79. It needs to be a lot higher for Comstock to make money on these wells.

What is the cost difference to drill a well exactly like these that are not in a hydrogen sulfide gas area?

That’s a good question, but I don’t know the answer.

Great Post and Information. These wells in this area are classified as hydrogen sulfide wells by the RR Commission. They are a lot more expensive to drill than the ones that are not!. Marketing and treating cost are TOO high. 40 Million CF/day ought to make a lot of money anywhere.

$.79 ? Way out of reason!

Comstock’s marketing costs had been running about $0.61 per MCF until they did their pipeline expansion in Leon County. That’s when their cost zoomed up to $0.79 per MCF.

Aethon’s costs in Robertson County are in the $0.55 to $0.62 range.

Does anyone know how far south in Leon this play goes? I see the rigs are sitting on a NE line. Do you think they will step down further south to where the Gasstar well was drilled?

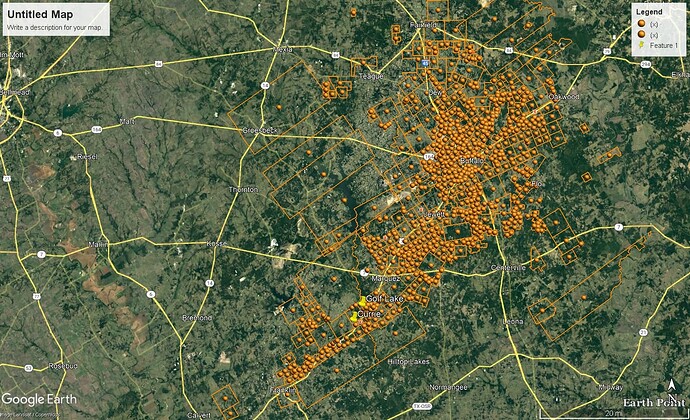

This developing play follows (so far) a southwest to northeast trend following Highway 79 from Franklin in Robertson County to Oakwood in Leon County (55 miles).

The players have acquired more than 300,000 gross acres so far (225,000 gross plus whatever the gross equivalent is of the 60,000 net acres that Comstock acquired from Legacy Reserves).

Here’s a map of the county surveys that include leased acreage:

Is your professional opinion Hilltop Lakes is out? Comstock acquired all if the unit’s due west of Hill Top Lakes. I do see the trend.

Well, I’m not an oil and gas professional, so I can’t give you a professional opinion! In addition, I have no knowledge of geology, so I can’t comment about the prospects for the Hilltop Lakes area.

I’m just a data guy who got interested in the oil and gas business…