We were recently contacted by a buyer, and they said we have 3.5 acres?

We have paperwork, but no idea what the offer means and why it’s not for 280 acres.

We have a 1990 lease to someone, but not sure if it’s active or expired.

All is from early 1960’s, when Eddy was auctioned off.

NMoilboy, care to look at this? The owner name is Hendrix or Williams.

I’ll look at it over the holiday. Knowing nothing and just guessing, you probably have an override in a Fed lease. 1.25% ORRI times 280 would get you 3.5 “revenue acres”.

thanks, we are wondering what it all means.

Im not a landman, but here is what I think after quick look through some records.

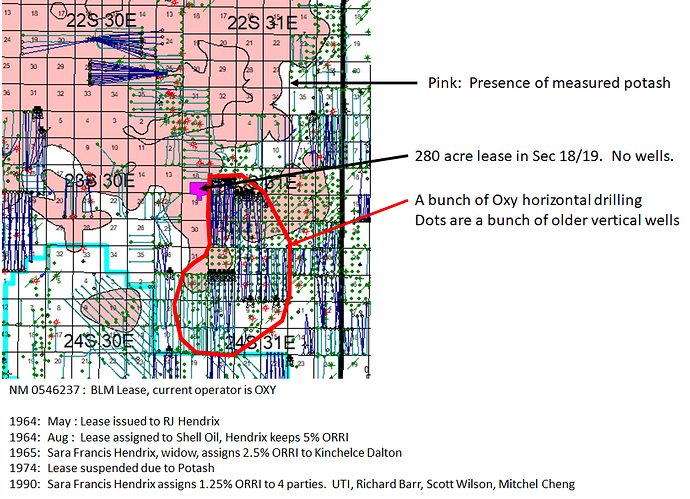

Heirs of RJ/Sara Hendrix should still have 1.25% ORRI in BLM lease NM-0546237, barring some other transaction. Dates and events listed below.

Known mineable potash covers this lease, thus its difficult to extract the oil and gas. This is why the lease is still in effect (suspended) even though there have been no wells drilled. To drill under potash you either need to have your surface location outside of potash or you have the BLM grant a vertical ROW through the potash (a drill island). This is as of 2012 I believe. Oxy is getting horizontal wells drilled here. Presumably they have some plan in effect to also drill up Secs 18/19 though it is not evident to me. In short, there should be good oil&gas rock under this lease, its just may have a very delayed development timeline Thus its worth less to you or anybody that would want to buy it.

The 1.25% ORRI under 280 acres would be equivalent to owning 100% of the revenue under 3.5 acres. Thus somebody might call it 3.5 net revenue acres. Or 3.5 x 8 = 28 net royalty acres.

Its hard to put too much info on here at once, if you want to talk about it send me a text. 817-475-3658. Hope this helps some.

great . I wonder if the 1990 is expired? Could we still sell even though those 4 parties are in contract?

The offer was pretty good in my mind, $8k/acre.

I wonder if there is more on the table with shopping it.

Nothing expired, all the ORRI are still valid as the lease is still valid. Each ORRI is separate and parties can do whatever they want with them individually.

You don’t want to sell for $8k per net revenue acre.

Dave

I can probably make you a better offer on this acreage. Email me: keestp I am at aol.com.