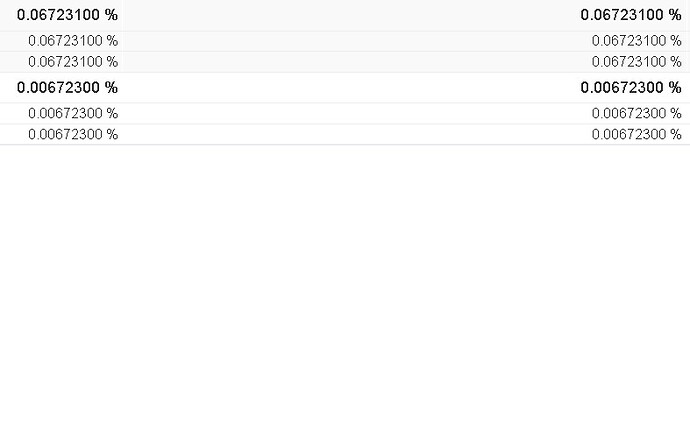

Anyone having issues with EnergyLink statements and there owner interest is wrong? I am having a lot of issues with them and wondering if I am the only one with this problem. Sometimes they will have my interest as x.xxxYYYYYY, other times they may have x.xxxxYYYYY other times it is x.xYYYYYYxx, all on the same well, different months? They may at times have distribution interest different than owner interest that makes it even more confusing? When I call they give me some BS answer and nothing happens. I am about ready to drive over to Pioneer HQ which is about 4 miles from my house and show them these statements and ask them what is going on as EnergyLink / MineralQ is not doing anything to correct this and maybe Pioneer can give me answers. It is very hard to make sure they are paying the correct amount when the interest numbers keep changing. MK Here is an example: Same well this months statement on top and the one from before on bottom.

I also noticed the differences. I’m new to this process and and just wrote it off to minor differences that would even out over time. It would be nice to know what’s going on.

@Lee_Cooper, At least I am not the only one seeing this. I thought I got it straightened out two years ago with Energy Link now it is starting again. ugh!!! I know Pioneer does not control what Energy Link does, like so many other Operators report to Energy Link as well but at least on some of my statements ,I know Pioneer is the one paying and maybe they can help me. Anyone else seeing this issue? MK

EnergyLink receives formatted electronic data from operator and simply converts it to a standard check detail form for royalty owner to access. Some operators have odd programming and the converted data is off. In that case, the operator must have its own programmers rewrite the code for decimal to be appear correct on check. So it is possible that decimals are not affecting your net numbers. To determine, take royalty royalty share and divide by well gross number, line by line. Best to use spreadsheet. For example, Well A gross sales 100,000 and gross royalty 150, then 150/100000 = 0.0015000. Gross severance tax 5,000 and royalty severance 7.50, then 7.50/5000 = 0,0015000. Fair warning, there are a lot of complexities to check detail and just because your check stubs look pretty, the net data may not be totally accurate. Some operators hide cost deductions by reducing gross sales instead of reporting true gross sales and then listing cost charges. This is unfair to royalty owners because depletion is calculated from gross royalties, before cost deductions, and so your depletion is lower than it should be.

Thank you Tennis Daze. I am aware of the procedures as you have helped me before on this. It is just mind boggling that Energylink or maybe the operators as the source of info has there code wrong so something like this would be a problem. Many people rely on this info being something they can put into the hands of there CPA and then the CPA can do there job so the IRS is happy. I know it is not about them it is about the individual and there responsibility. At least I know I am not alone in seeing this issue and it being as maddening as it is. Again many thanks for the explanation. MK

Always go back to the operator for answers. They are supplying the data to Energy Link. Operators have the original data.

Thank you Martha, I was already thinking that I should go to the operator. You are always great help here in this forum. Thank you again. MK

Martha, Thank you for all your help. I’m not having problems with Energy Link, but with Contango Resources who uses Energy Link. I called Contango and left message on Jan 3, have called several times since and wrote emails. If you take the 1099 it won’t add up. Then they took deduction and I have a no deduction lease. I finally got an email that they knew the 1099 was wrong and would get back to me, that was over 2 weeks ago. I am about ready to turn them in to the IRS for an audit. Have you heard of anyone else having problems with them?

Mineral owners have trouble with many operators with mistakes on 1099s. If you have your check stubs, then you can add up what you actually received and report that instead. You probably should add the copy of the email or notice from Contango that says they know the 1099 is wrong. Consult your accountant for the official way to do it. The IRS is seriously understaffed, so I doubt they will pay attention to a request for audit. Always keep your check stubs for at least seven years just in case there are any IRS questions.

This topic was automatically closed after 90 days. New replies are no longer allowed.