This is for Section 28, 7N, 13 Pittsburg County. Currently under court review Cause CD No. 202001490-T for Sanguine Gas Exploration. We have 54 net mineral acres. We see lots of lease offers, but not many outright purchase pricing in this forum. Our lease agreement with Canaan Expired in July and want to look at selling the mineral rights. Would Sanguine deal directly with owners or do we need to work with one of the many land men that are sending us letters.

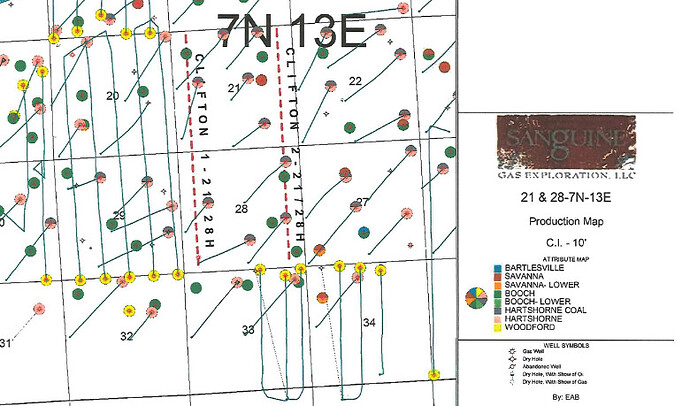

Sanguine has an increased density hearing and two horizontal wells pending in that section with 21. The section to the west has five horizontal wells on the exhibit map but may have a few less if that makes a difference as to possibilities. You either need to lease or you will get pooled or you can sell. You can ask Sanguine to make an offer or you can go with others. Or just wait until the new wells are drilled and take the royalties.

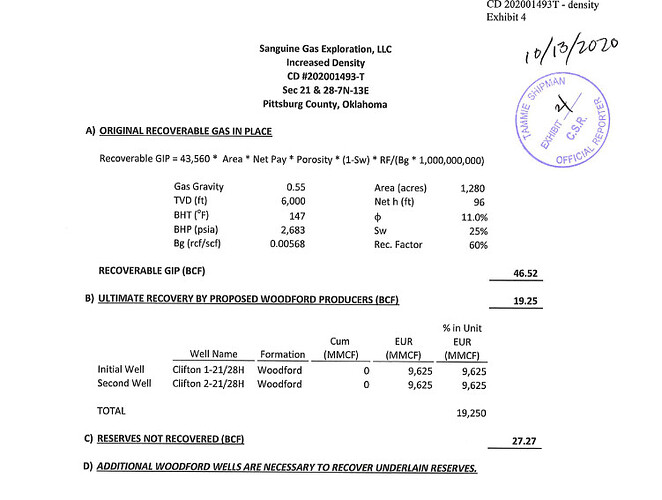

We have an offer from Castlerock for $2,000 per net acre. We are retired at ages 70 and 67 with no children to leave the minerals to, so do you think that two horizontal wells could possible deliver more income than that ($108,000) in 10 years using a royalty of 3/16th and a $500 bonus if we could get the bonus? Am I correct that we do not get the bonus if forced pooling is used by the driller?

The pooling bonus offers will be competitive for the area. 1/8th will have a higher bonus than 3/16ths or 1/5th. Many of us will take the higher royalty as the royalty over the life of the wells can exceed the bonus.

Your royalties will be calculated using the following equation. net mineral acres/actual spacing acres x royalty x % perforations in your section.

Example: 54/640 x .1875 x .50 (if well is half in 28 and half in 21. gives a decimal interest of .00791016. Your royalties will then depend upon the price of the products-oil, gas, plant products, etc. If you have 1/5th royalty, then the decimal is 0.0084375.

On the sale, you may have capital gains, so factor that in. On royalties you have an OK severance tax and state and fed tax so factor that in. But you get a bonus if you lease or pool. (Except the higher royalty amount may have a zero bonus which I often take in order to get more royalty dollars). Horizontal wells produce most of their revenue in the first four years and then taper off sharply and can last for decades. The shape of a hockey stick is commonly used to visualize-blade is the first few years, long handle are the last decades.

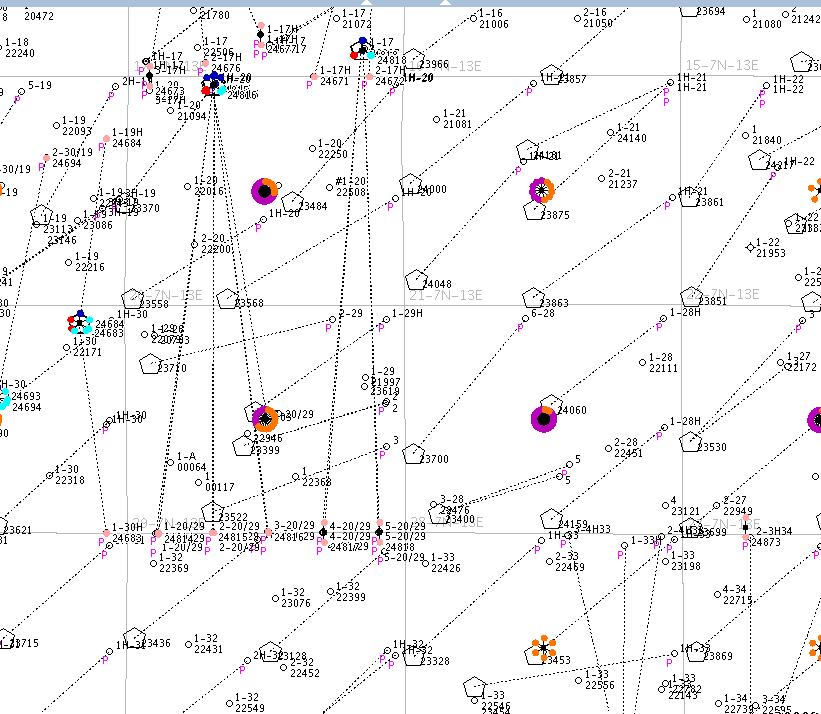

This is what the area looks like. Trinity drilled five long Belle wells to the west of you in 20/30 in 2018. Three Belle wells have made close to 2BCF each in three years. Two have made close to 4 BCF.

I was just looking at my last statement from Blue Water Resources at the Holt 4-28 well just above this formation is paying $1.51 per unit price (June 20, 2021) which I assume is Mcf. Would that be a better price to use rather than the $3 you recommend for both Clifton horizontal wells for the estimated income?

Martha, I really need to Know if I am understanding the math on this as the terms are new to me. Using the estimated lifetime production of Clifton #1 well we have 9,625 MMCF which = 9,625,000 Mcf @ $3 per Mcf = $28,875,000 Then with a royalty percentage decimal of 0.007915 (3/16) the gross royalty would be $228,545 per well. That’s gross, net would be prior to production taxes and post production costs that I might not be able to negotiate out. The annual first years production (1 to 3) per well could be on the low side 2,000,000 Mcf @ $3 per Mcf = $6,000,000 each well. Royalty would be times 0.00791016 for $47,490 each well if they both produce the estimated low side. Did I do the estimated math correctly? Thanks for your help on this. These are real answers to difficult questions.

Yes, that is fairly close to what I calculated using $3.00. Your operator may have a different contract with the gas processing group so a lower amount is also possible which addresses your other question. Given that the section to the west has five wells, the reservoir can handle that kind of volume extraction. Your operator has two wells planned but has left room in the middle for additional wells. There is never a simple answer, but a range of high side-low side estimates, do you want your money now or more spread out, etc. Another option is to sell a portion and keep a portion and split the risk. You get some upfront and some along the way. You will get the most value out of the wells in the first four years, so either way you get value (if the wells are successful).

Martha, Wow I can see now why we should look at not selling the Minerals, and hold on for the leasing. Sanguine has not been responsive to royalty owners questions, so I might need to find out more about who does what in forced pooling. Thanks, your info is of great help to us.

The Oklahoma Corporation Commission has a nice document that describes Force Pooling. If I cannot get a good lease with favorable terms that change objectionable clauses, then I frequently go with the FP. It is essentially a six month or one year “lease” for just the reservoirs listed. Essentially gives a depth clause and a tight time frame in which to drill. The options given are generally fairly close to the competitive offers for leasing. Many banks and trust offices just automatically go with the FP route. In a few rare cases, I have had the times run out and have received several sets of bonus checks before the well gets drilled. Rare, but nice.

when force pooling comes into effect does it cover “no post production charges”

in the past, the forced poolings for OK were for gross proceeds. It depends upon the wording of the pooling now and which operator you are dealing with.

Ed- short answer- Doubtful.

If Mittelstaedt language is added to a lease, pertaining to the requirement for the operating company to release data showing that the extra lease payment deduction beyond the first marketable gas price are shown to be reasonable, that the deduction is shown to be proportionally assessed, transforming an already marketable product to an enhanced product do operators actually release these details to a lease holder? Have you seen any of these details ever released by Sanguine Gas or Trinity Operating? Does it take a letter from a lawyer to get this released or do they release it with a letter from the royalty owner? If the cost are not reasonable (such as building a mini refinery or negatively effecting a first marketable gas price, does the lessor have any other option but hiring a lawyer to sue?

This topic was automatically closed after 90 days. New replies are no longer allowed.