My question is about what deductions I can take on my tax returns. When I look at my check stubs, the amounts deducted from my royalties are mind boggling. Dollars deducted are larger than dollars received. I absolutely do not understand the terms being used and why I am paying for these things. It’s either in my contracts or these are considered normal. So here is a list of things being deducted 1) downstream pricing adjustments 2) transportation line fill 3) transportation 4) compression-Gath 5) processing. I see all these as costs to me. If I do not pay them, I do not get paid. Are any of these items tax deductions for my forum neighbors? My minerals are in North Dakota and I live in California if that’s of any help.

Hi Poppi,

What you’re seeing are “post-production” costs, and are a bit of a hot topic right now. I don’t believe they’re tax deductible because you’re reporting income AFTER they’re been removed, not before. That’s as far as I step into tax-land, but for explaining what they are…I can do that.

Essentially, any costs the company incurs getting the oil/gas to the wellhead (drilling, completing, all the iron downhole, etc) are not your responsibility as a mineral owner, but once it reaches the surface, the lease agreement determines what share of costs the mineral owner bears to get the minerals from the well head to the sales point. Look at your lease and see if you can find language that sounds like “deliver in the pipeline” or “at the mouth of the well” or “cost free” (note: not “free of cost at the well”…that’s usually referring to the drilling & completing costs)

These royalty clauses control which fees you pay.

You can think of it like this:

Cucumber Example

Say you have a big beautiful garden that you’re not currently using and the neighbor kid asks if he can grow cucumbers as a summer side-job. You can get 1/8th of his market profits, he says, to make it worth it to you. So he brings in the compost, buys the seeds, waters the garden for a few months, all at no cost to you.

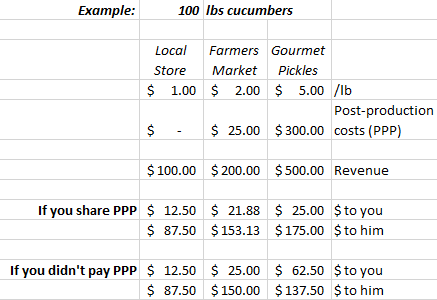

Once the cucumbers start coming in, he tells you he has 100 lbs of cucumbers he could sell to the local store for $1/lb. $100! Great!

But wait, he could drive to the farmers market 10 miles down the road and sell them for $2/lb (because, organic local farming is in), but it costs $5 gas to get there and a $20 fee to have a market stand there. And if he made gourmet pickles out of them, he could transform them into $5/lb (but would need to buy $275 of canning/pickling supplies, plus the farmers market fees).

In this example, the $5 gas, $20 market stand, and $275 canning supplies are post-production costs. Obviously you don’t WANT to pay them, but there’s wouldn’t be much incentive for the person doing all the work to find a better price for the product if there wasn’t some sort of share of the costs. In this example, he actually would lose money if he made pickles because the burden of the production costs was too high.

Yes, you’d make more money if you didn’t have to pay cucumber post-production costs, but there also wouldn’t be any pickles since it wouldn’t be in his interest to make them. This is not always the case with oil and gas, but this is the reason the post-production cost sharing exists. It’s obviously in your best interest to not have to pay them and can make a big difference.

Sorry for the long answer…I had some time to kill…

Thank you Tracey. I was hoping for some deductions but it doesn’t seem to be. I enjoyed your cucumbers very much and they added a bit of levity which help lessen my disappointment.

Oops I correct Tracy. Apologies for misspelling.

You’re welcome! You can still check with your tax person as I’m not a CPA or anything, but I’d bet on a “no” from them.

I also happen to have about 8 jars of pickles and a drawer full of cucumbers in my fridge, so it was on my mind ![]() . Glad to help how I can haha

. Glad to help how I can haha

This topic was automatically closed after 90 days. New replies are no longer allowed.