I received a call from a Landman for a company and they have sent me over a lease and a memorandum. I have been given the conveyance of the miner rights. I have reached out to a few attorneys to go over the information and all are very expensive. Is that normal? does anyone know the current going mineral rate in Gaines County? What are things I should negotiate and or watch out for?

You can observe qualified professionals (often with localized expertise) who provide services to mineral owners right here on The Mineral Rights Forum. You will notice them in 3 different places on the site:

-

in display image ads and text links on site

-

in our Mineral Service Provider Directory in the main navigation bar above. These are arranged by professional discipline.

-

as a Business Member within many conversations throughout the site Look for the blue colored “B” on their picture and blue colored text).

These practitioners are often able to provide specific (and often localized) services that meet your needs.

The Mineral Rights Forum Administration

Are your minerals north, south, east, or west of Seminole? Approximately how many miles? Gaines is a large county, maybe 30 x 60 miles. Far southwest Gaines is in the Midland Basin and might command more bonus than something on the Central Basin Platform. Back around 2017, Oxy leased up a lot of land in Gaines. See “Oxy leasing in Gaines County” thread in this forum. And then it seems as if nothing happened. You could edit out the personal and company information on the proposed lease, share it here on the forum, and get opinions as to its fairness. Or you might upload it to GPT 4.0 or Claude and get an AI readout. It’s 2024, would anyone offer less than a $500/acre bonus? Do you mind sharing how much the attorneys wanted to review your lease? If you own 2 acres that is a much different picture than owning 20 or 200. If you own 200, I think it would be an absolute necessity to get an oil and gas attorney on your team as one wrong clause could cost you $$$$ if there is ever drilling and production.

OGL_1.pdf (166.5 KB) Here it is. I believe I took everything out that was personal. Let me know what you all think.

I have them agreeing to add a through or under clause in section 9. My biggest question is in section 3, is 25% a lot to pay for the cost of treating and rendering it marketable?

Do not recommend the mineral owner using the Oil Company attorney as they work for the Oil Company. You can certainly correspond with the land department to get information. Use your own attorney that has their fiduciary responsibility with you to get legal advice.

You need an oil and gas attorney that will work in your favor. I would not sign this lease under any circumstances!

This is an old pro-oil company, anti-mineral owner lease form, dressed up to add horizontal wells. Here is a link to a 2015 TAMU article which will give you a very basic understanding of some of the issues and things to consider, even though it has not been updated recently. Oil and gas leases is complicated legal documents and the exact wording of each term matters. This is why an oil and gas attorney (not a general attorney) is worthwhile. Do not get pressured into signing before you do some research. There is a lot of good information on this site. NARO is another source of information and the Texas convention is in Austin from July 10-14. Your ability to negotiate terms will be limited if you own very small net mineral acres. https://trerc.tamu.edu/wp-content/uploads/files/PDFs/Articles/229.pdf

I own a 1/16th (i dont really know what that means). it is a Three (3) year primary term, 25% royalty and $700.00 per net mineral acre bonus money consideration.

1/16 is your fractional interest in the mineral acres. If Grandpa owned 100% of minerals and had 4 children, then each received 1/4. If Son A had 2 children, then each gets 1/2 of his 1/4 = 1/8. If Daughter B had 4 children, then each gets 1/4 of her 1/4 = 1/16. The net mineral acres will depend on size of the tract. If it is 100 acres and you own 1/16 = 6.25 acres. If it is 16 acres and you own 1/6 = 1 acre. Do you have a legal description? It could be a tract description with XX acres, more or less. Or it could be the North half of the section or the East quarter of the section.

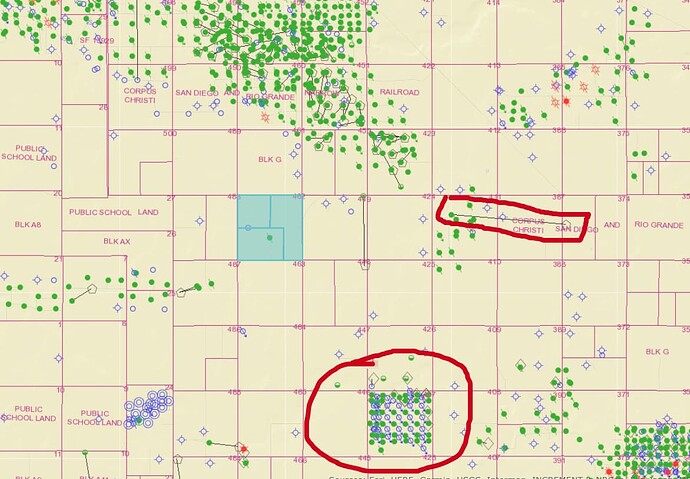

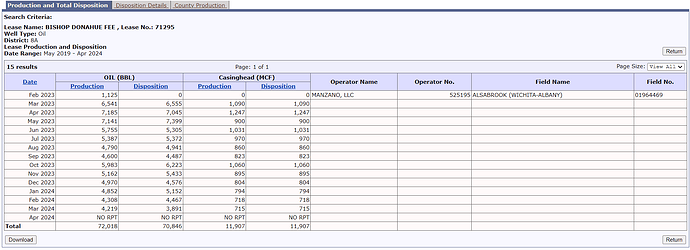

I am not offering you any legal or business advice with the following. Agreeing to warrant the title like that would be very concerning to me. I would strike the “minerals” and just have it be “oil and gas” only throughout the lease. Do you own any surface rights? If so, why give the company free use of the water or let them drill so close to your barn? I don’t see a Pugh Clause. I would want a gross proceeds lease with zero post-production deductions of any kind whatsoever. Achieving that without an oil and gas attorney would be short of impossible, at least for me, and it might not be such an easy thing even with an attorney. Given $80 oil and that you are near production like Kinder Morgan’s strong “Tall Cotton” ROZ production (red circle) and Manzano’s hz well (red rectangle), I would think your minerals might easily command more than $500/nma. If you own more than a very few acres I would urge you to get an oil and gas attorney to assist you. But be aware if you get too horsey, or if the company’s plans change abruptly, you might lose out on leasing and getting your bonus money. I have had that happen three times in Gaines county. Not fun.

My longer post is awaiting approval. If you sign the lease and get a $10,500 bonus check, it means they have determined you own 1/16 of the 240 acres, or 15 acres. There is no way of knowing what the oil company is planning. If by some chance your minerals have a Residual Oil Zone which they are intending to produce, or might be produced by someone else in the future, an oil and gas attorney is needed, imo.

Im curious Aj as to why you would strike minerals…my family makes money on other items. And at the point where I was analyzing things (I cant deal w/ family anymore) we were making almost as much on everything else as we were on oil. As I recall…you were helpful in the past with the lease (before this site got so tight)

Thank you

Madena

whoops…sorry!! I just saw your other post! Always on top of things AJ!!! (and yes…if my family had listened to me on just water alone theyd be making twice the money. I think they are ashamed to be getting money from an inheritance…but Its been a year of no contact and its LOVELY)

I don’t know how on top of things I am, Madena_Bennett, but thank you for the kind words. Glad you are enjoying your freedoms!

I took a Producers 88 type lease to my attorney once and the first thing he did was line out the “minerals” at the top of the page. I can’t say with certainty what the reasoning is, but I believe in general it may be that other minerals deserve their own lease language to best protect the lessor. If an oil company has land under an all inclusive lease and another company comes along and wants to produce, say, helium or something not covered by an oil and gas lease, then the owner, not the oil company, gets consideration like bonus money. Why give an oil company all the additional upside for the bonus payment for the right to produce oil and gas?

It is worth the money to pay a professional to help. My father signed what we thought was a “Royalty Lease” with Agave Natural Resources and ended up losing 3/4 of what we owned. Took them to court and ended up only losing half. This is no business for people like me who are easy targets for unscrupulous companies.

This topic was automatically closed after 90 days. New replies are no longer allowed.