Royalties from Newfield well have fallen off sharply since well completion approx. 1 1/2 years ago. Is this a normal drop-off for a Horizontal well? Heard rumors of a second well being drilled but have seen nothing or heard nothing in months.

The horizontal shale wells drop 80-90% in the first year. Don’t count on the additional wells being much better than what the current well is now producing. Horizontal wells do not “make” more oil, they only produce the oil that is present, much faster.

Todd M Baker

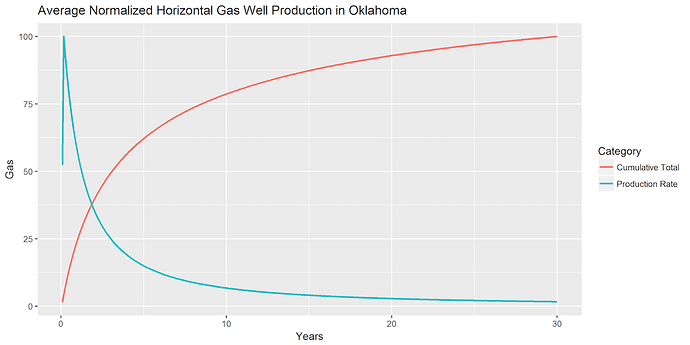

You have a combination of two effects going on. Prices have dropped substantially in the last year and the normal decline of a well which can be 50-80% in the first year or so. The shape of the decline curve is frequently described as a “hockey stick”. If you lay the stick on its side, the blade is the first few years of production and the handle is the long many years of predicted low production.

Newfield was bought by Encana this year, so Encana probably has a different strategy than Newfield for their infill wells.

Thank you for your response. Yes the rate of decline is in the range you described at 62.5%. Interestingly enough, the royalty checks are still coming from Newfield even though it was purchased by Encana. I have heard from some of my old contacts from my NGL Trading days that investor monies aren’t flowing in like they used to either so perhaps some drilling programs are being put on hold, just guessing as to why the second well never happened… Again thank you for your reply, makes perfect sense now.

Here is a great graph…first 6-12 months steep production then falls flat. Main reason that companies are in their current financial situation, horizontal wells are not economical at current prices and rates of production.

Your checks are still coming from Newfield because Encana purchased the Newfield oklahoma company, not just the assets.

Thanks, that is a great graph.