New York, 1957

First

- The will states that the Wife will be the sole executrix of the will. There are no other names mentioned in the will

- There are two documents that affirm the will is legit

- Will is probated in New York Court with no contest

- The brother and sister each filled out a separate form stating that they do not contest the will

- These forms are all filed 2 days before the Probate began

- Probate takes place in New York.

- Deceased owns in excess of 20,000 personal property

- Deceased own no real property in state he died (new york)

- Deceased estate is in excess of 20,000

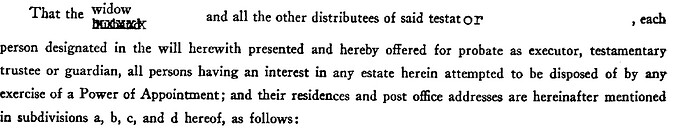

- Probate document includes this statement - What does this statement mean? There are three names listed below it, one is the executrix, one the brother (not mentioned in will), one sister (not mentioned in will). Does this statement give the brother and sister any rights to ownership of any personal or real property?

---------------------------------------------------------------

Second

If the wife is the sole executrix of this probate, when the probate is complete does the wife own all mineral rights that may exist in another state (North Dakota). I do know that the will will have to be re-probated in North Dakota to transfer deeds.

So according to the probate of this will, do the brother and sister have any rights to the deceased estate?

2712-will1.jpg (237 KB)

2713-will2.jpg (204 KB)

2714-Will4.jpg (288 KB)

My sympathy for your loss. I have one question, if the deceased had no property in the state of NY, why is a probate being done there?

I am not a lawyer -- here are my thoughts.

The identity of the executor/executrix doesn't correlate to the inheritors of the will. If the will leaves everything to the wife, then everything is left to the wife no matter the location of the property or who the executrix is.

There is no "real property" in New York. There was personal property. There were also mineral rights that are in 14 counties in North Dakota.

r w kennedy said:

My sympathy for your loss. I have one question, if the deceased had no property in the state of NY, why is a probate being done there?

I see your point now. Still, when my great grandfather passed and his will was probated in ND all of the chattle property in Tx was disposed of, furniture, cars and so forth. Evidently it was not necessary to probate in Tx. I was wondering if there was a rule or law that forced a probate to be done in NY. I am asking because there may be differences in the inheritance laws between the two states. I believe that in the normal course of events that the will controls who gets what but the normal course of events aren't always what happens. If you think something is taking a wrong turn or may take a wrong turn, I suggest you consult a lawyer.

Marguerite Lowak said:

There is no "real property" in New York. There was personal property. There were also mineral rights that are in 14 counties in North Dakota.

r w kennedy said:

My sympathy for your loss. I have one question, if the deceased had no property in the state of NY, why is a probate being done there?

The first thing I would do is check in the county where the mineral rights are recorded. Mineral rights being inherited is complicated business. They may have been sold. Check on the recorded deeds, get copies. There is a law called "after aquired property doctrine" which is quite complicated.

The After Acquired Title Doctrine is a legal doctrine under which, if a grantor conveys what is mistakenly believed to be good title to land that he or she did not own, and the grantor later acquires that title, it vests automatically in the grantee. A practical example is Husband and Wife own 200 mineral acres. Wife is awarded the property through a will. Husband had sold the property to a bonafide purchaser for value without wife knwing or signing. Husband executes a Warranty Deed to the purchaser and the deed is properly recorded. Subsequently, a deed from the Husband to the Wife is recorded. Under the After Acquired Title Doctrine, the interest received by the wife automatically transfers to the new purchaser. It happened to me.

I would like to add that it happened to me but not by my husband. It was a big issue in an inheritance matter.

Cookie Gartner said:

The first thing I would do is check in the county where the mineral rights are recorded. Mineral rights being inherited is complicated business. They may have been sold. Check on the recorded deeds, get copies. There is a law called "after aquired property doctrine" which is quite complicated.

The After Acquired Title Doctrine is a legal doctrine under which, if a grantor conveys what is mistakenly believed to be good title to land that he or she did not own, and the grantor later acquires that title, it vests automatically in the grantee. A practical example is Husband and Wife own 200 mineral acres. Wife is awarded the property through a will. Husband had sold the property to a bonafide purchaser for value without wife knwing or signing. Husband executes a Warranty Deed to the purchaser and the deed is properly recorded. Subsequently, a deed from the Husband to the Wife is recorded. Under the After Acquired Title Doctrine, the interest received by the wife automatically transfers to the new purchaser. It happened to me.

From my experience as a landman, not a lawyer, whenever we had minerals in one state and a decedent who died intestate in another state, we always applied the laws of descent and distribution for the state in which the minerals were located. Some states, I think Missouri is an example, try to say that all property of the decedent must follow their laws of descent and distribution if decedent died there, but I don't think that law is enforceable.

NOT LEGAL ADVICE

Well, the images attached appear to be for what I would call an Application to Probate Will. There is no image for where the Court accepted the Will for probate, and no image for the Will itself, so it's not possible to say with reasonable certainty whether or not the brother and sister inherited anything. As far as what "this statement" means, those names are just identifying who might have an interest in the Will. They have to be listed and served notice of the hearing in case they want to contest the Will. Since they did not contest the Will, I doubt they ever attended the hearing. No, that statement alone does NOT mean the brother or sister has any rights or get any rights from the Will or Probate.

Now here is why it would be helpful to read the actual Will. If the Decedent owned some minerals or mineral rights in North Dakota at the time of his death but did not specifically or generally bequeath them to anybody (a devisee) in the Will, then you need to look for a "residuary clause" in the Will. This clause, if it exists in this Will, will say something like "I give, devise, and bequeath all the rest and residue of my Estate, whether real or personal property, and wherever situated, to _______________." THAT person would inherit the minerals or mineral rights in North Dakota as well as anything else not specifically or generally bequeathed. So the person who died could have left his main house to A, his vacation home to B, all his mineral or royalty interests in New York to C, his cigar collection to D, and everything else (the residue) to E. In this case, E would inherit the minerals or mineral rights in North Dakota. If there is no "residuary clause" in the Will, which would be rare, then, at least in Texas, one would have to follow the laws of descent and distribution to determine who would inherit what ended up in that bucket (the residue of the Estate).

The Sole Executrix inherits NOTHING simply by virtue of being the Executrix, unless the Will specifically says so, which would be very unusual.

Cookie, as I recall from your posting on another discussion, your father executed a Warranty Deed guaranteeing to convey a property to a Buyer, but owned only a community 1/2 interest in that property at that time, not the full fee-simple interest. Then, when your mother died, she bequeathed the other community 1/2 interest to your father in her Will. Therefore, under the doctrine of after-acquired title, title to this second community 1/2 interest automatically vested in the Buyer of the first community 1/2 interest. That makes sense, but that is different than how you have summarized the scenario in this posting.

Put yourself in the position of the Buyer, not the daughter who feels disenfranchised from owning the second community 1/2 interest. If I signed a Warranty Deed to you for the house that you are now living in, you paid me full price (not half price), but then it turned out that I owned only a 1/2 interest in that property at the time that I sold to you, what do you think should happen to the other 1/2 interest that I inherit it from my wife when she passes away? Should I be able to sell that second 1/2 interest to somebody else and make even more money? OF COURSE NOT, it would go to YOU because you paid full price and you were expecting to get 100% ownership in the house. If I could sell the second 1/2 interest to somebody else, then there would be documentation showing 150% ownership in your house in the Deed Records, an obvious impossibility.

Your father could have avoided the triggering of "after acquired title" by stating in his Deed many years ago that he was conveying "my community one-half (1/2) interest" or "whatever ownership interest is vested in me AT THIS TIME," or some wording to that effect. If he or the jackleg lawyer preparing his Deed had done that, then you would own your mother's 1/2 interest in that property today. Complicated and seemingly unfair, yes, but the proper outcome, in my opinion. And if your mother had left her community 1/2 interest to you or somebody else in her Will, then there would have been a real mess. The owner of the first 1/2 interest probably could have sued your father to enforce the Warranty that he made.

Cookie Gartner said:

The first thing I would do is check in the county where the mineral rights are recorded. Mineral rights being inherited is complicated business. They may have been sold. Check on the recorded deeds, get copies. There is a law called "after aquired property doctrine" which is quite complicated.

The After Acquired Title Doctrine is a legal doctrine under which, if a grantor conveys what is mistakenly believed to be good title to land that he or she did not own, and the grantor later acquires that title, it vests automatically in the grantee. A practical example is Husband and Wife own 200 mineral acres. Wife is awarded the property through a will. Husband had sold the property to a bonafide purchaser for value without wife knwing or signing. Husband executes a Warranty Deed to the purchaser and the deed is properly recorded. Subsequently, a deed from the Husband to the Wife is recorded. Under the After Acquired Title Doctrine, the interest received by the wife automatically transfers to the new purchaser. It happened to me.

Pete, since the state of North Dakot does not recognise the probates of other states, wouldn't the estate have to be probated in the state of North Dakota? I wonder if those left out of the will wouldn't have a claim on the minerals if passed through North Dakota intestecy laws for lack of a recognised probate?

Pete Wrench said:

NOT LEGAL ADVICE

Well, the images attached appear to be for what I would call an Application to Probate Will. There is no image for where the Court accepted the Will for probate, and no image for the Will itself, so it's not possible to say with reasonable certainty whether or not the brother and sister inherited anything. As far as what "this statement" means, those names are just identifying who might have an interest in the Will. They have to be listed and served notice of the hearing in case they want to contest the Will. Since they did not contest the Will, I doubt they ever attended the hearing. No, that statement alone does NOT mean the brother or sister has any rights or get any rights from the Will or Probate.

Now here is why it would be helpful to read the actual Will. If the Decedent owned some minerals or mineral rights in North Dakota at the time of his death but did not specifically or generally bequeath them to anybody (a devisee) in the Will, then you need to look for a "residuary clause" in the Will. This clause, if it exists in this Will, will say something like "I give, devise, and bequeath all the rest and residue of my Estate, whether real or personal property, and wherever situated, to _______________." THAT person would inherit the minerals or mineral rights in North Dakota as well as anything else not specifically or generally bequeathed. So the person who died could have left his main house to A, his vacation home to B, all his mineral or royalty interests in New York to C, his cigar collection to D, and everything else (the residue) to E. In this case, E would inherit the minerals or mineral rights in North Dakota. If there is no "residuary clause" in the Will, which would be rare, then, at least in Texas, one would have to follow the laws of descent and distribution to determine who would inherit what ended up in that bucket (the residue of the Estate).

The Sole Executrix inherits NOTHING simply by virtue of being the Executrix, unless the Will specifically says so, which would be very unusual.

As I said before. Husband and wife pay off a house. It usually takes 30 years in Texas. He needs or wants money, let's say to pay off gambling debts or to keep a mistress. He sells house, spends all the money. Wife dies first, children go without even though mom thought he would take care of children. If I had known that there is an after acquired title doctrine, I could have saved a lot of money by not buying title insurance when I purchased homes for many years.

I don't feel disenfranchised at all. I tried to learn the law. I was offered money because CHK thought we owned it. I inherited minerals from these same parents, but I think this law leaves a lot of room for fraudulent behavior.

Pete Wrench said:

Cookie, as I recall from your posting on another discussion, your father executed a Warranty Deed guaranteeing to convey a property to a Buyer, but owned only a community 1/2 interest in that property at that time, not the full fee-simple interest. Then, when your mother died, she bequeathed the other community 1/2 interest to your father in her Will. Therefore, under the doctrine of after-acquired title, title to this second community 1/2 interest automatically vested in the Buyer of the first community 1/2 interest. That makes sense, but that is different than how you have summarized the scenario in this posting.

Put yourself in the position of the Buyer, not the daughter who feels disenfranchised from owning the second community 1/2 interest. If I signed a Warranty Deed to you for the house that you are now living in, you paid me full price (not half price), but then it turned out that I owned only a 1/2 interest in that property at the time that I sold to you, what do you think should happen to the other 1/2 interest that I inherit it from my wife when she passes away? Should I be able to sell that second 1/2 interest to somebody else and make even more money? OF COURSE NOT, it would go to YOU because you paid full price and you were expecting to get 100% ownership in the house. If I could sell the second 1/2 interest to somebody else, then there would be documentation showing 150% ownership in your house in the Deed Records, an obvious impossibility.

Your father could have avoided the triggering of "after acquired title" by stating in his Deed many years ago that he was conveying "my community one-half (1/2) interest" or "whatever ownership interest is vested in me AT THIS TIME," or some wording to that effect. If he or the jackleg lawyer preparing his Deed had done that, then you would own your mother's 1/2 interest in that property today. Complicated and seemingly unfair, yes, but the proper outcome, in my opinion. And if your mother had left her community 1/2 interest to you or somebody else in her Will, then there would have been a real mess. The owner of the first 1/2 interest probably could have sued your father to enforce the Warranty that he made.

Cookie Gartner said:

The first thing I would do is check in the county where the mineral rights are recorded. Mineral rights being inherited is complicated business. They may have been sold. Check on the recorded deeds, get copies. There is a law called "after aquired property doctrine" which is quite complicated.

The After Acquired Title Doctrine is a legal doctrine under which, if a grantor conveys what is mistakenly believed to be good title to land that he or she did not own, and the grantor later acquires that title, it vests automatically in the grantee. A practical example is Husband and Wife own 200 mineral acres. Wife is awarded the property through a will. Husband had sold the property to a bonafide purchaser for value without wife knwing or signing. Husband executes a Warranty Deed to the purchaser and the deed is properly recorded. Subsequently, a deed from the Husband to the Wife is recorded. Under the After Acquired Title Doctrine, the interest received by the wife automatically transfers to the new purchaser. It happened to me.

Years ago not everyone had a lawyer, Pete. Especially not in places like Cotulla. (Jacklegged or not.) People knew each other and did things such as a one page title transfer. They walked down to the courthouse and did it. No mineral rights were included or excluded in the probated will many years later. I am not suggesting that the buyer should not have it. I just think it is a bad law. It stems from way back when, when a man could sell what his wife owned after a loss in a poker game. I guess he did not want to lose face by running home to ask if he could sell the farm. It is complicated but South Texas was owned by farmers with many Mexican wives who were given land as trousseaus. That changed. The "after acquired title" covers properties that are not homesteaded. So, someone must have complained about being out on the streets with 10 to 12 kids. Thank you for your replies but I do not think one spouse, man or woman, should have that much power. That is the reason why title companies exist on every corner today. .

Cookie Gartner said:

As I said before. Husband and wife pay off a house. It usually takes 30 years in Texas. He needs or wants money, let's say to pay off gambling debts or to keep a mistress. He sells house, spends all the money. Wife dies first, children go without even though mom thought he would take care of children. If I had known that there is an after acquired title doctrine, I could have saved a lot of money by not buying title insurance when I purchased homes for many years.

I don't feel disenfranchised at all. I tried to learn the law. I was offered money because CHK thought we owned it. I inherited minerals from these same parents, but I think this law leaves a lot of room for fraudulent behavior.

Pete Wrench said:

Cookie, as I recall from your posting on another discussion, your father executed a Warranty Deed guaranteeing to convey a property to a Buyer, but owned only a community 1/2 interest in that property at that time, not the full fee-simple interest. Then, when your mother died, she bequeathed the other community 1/2 interest to your father in her Will. Therefore, under the doctrine of after-acquired title, title to this second community 1/2 interest automatically vested in the Buyer of the first community 1/2 interest. That makes sense, but that is different than how you have summarized the scenario in this posting.

Put yourself in the position of the Buyer, not the daughter who feels disenfranchised from owning the second community 1/2 interest. If I signed a Warranty Deed to you for the house that you are now living in, you paid me full price (not half price), but then it turned out that I owned only a 1/2 interest in that property at the time that I sold to you, what do you think should happen to the other 1/2 interest that I inherit it from my wife when she passes away? Should I be able to sell that second 1/2 interest to somebody else and make even more money? OF COURSE NOT, it would go to YOU because you paid full price and you were expecting to get 100% ownership in the house. If I could sell the second 1/2 interest to somebody else, then there would be documentation showing 150% ownership in your house in the Deed Records, an obvious impossibility.

Your father could have avoided the triggering of "after acquired title" by stating in his Deed many years ago that he was conveying "my community one-half (1/2) interest" or "whatever ownership interest is vested in me AT THIS TIME," or some wording to that effect. If he or the jackleg lawyer preparing his Deed had done that, then you would own your mother's 1/2 interest in that property today. Complicated and seemingly unfair, yes, but the proper outcome, in my opinion. And if your mother had left her community 1/2 interest to you or somebody else in her Will, then there would have been a real mess. The owner of the first 1/2 interest probably could have sued your father to enforce the Warranty that he made.

Cookie Gartner said:

The first thing I would do is check in the county where the mineral rights are recorded. Mineral rights being inherited is complicated business. They may have been sold. Check on the recorded deeds, get copies. There is a law called "after aquired property doctrine" which is quite complicated.

The After Acquired Title Doctrine is a legal doctrine under which, if a grantor conveys what is mistakenly believed to be good title to land that he or she did not own, and the grantor later acquires that title, it vests automatically in the grantee. A practical example is Husband and Wife own 200 mineral acres. Wife is awarded the property through a will. Husband had sold the property to a bonafide purchaser for value without wife knwing or signing. Husband executes a Warranty Deed to the purchaser and the deed is properly recorded. Subsequently, a deed from the Husband to the Wife is recorded. Under the After Acquired Title Doctrine, the interest received by the wife automatically transfers to the new purchaser. It happened to me.

Pete, one more question about the after acquired property. If I buy stolen items such as a car with title, why would I not be able to keep it if I bought it in good faith? No one says well, look at it from the buyer's side. I would be forced to return it or go to prison, right? Just arguing the problem with this doctrine.

Cookie Gartner said:

Years ago not everyone had a lawyer, Pete. Especially not in places like Cotulla. (Jacklegged or not.) People knew each other and did things such as a one page title transfer. They walked down to the courthouse and did it. No mineral rights were included or excluded in the probated will many years later. I am not suggesting that the buyer should not have it. I just think it is a bad law. It stems from way back when, when a man could sell what his wife owned after a loss in a poker game. I guess he did not want to lose face by running home to ask if he could sell the farm. It is complicated but South Texas was owned by farmers with many Mexican wives who were given land as trousseaus. That changed. The "after acquired title" covers properties that are not homesteaded. So, someone must have complained about being out on the streets with 10 to 12 kids. Thank you for your replies but I do not think one spouse, man or woman, should have that much power. That is the reason why title companies exist on every corner today. .

Cookie Gartner said:

As I said before. Husband and wife pay off a house. It usually takes 30 years in Texas. He needs or wants money, let's say to pay off gambling debts or to keep a mistress. He sells house, spends all the money. Wife dies first, children go without even though mom thought he would take care of children. If I had known that there is an after acquired title doctrine, I could have saved a lot of money by not buying title insurance when I purchased homes for many years.

I don't feel disenfranchised at all. I tried to learn the law. I was offered money because CHK thought we owned it. I inherited minerals from these same parents, but I think this law leaves a lot of room for fraudulent behavior.

Pete Wrench said:

Cookie, as I recall from your posting on another discussion, your father executed a Warranty Deed guaranteeing to convey a property to a Buyer, but owned only a community 1/2 interest in that property at that time, not the full fee-simple interest. Then, when your mother died, she bequeathed the other community 1/2 interest to your father in her Will. Therefore, under the doctrine of after-acquired title, title to this second community 1/2 interest automatically vested in the Buyer of the first community 1/2 interest. That makes sense, but that is different than how you have summarized the scenario in this posting.

Put yourself in the position of the Buyer, not the daughter who feels disenfranchised from owning the second community 1/2 interest. If I signed a Warranty Deed to you for the house that you are now living in, you paid me full price (not half price), but then it turned out that I owned only a 1/2 interest in that property at the time that I sold to you, what do you think should happen to the other 1/2 interest that I inherit it from my wife when she passes away? Should I be able to sell that second 1/2 interest to somebody else and make even more money? OF COURSE NOT, it would go to YOU because you paid full price and you were expecting to get 100% ownership in the house. If I could sell the second 1/2 interest to somebody else, then there would be documentation showing 150% ownership in your house in the Deed Records, an obvious impossibility.

Your father could have avoided the triggering of "after acquired title" by stating in his Deed many years ago that he was conveying "my community one-half (1/2) interest" or "whatever ownership interest is vested in me AT THIS TIME," or some wording to that effect. If he or the jackleg lawyer preparing his Deed had done that, then you would own your mother's 1/2 interest in that property today. Complicated and seemingly unfair, yes, but the proper outcome, in my opinion. And if your mother had left her community 1/2 interest to you or somebody else in her Will, then there would have been a real mess. The owner of the first 1/2 interest probably could have sued your father to enforce the Warranty that he made.

Cookie Gartner said:

The first thing I would do is check in the county where the mineral rights are recorded. Mineral rights being inherited is complicated business. They may have been sold. Check on the recorded deeds, get copies. There is a law called "after aquired property doctrine" which is quite complicated.

The After Acquired Title Doctrine is a legal doctrine under which, if a grantor conveys what is mistakenly believed to be good title to land that he or she did not own, and the grantor later acquires that title, it vests automatically in the grantee. A practical example is Husband and Wife own 200 mineral acres. Wife is awarded the property through a will. Husband had sold the property to a bonafide purchaser for value without wife knwing or signing. Husband executes a Warranty Deed to the purchaser and the deed is properly recorded. Subsequently, a deed from the Husband to the Wife is recorded. Under the After Acquired Title Doctrine, the interest received by the wife automatically transfers to the new purchaser. It happened to me.

I never knew that there was a state that refused to recognize the probate of another state until I read some recent posts made by others on this Forum. Here's my cop-out answer to your question:

Under North Dakota law, my guess is that you are correct, the will filed for probate in New York will also have to be filed for probate in North Dakota (call it the "North Dakota Probate Judge Full Employment Act").

However, my guess is that the North Dakota law is unconstitutional under the "Full Faith and Credit Clause" of the U.S. Constitution. According to this Web site,

http://legal-dictionary.thefreedictionary.com/Full+Faith+and+Credit...

the U.S. Constitution "ensures that judicial decisions rendered by the courts in one state are recognized and honored in every other state. It also prevents parties from moving to another state to escape enforcement of a judgment or to relitigate a controversy already decided elsewhere, a practice known as forum shopping." So as soon as somebody with enough dollars to test this North Dakota law is impacted by it, we will see a challenge to that law, I predict.

r w kennedy said:

Pete, since the state of North Dakot does not recognise the probates of other states, wouldn't the estate have to be probated in the state of North Dakota? I wonder if those left out of the will wouldn't have a claim on the minerals if passed through North Dakota intestecy laws for lack of a recognised probate?

Unless you were paying cash for those homes for many years, or unless your lender was extremely unprofessional, you would have been required to buy title insurance. What lender would make a loan to you for property that somebody "says" that they own, without verifying it? Not any that I know of. And if you had know about "after acquired title" at the time you were purchasing these homes, that should have made you MORE willing to pay for title insurance, not LESS so!

Cookie Gartner said:

As I said before. Husband and wife pay off a house. It usually takes 30 years in Texas. He needs or wants money, let's say to pay off gambling debts or to keep a mistress. He sells house, spends all the money. Wife dies first, children go without even though mom thought he would take care of children. If I had known that there is an after acquired title doctrine, I could have saved a lot of money by not buying title insurance when I purchased homes for many years.

I don't feel disenfranchised at all. I tried to learn the law. I was offered money because CHK thought we owned it. I inherited minerals from these same parents, but I think this law leaves a lot of room for fraudulent behavior.

Where does it say that the doctrine of "after-acquired title" applies only to non-homestead property? Also, one spouse does not and did not at the time that your father executed that instrument "have that much power" to dispose of your mother's property. Maybe in the 1760's or 1860's but darn sure not in the 1960's. Your father did not have the power to sell what belonged to your mother at the time that he signed that Deed. The only reason that he ended up "having the power" to sell her part of it (prospectively) is because she gave it to him in her Will! SHE gave him the power to dispose of her property, but he had already sold it! So in the end there was nothing fraudulent about the Buyer getting the entire ownership of the property.

The stolen-car analogy is not a valid one because your father stole nothing from your mother, neither did the Buyer. Your father might have even given your mother half of the proceeds of the sale in 1963 based on her promise that she would leave her half of the property to him, had you thought about that?

If you buy a stolen car in good faith and receive title to it, then you must return it, the Seller goes to jail, the title is voided, and you sue the Seller for the price of the vehicle plus whatever else you can get. So if your mother had died and left her Estate to you, you actually could have filed a lawsuit to "quiet title" in District Court, which would then have prompted the Buyer (or whoever he sold the property to) to sue your father for failure of Warranty and possibly sue him or you for back taxes he paid for your mother's 1/2 interest in the property over the years, plus 1/2 of the cost of any expenses and improvements he made to the property over the years.

The bottom line is words have meaning, and when you sign a legal document you better darn sure understand what the words mean or have insurance to cover your butt if you don't. Otherwise, don't complain down the road if those words did not mean what you thought they meant.

Cookie Gartner said:

The "after acquired title" covers properties that are not homesteaded. So, someone must have complained about being out on the streets with 10 to 12 kids. Thank you for your replies but I do not think one spouse, man or woman, should have that much power.

Cookie, your mom should have left it to someone else.

Pete,

From what I can tell many states do not unconditionally recognize a foreign probate regarding mineral rights, some never. Oklahoma, Colorado, Kansas, Mississippi, Montana, North Dakota, New Mexico, Ohio, Louisiana, Arkansas, California.

Pete Wrench said:

I never knew that there was a state that refused to recognize the probate of another state until I read some recent posts made by others on this Forum. Here's my cop-out answer to your question: