I agree with Jeffrey. Generic databases like the one you shared need to be verified, price adjusted, reservoir adjusted, completion type, vertical vs horizontal, time frame identified by well, etc. Very dangerous to use without knowing what the data is and where it came from. Statistics can lie so easily.

For example, that screenshot from the generic website has 1737 leases “in the database” supposedly from 7/1/1990. There are actually over 5000 leases in another data base just from 4/20/01 to 12/23/05, so you can see there is a huge problem with the generic data base number of leases and every calculation that might be based upon it.

I would not trust that generic data base oil number at all… For example, I queried a different database on production from all wells in Hughes county from 7/1/1990 to 5/1/2018. And cum oil was 3,179,182 bbls and 873,648,446 mcf gas from 1599 wells. (643 were listed as Woodford wells with 247,518 bbls oil and 747,383,366 mcf of the total) Horizontal drilling is well underway already. Vastly different than the numbers from the generic website. For the most part, Hughes county has historically produced primarily gas with associated liquids. Those liquids were usually reported in the “oil” column in older wells. More recent production puts the NGLs in the their own category and puts condensate in the oil category.

I would refer you to a good summary article

https://info.drillinginfo.com/arkoma-basin-next-scoopstack/

It has a nice comparison of leasing prices in the Arkoma versus the STACK. They are from 2017, but horizontal Woodford drilling was already in full swing. Lease prices in 2018 are up a bit from then since gas prices are a bit up, but the highest I have been offered so far this year is $500 3/16 which is reasonable considering that the product is mostly gas. I prefer to 1/5, so my leasing bonuses have been a bit lower for that. You can want $2500 and 1/5th, but you will probably not get it in the near future for a lease and the poolings will probably not get to that level in the near future either. I hope you do, but given the product and price, not likely. If gas goes to $15-20/mcf, then maybe…

The conventional reservoirs have been producing since the 1950s. Since they are so gas rich, they have produced for a long time. The Woodford is the newer play at deeper depths and is also gas prone-even more so, since it has a higher level of maturity and is also the source rock for the shallower reservoirs.

The article has a nice map showing the main reservoirs and where they have produced. The leasing is driven by the preferred economic reservoirs. The Rate of Return is highly dependent upon the price of gas and that drives the lease bonus offers.

I used my database to sort by gas and oil wells. The “oil” wells are on the west side of Hughes in the old conventional reservoirs. The “gas” wells are mostly on the east side of the county in the Woodford with the best wells in the SE townships (hence probable slightly higher bonus values).

Here is an older map from the USGS

It is a bit confusing, but the Ro 1.4% orange line is the important one. Woodford to the left will be wells with condensate (in purple) and wells to the right in red are gas only (in red). Most of Hughes Woodford is gas. The map also shows the regional Woodford depth and thickness.

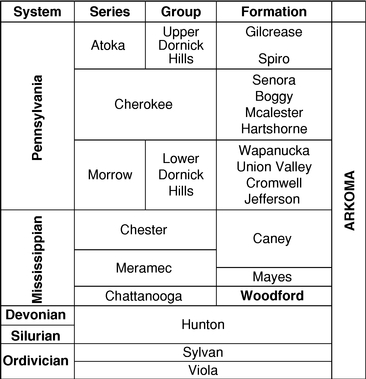

For those of you who would like a strat column for the Arkoma basin. Here is one:

If you want a good geologic summary of the Arkoma basin, then here is a good article with some great pictures. The file is too big to upload, but the reference is Shale Shaker, Vol 63. No 1 July-August 2012 Issue. Arkoma Basin Petroleum-Past, Present, and Future, A Geologic Journey through the Wichitas, Black Mesa Basalt and much more by Neil H. Suneson.

Hope this helps you have a better feel for the Arkoma Basin.