I have all of the tax data and payments from the various energy companies but nowhere can I find a single api number.

Do you have a list of wells/names? If its not insanely long I can look them up for you.

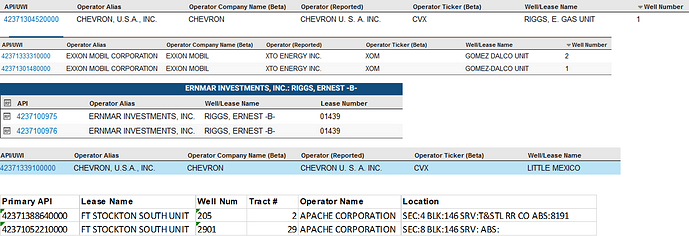

here is what i have on the 4 properties do you need lease numbers?

I do not know what goes with what…

riggs, e gas unit gomez (ellensburg er) ft stockton s un tr 29

gomez-dalco unit gomez (ellensburg er)

riggs, e-b-

little mexico gas unit

ft stockton s un tr 2

Blck 114 Trct 1 Abst # 6041 A RIGGS Sec 2 Acrs 40 NE/4 SW/4, block 114 section 2 Blck 114 Trct 2 Abst # 6042 A RIGGS Sec 4 Acrs 200 NW/4 NE/4, Blck 146 Trct 3 Abst # 8263 T&STL Sec 8 Acrs 80 W/2 SE/4 Trct 4 Abst # 8263 T&STL Sec 8 Acrs 80 E/2 SE/4,

VERY EXCELLENT! thanks I am only missing Ft Stockton unit tr 11 lease 34110 operator diamondback. Also do you have a link to where I can input the API number and see current well status thank mark

VERY EXCELLENT! thanks I am only missing Ft Stockton unit tr 11 6042 A RIGGS

A Riggs - 4237130466 (Mongoose Energy) Ft Stockton Unit Tr 11 - 4237133351 and 4237133355 (Diamondback)

I only sent you the active APIs on those tracts, which I found through IHS subscription service. There has to be some way to see if other things are active or not on the TRRC website, but I’m not too familiar with it. Wellbore or Completions Query maybe? Sorry unfortunately the RRC website totally blows relatively to states that don’t have to manage 1million wells, so I avoid it like the plague if at all possible and rely on subscription services.

I agree the rrc is tough to use. Thanks for you work I do appeciate it. mark

Hi can you possibly help me find the APIs for my interests? I only have a description. Pecos.pdf (3.2 MB)

These wells were producing in Abstract 4522 early in 2024.

- 4237104215

- 4237104216

- 4237105389

- 4237105391

Flora Barton wells operated by Vidonia oil. Not much oil. Do not show any production past Feb 2024.

I need some help as well. I see alot of wells in Kansas but I have a hard time finding in Texas… Is it true API numbers the five digits are the first five digits of your SSN.

API numbers have nothing to do with your SSN. The first two numbers are the state code. The next three numbers are the county code. The next five numbers are the well code in sequential date order as the permits are filed. If there are four more numbers, those are for sidetracks or redrills.

1# 370 30 11100 21R 14B2 EXT 31 1# 370 30 11100 36 1# 186 30

Maybe u can help locate these ill appreciate it this what came up when I scanned my IRS letter.

Do you know which county? Those are not in Pecos-it is 371. TX code is 42 (Which they have not listed), 370 is the county code, but I don’t live in TX, so don’t have them memorized.

I’m not from there neither. I have the slightest clue. 21R?

21R may be a redrill. 14B2 may be part of the well name. Someone in TX may be able to help.

Thanks for the information. I only asked because i recently notice my daughter has a 704 SSN connected to railroad commission and she’s only 11. Also I. My dealings with IRS i received a 2d barcode voucher which I scanned my last four digits on voucher and it said railroad commission and I clicked link and I was able to see the oil wells they have but I don’t know which one is connected to me. So in Kansas I use my first five digits of SSN n it brought sum old wells up, thought I ask but once again thank you. One more question what are the sequences numbers on API?

In general, the middle five digits are the well codes which are assigned sequentially as the permits are assigned. So the first well might be 00001, and the second well 00002, etc. In some cases, very old wells did not have API numbers, so if still active, they have been assigned numbers with higher digits. I have a feeling some counties are going to run out of numbers eventually, so they may have to adapt the rules.

These may be RRC oil and gas proration schedule figures. Eg, Well #31, Daily oil bbl allowable 1, Daily Gas mcf allowable 370, Monthly Oil bbl allowable 30, Monthly Gas mcf allowable 11100. Proration schedules are issued regularly and you have to know the operator and well and year to match. IRS is concerned about unreported oil and gas income on your tax return. You need to find the 1099-MISC (royalties) or 1099-NEC (working interest) from the operator for the year to see what the IRS is telling you was not reported on your tax return. Look at your check detail for the year to see the well names that you were being paid on. If you do not have your 1099’s, then your CPA may be able to get them from the IRS. If you are not being paid royalties, then you can contact the issuer of 1099 and ask whether the royalties are in suspense or have been remitted to the state and for well information.

That makes much more sense!