How much do the production checks typically increase after they do 2 increased density wells? I own just over 1 acre and I make around $150.00/month from it. Trying to decide if I should sell it or hold onto it.

The answer totally depends upon your location and what reservoir they are planning to drill. Also depends upon the volume of oil and gas and the prices over time.

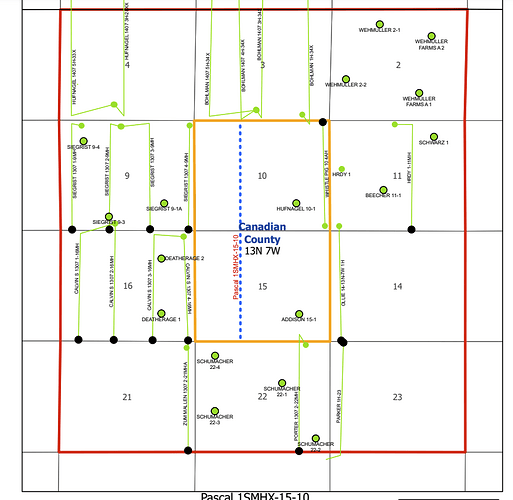

If you want to share your section, township and range, we can look up the pending wells and give you a feel for the activity.

Most offers to buy tend to be for your current production for a certain amount of time at a discounted value due to the value of money over time. They usually will not offer you the value of the pending wells as that is how they plan to make a profit.

Section 10-13N-7W. Received letter from Canvas Energy that they are planning to increased density wells.

Canvas is planning to drill the Pascal 1SMHX-15-10 and the 2S. As you can see, the other surrounding sections tend to have four wells, so they may come back for one or two more wells.

The Whistle Pig 10 4AH was drilled in 2015 and has produced about 1.8BCF of the predicted recoverable of 3.4 BCF. So you have about 47% of the original well left.

The technology has improved since 2015, so you may get better production out of the new wells. The first well spud in December.

If it were me, I would keep the acreage and enjoy the old well and the new ones, plus maybe future ones. You do what makes sense to you.

Thanks for the info. When do you think I’ll see payment from that new well that spud in Dec?

Usually takes about 9 mo to a year before first royalties. They have two to drill, so probably will not frack until both are done drilling. Four-five months to drill and complete and then another six months before they have to pay. Takes months to clear the Division Order title opinion for hundreds of owners in each section.

This topic was automatically closed after 90 days. New replies are no longer allowed.