My wife’s father sold his land in Cass county but retained the mineral rights. He passed away and we never thought much about it. She was contacted a few months ago by G2 land services wanting to lease the mineral rights. What do we need to look out for? Since they no longer own the surface does this complicate things. She no longer has family in Cass county TX , we are in Kentucky and it is hard to find any one here that knows about mineral rights contracts.thanks for any help.

My understanding is the Smackover formation has good lithium potential in Cass county. Do a search on this forum under lithium - Smackover & Cass county to see other discussions .

In regards to the question of no surface ownership , that is not at all unusual.

In the initial lease offer it is 3/16 for oil and gas and 1/32 for lithium and other minerals at the wellhead? This doesn’t sound good considering the information that you provided. Thank you

Initial offer is always low especially if they think you are out of the loop. You can also search the forum for “offers” “bonus” etc to see what going rates might be. You do not want at the wellhead in Texas, instead “gross proceeds” if you can get. I suggest contacting a Texas O & G attorney with recent Cass county experience. There is a directory in this forum of professionals.

Thank you for your help the farm was around 80 acres but they are saying around 43 mineral acres due to previous reservations.

As for G2 leasing, most deals ive seen have been 400 / acre bonus, 1/5 royalty, 3 year lease, with or without 2 year extension.

DRB, i have minerals in this area and paying oil wells. It would help to know what survey the land is in. The area between lone star and linden is a hotbed right now for vertical and horizontal wells. Most of the letters i get from buyers have been from $400 - $1200 per net mineral acre. If your minerals are in this area, that’s pennies to its true value. In short, DO NOT SELL! If they’re buying, its because they know exactly what’s in the ground.

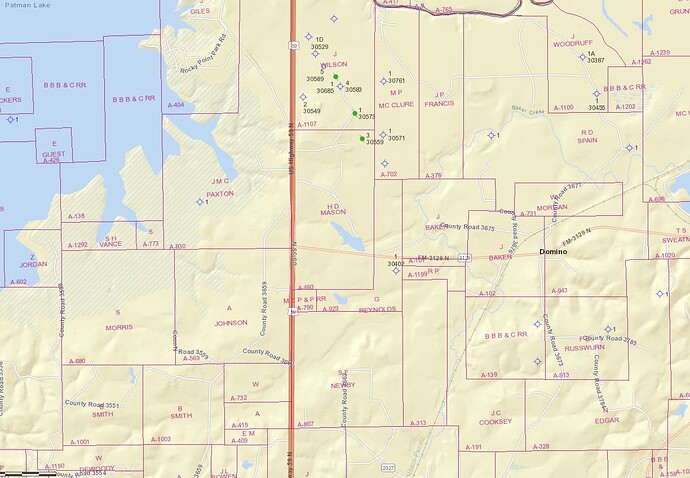

Thank you so much for the help. Im told 40+ acres is part of Green Reynolds A-923 Headright Survey and M.E.P. &P. R. R. A-790 Headright Survey and an additional 400 + acres that belonged to her great grandfather that is in Bowie and Cass County’s they didn’t tell what survey. The Land man said they were trying to find the all heirs of 400 acres.I am trying to help my wife and her Two sisters with this It is hard to know where to start. The land man called out of the blue and at first I thought it was a scam. I appreciate your help it gives some insight thank you.

DRB, both the survey numbers you gave are in Cass county. There is nothing going on in this area except for some old plugged oil wells and several dry holes. If you say you have additional minerals in Bowie county, would help to find out survey location. I’m not aware of much oil and gas drilling this far north in Texas. G2 has been leasing all around the Wright Patman lake area since 2021, but no drilling activity. They obviously know something. I’ll reach out to some land men and see if I can get more information on activity in the future. In my opinion, I would probably hold out signing any lease, at least until drilling in the area starts and see how hot the area gets. There’s also alot of talk about lithium around north east texas, OK, AR region, but I admittedly don’t no anything about it.

Thanks Bill the Bowie was at Wright Pathan lake and the property they made the offer on is not far.

Most county clerks records are online these days, if not you can use Texasfile, a commercial provider, for research. Start by researching the grandfather’s name to find properties where he reserved or bought minerals. Look for heirship affidavits or probate to determine flow of ownership. You can look up the county and survey on the Texas railroad Commision GIS for nearby oil and gas activity. Also worth looking up names on the Texas unclaimed funds. Keep searching this forum for similar topics and you will get great pointers.

This is what they sent along with a generic looking contract Thanks again for any help.

RE: Offer of Lease Option

43.947 net acres, more or less

Cass County, Texas

Pursuant to our telephone conversation and email Please see below the following terms:

Option Term: 1 year

Option Payment: $30/acre

Primary Term: 5 year including option term

Primary Term Balance: $270/acre

Extension Term: 5 years

Extension Payment: $300/acre

Royalty: 3/16

The option covers the first year of the lease in which we will pay 10% (Option Payment)

of the Bonus payment. Prior to the expiration of Option Agreement, we are required to pay the

remaining balance of 90% (Primary Term Balance) for the lease to continue for the remainder of

the Primary Term. If such payment is not received, the lease will terminate and become null and

void. Prior to the expiration of the Primary Term, there is an option to extend for an additional

term of 5 years, but the full extension payment will be due at the exercise of such extension.

We would be interested in Leasing the following interest

Personally, Heck No! (Not giving legal advice) I would only lease for three years up front with no options for extension. Payments are always due the day of turning over the lease, NEVER at the end and not using a 60 day delay on payment or any delay at all. You really need to get an oil and gas attorney to look over any draft lease. I always ask for at least 1/5th and also 1/4. just to see how serious they are and what the interest in the area is. This looks like a flip waiting to happen. IF it were me, I would sit this one out for a while and see what develops.

Every one here is so helpful thank you so much!

Agree wholeheartedly with Ms. Barnes. That sounds like a crap agreement.

J_Walker is right. Here are the links to search deed records for both counties:

https://bowiecountytx-web.tylerhost.net/web/ https://cc.co.cass.tx.us/

Thanks again J Walker, Bear Creek Bill,M_Barns , It was a different land man that initially contacted me, He gave me the information about the survey # and seemed to know more information. Verbally seemed to have a better deal and said that he was changing territory and turned it over to the man that emailed the contract. Both said they worked for G2.After reading this I told him I wanted to get a Lawyer to look at it before they signed anything. I was looking for a lawyer online that deals with mineral rights when I found this site. You have been so helpful Thank you!

DRB, i just talked to a couple landmen working in Cass county, but not for G2. On both accounts, it’s likely that G2 is collecting land on behalf of another operator, or like M Barnes suggested looking to flip them. Not certain but it does sound like they’re trying to target smackover formation for lithium brine. Obviously you would want to seek a good O&G attorney to help navigate. They will probably tell you to separate the lease, one for O&G and a separate one for brine. Lithium collection from brine is too new and you wont find much information on it. RRC doesn’t have much to help either. I would suspect there will be alot of litigation over the next several years on working brine leases out.

As for O&G, i wouldn’t accept less than 1/5. Any bonus payment for the lease should be 100% up front in my opinion. Brine is a different animal. Sorry i can’t help more.

Thank you so much ! I really appreciate your help.

You may want to consult an attorney on the lithium issue since it may not be considered an “an oil or gas associated mineral”. Regardless, no reputable firm offers to ‘Pay you later”. That is a major red flag.