Hi…I just received an invoice from Callon Petroleum and I’ve never heard of them. I found out I had mineral rights in Cochran County when I had a landman contact me for a lease 9 years ago. He told me about rights in Reeves County but said he had nothing to do with those. I have never been contacted by anyone concerning the rights in Reeves County, and now I get a bill? Can someone please help me out with what this is?

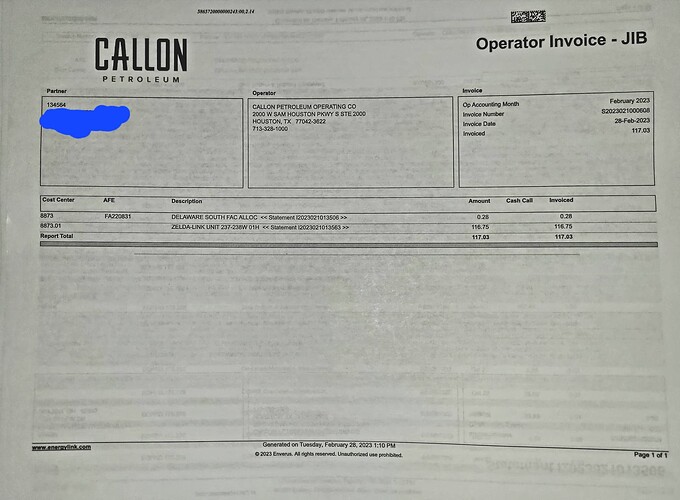

Can U post a picture of the bill or explain the contents?

Hi Jennifer

Will need some more information before someone might be able to help on your question.

You indicated you knew something about mineral rights you own in Reeves County. Do you have a legal description for them (Block and Section #, or Survey/Abstract Number)?

Did the invoice from Callon include a well name, legal description, or any explanation what they are billing you for?

Have you tried contacting Callon? They are headquartered in Houston but also have an office in Midland. The email address for their Land & Royalty Owners Section is owners@callon.com or phone 800-451-1294 Ext. 714

The description in my paperwork from 2014 says, “An undivided 1/4 of 1/16 free royalty interest in the minerals lying on, in and under the North one half of the North one half and the East one third of the South three fourths of Section 238, Block 13, cert no 7/1321.”

I received this on Monday. The phone number attached to the invoice is invalid.

Hello Jennifer, I recently had a similar experience with Callon. Last fall I began to receive invoices for a well drilled in Reeves County. I called them and was told that I was an unleased owner in a well that was drilled on one of my properties, and that since I did not have a lease with them, I would have to pay their costs relating to the well (Ramones Unit 267-266W 01H), and that those costs would be deducted from payments for royalties. I had to sign a division order to obtain my royalties.

I do own some mineral rights on two properties in Reeves, and they were apparently transferred to Callon from Primexx (along with a well that was drilled on one property - Frio State Unit 221-222W1H). The other property was leased to Centennial in 2018 and the lease expired in 2021. I spoke to a helpful young lady named Janet, who advised me that this well was drilled in 2018 or 2019, but that Callon had no records that I had a lease on the property…thus I was “unleased.” I might note that Callon never contacted me in any way before I suddenly started getting these large invoices. At first, I thought that maybe I had additional mineral rights that I was not aware of. So, I started doing a lot of digging. I eventually learned that the well was on the same property, and I was able to trace the lease transfer from Centennial to OXY to BP Acquisition ( Primexx) to Callon. Long story short, when I provided Callon with all of the documents, they eventually determined that they did, in fact, have my lease. I was then advised to sign the Division Order, and that they would initiate payments according to the terms of the lease. I finally got this all accomplished in late February, but have not yet received word about when i will be put in a pay status. All in all, my experience with Callon has not been very good. First, they never contacted me until I started receiving invoices for expenses, Second, they supposedly searched their records and told me they did not have a lease under my name. Third, it has been a real headache and has taken A LOT of my time. I have never had this kind of experience with any other operators over many years. The only bright spot was the Callon representative named Janet, who was very helpful whenever I had new information.

Additionally, FYI (in case you were not aware), I was advised by my attorney a number of years ago that an operator does not necessarily have to get a lease with a specific individual if they have enough other signed leases to make up the preponderance of the acreage. In that situation, the operator can drill, but he must pay the “unleased partner” 100%% of revenue from owner’s share, less operational and other expenses. In my case, I was tempted to do this, since it looks like quite a good well and might increase my take, but my attorney advised me that if I signed the Division Order under those circumstances and Callon later “found” the original lease, they might want to be paid back any difference that I received from what I would have received under the lease. I simply did not want to fight that fight, so I did the digging that was necessary to clarify the situation.

I am not sure that this is enough information to help you resolve your particular situation, but I thought it might be helpful. Good luck with Callon!

Jennifer

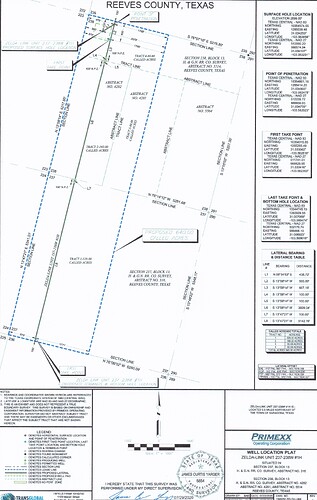

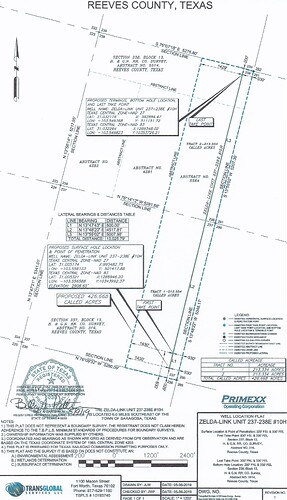

Below is Railroad Commission’s current map with the part of Blk 13, Sec. 238 that you described outlined in red.

The situation J_H_K told you about seems like it could match what is happening to you based on your legal description and the well name shown on the Callon invoice.

Before they were acquired by Callon in October, 2021 Primex formed two pooled units including parts of Sec. 238 and Sec. 237 that joins it on the south. Primex drilled one well in each of those units, called the Zelda-Link 237-238E and W. Based on the units plats that are below, it looks like the mineral interest you described should be within both those units.

Primex (now Callon) has been reporting production from the 237-238West well since January, 2021. But for some reason no completion report has been filed and no production reported from the East well although the records indicate drilling was completed there in 2020.

You may want to send a registered letter to Callon trying to pin down whether you have mineral interest in those two units, and if so consider the same kind of decision J Howard described on signing a division order to get set up to receive royalties.

It would seem that Callon considers you to be an unleased mineral owner in this unit. I have been dealing with Callon for several years and have found the company easy to deal with, but some times slow to respond. If they are issuing invoices to you, then there is also a revenue interest associated with this interest. Give Callon a call and request a payout statement. This is an accounting of the revenues and expenses associated with you interest. The statement will show the remaining cost to recover until the well has “paid out” or if you are past the payout point and should be receiving revenue as well as the bill. I am assuming since you are receiving invoices, then the well has already paid out. Get a little more information, then we can be of more assistance. Good luck.

This topic was automatically closed after 90 days. New replies are no longer allowed.