I mean oil araound $2-3, Do you think make a lease for gas now? or wait till it goes around $8 like a year ago?

Generally speaking it is difficult for a mineral interest owner to market their property for leases. Leasing activity is driven by companies who have studied a prospective “play” then seek leases from the owners. When oil and natural gas prices are higher, then there tends to be greater activity.

This post is not legal, tax or investment advice. Reading or responding to this post does not create an attorney/client relationship.

@Mehmet_BESIKTAS You can lease when it is offered, or you can choose to wait. Personally, I lease and then see what happens in the next few years of the lease.

WTI oil is about $78 this morning. You may have been confusing gasoline gallon prices with barrels of oil. Natural gas is quite low right now, but is predicted to go up over the next few years. The $8 gas from two years ago was very unusual due to the winter storms and sending LNG to Europe before the first winter of the Ukraine war.

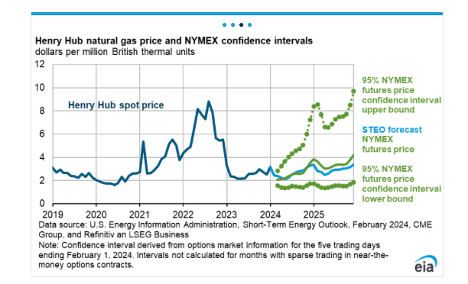

The EIA.gov puts out a prediction chart. General consensus is rather low prices in the first part of 2024 and trending upwards to about $3-4 per mcf in 2025 as more LNG trains come online. The outlier trends are really low and also really high, but less chance of those.

Many variables to your question. Where are your minerals located and is there any activity around the area? Whats the lease offer on the table? Do you need the money? $8 gas a year ago was an abnormal uptick in pricing, it was the first time it hit that mark since like 2008 when natural gas prices soared from 2000-2008 leading to natural gas companies drilling themselves out of business. Natural gas is to easy to find these days so if youre waiting for $8 gas to sign a lease, youll likely be force pooled before that day comes.

This topic was automatically closed after 90 days. New replies are no longer allowed.