Hi, I received an offer to top lease my mineral rights in Kingfisher County (Section 35, Township 15N, Range 05W). Offer is 3/16 royalty and $3,000 per acre signing bonus for three year agreement. I assume an initial offer is typically low. I'd appreciate hearing what others are getting or have been offered. Thanks

As you say, this initial offer seems low. However, I’m not familiar with the activity in your Township and Range. (My experience is based on an area more than 10 miles further north and west.) In other words, this offer may be appropriate to your locality. Perhaps, someone more familiar with your area will respond.

Don't know about your specific area, but you should be able to get 1/5 royalty. What you absolutely have to insist on in your lease is no deductions for "improving the marketability of the oil." Their deductions might easily leave you with only a fraction of what you thought you were going to get. Lawyer also advised me to not take a top lease because of possible legal problems.

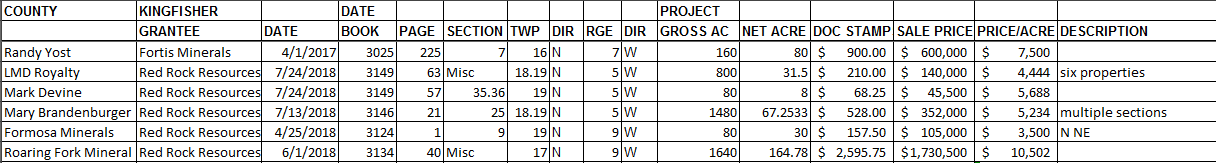

By looking up mineral deeds in the county court house, you want to find deeds that show the deed stamps and the actual net mineral acres (NMA) Deed stamps in OK are $1.50 per thousand. So if someone sells for $30,000, then 30 x $1.50 = the deed stamps. Then divide the nma into the sales price. Now, the typical rule of thumb is that the mineral rights are worth 3x the lease bonus. Divide the sales price per acre by 3 and this gives you a general idea of the lease bonuses… the closer to your property, the better. As you see prices can vary quite a bit.

Terrel,

I would have to disagree with the 3x rule with respect to the lease bonus. A lease for $0 1/4 is more valuable in a sale than a lease at $1000 and 1/8. The royalty rate is more important (if the well is productive and pays for itself).

In the old days, the going rate from informed seller to informed buyer was close to four years of oil production and seven years of gas production or variations thereon for vertical wells. Horizontals have blown that out of the consideration.

Terrel, Thanks for equation on the Deed stamps. That is very helpful.

ABSOLUTELY AGREE! The bonus multiple rule just doesn’t make sense

4 and 7 were Oklahoma tax commission methods of valuing a mineral for estate purposes, before state estate taxes were abolished. Yes, in theory a 25% lease is more profitable than a 1/8th. But most leases are 3/16th to no more than 20%. I have deconstructed actual lease bonuses, etc. against sales and the 3x rule is a pretty good indicator in this market. Yes, it might be 2.5x or 4x but day in day out it matches up. Likewise, if you deconstruct an actual sale of a company reserves v. the sale price, it often comes up pretty close to offering about 1/3rd the value of the risk adjusted reserves. SWN just sold for $1.9 billion, with Fayetteville Shale roughly 3.7 TCF…that’s 51 cents per MCF in the ground. 3x51 = $1.53, not far off the current prices which are mostly below $2 when you get the owner’s statements. And of course, the buyer gets all the equipment, etc.

No one in their right mind would pay 7x the annual income for a wasting asset (one worth zero at the end of the holding period). And I’ve seen enough people who plugged their own money in wells lamenting the fact they have yet to see a dime, operated to death, and spending all the royalty on expenses.

Yes, in a “hot” play, any price will sell. But when the rubber hits the road, many of these wells, especially in the old Sooner play, are kaput in 4 or 5 years not the 40 touted by companies. Go look how many wells have already been abandoned that were drilled no more than 5 years ago.

Obviously it depends on the pool. We have wells in the Sooner (vertical of course) that have been producing for well over 50 years, of course the oil now is just a dribble compared to what it was but we still get very small royalties once every few months. On the other hand, as you said, some new wells come in and then drop drastically in production in a few years.