I’m a little confused SW/4 and S/2 NW/4 of Section 13 6N 5W I was under the belief this where the Mowdy Well 1-13 is but the paper work I received reads the Olympia 0605 13-1 WH but the legal description is Section 13 Township 6 North Range 5 West, Grady County. Is this a different well. The paper says it is an amended order of 625635 to drill 3 more additional horizontal wells. Does this mean it isn’t the Mowdy Well? I really thought I was learning but now I’m back to questioning what I thought I had learned. Is Olympia the dead well cause the Mowdy well is what I believed we received our small amount of royalties off of. Can any one help me understand this better. Thank you in advance.

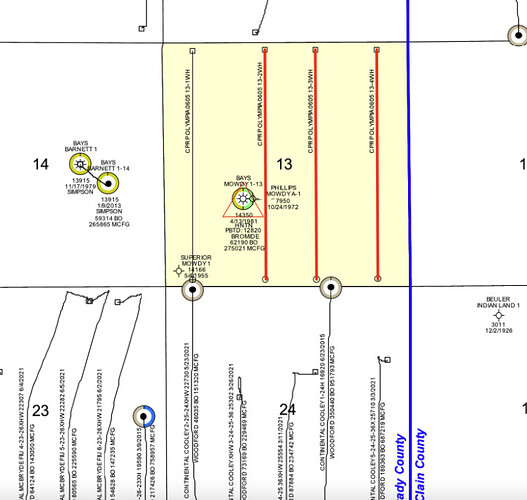

The Mowdy well is marked in yellow on the map below. It is a vertical well which is still online. You should still be getting royalties from it.

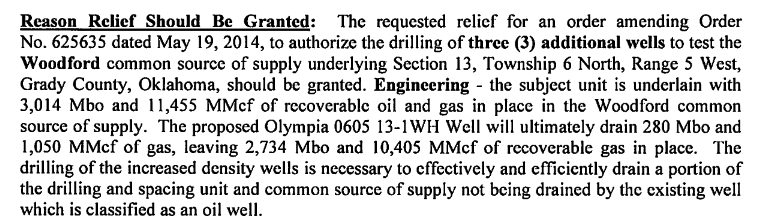

Casillas has filed several cases at the OCC for drilling four additional horizontal wells in the Woodford horizon. Congratulations!

The increased density case has some nice exhibits which give both a map view and a side view of the pending wells. Case 2022-001154. The wells were approved in September.

Cases 2022-001155, 57, 58 give three of the locations. Do you know how to look them up on the Electronic case file website? If not, come back and I will walk you through it. You should have received mailed copies.

Ms. Barnes yes I have figured out how to set up the subscription and have received emails on all I think except the pooling case. Not really sure what I’m reading but I guess when the pooling is approved maybe it will tell me more. I’m thinking we are just under the old Mowdy Well so our royalties will remain the same. Some of my family were considering selling but I’m holding out lol you think this is a good area I think my great grandparents did pretty good with the Mowdy well at one time but I think it must slow over years. But maybe something good will come from these. Thank you for your help.

You are held by production under the lease that involves the Mowdy well. I think you will be pleased with the new wells if they come in as predicted.

Is this common knowledge when you say if they come in as predicted, or is this because your a savvy oil lady that know her stuff (lol I know you know alot about this stuff) does it show somewhere that you can read and see that kind of information? Or are you going by other wells close by? Sorry I’m not to smart but I’m trying to learn.

45 years as a geologist…I compare the wells close by in the same reservoir and the OCC documents of the wells close by or for the intended wells.

The Mowdy well has produced since 1981 for 60,761 bbls oil and 276,937 mcf gas through May of 2022. It is a vertical well with about 50’ of perforations in the Bromide. It was drilled into a horizon deeper than the Woodford, so holds the Woodford if you do not have an upper depth clause in your lease (very rare).

Rodgers 1-11-2XH catty corner to the NW Jun 2014-May 2022 538,635 bbls oil 944,577 mcf gas (Divide by two to get one section’s worth) 9500’ of perforations. About half in each section.

Shaw 1-12H next door Jun 2015-May 2022 255,375 bbls oil, 611,310 mcf gas. About 4350’ perforations.

Etc. etc.

Read exhibit one from the case 2022-001154 to see all of the other wells nearby. Their cums may be to a different months. But look how many Woodford wells surround these.

Paragraph 7 of the increased density hearing gives a ball park idea of the recoverables. You are looking at remaining recoverables of about 3 million bbls of oil and 11.4 BCF of gas (take them with a grain of salt)

Very well established successful reservoir with an excellent operator, so pretty sure they will do nicely.

M Barnes when you said well with about 50’ of perforations in the Bromide. It was drilled into a horizon deeper than the Woodford, so holds the Woodford if you do not have an upper depth clause in your lease (very rare). Where do I look to find that information do I go all the way back to the first Mowdy well is that where this all starts from? if I can even find those papers. Upper depth clause? I want an upper depth clause or I don’t? Sorry but thank you for your help.

It would be very unlikely to have a depth clause on a lease back in the 1970’s. You can ask your current operator for a copy of the lease or find out if your family was force pooled back then. A pooling is usually for the reservoir of interest, so does have limits on what is pooled, often leaving reservoirs above or below open for later leasing or pooling. At this point, nothing to worry about. If you did not get the pooling case mailed to your house, then you are probably held by a simple old lease. The county courthouse has a filed lease (usually). You could try looking it up on www.okcountyrecords.com Free to look, cheap to print. The digital files may not go back that far.

I received the Increased Well Density 2022-001154 this is the only paperwork at this time, and a lot of names attached.

Ms. Barnes I came across a paper from Bays Exploration INC permit to recomplete the Mowdy Well number1 and this is what I found listed about formations (Permit Valid for listed formations only! Hart 10200, Mississippi,11500 and Hunton 11898. Spacing 147146 Location exception order and increased density order. This was dated approved 8/30/16 expiration 2/28/17. Does this tell us anything in regards to a depth clause?

It is very common to drill for the deepest know reservoir at the beginning of the well and then recomplete in shallower horizons up the hole over time. Starting deep usually saves all the reservoirs above for those folks that have no upper depth clauses.

I wouldn’t spend too much time worrying about a depth clause. They were very rare back then. You probably have none.

Whatever royalty you have on the Mowdry will be used for the new wells. The equation for your new decimals is: net acres/actual spacing acres x royalty x % perforations in your section. Each of the new wells will have slightly different depths and feet perforated. In this case all the perfs will be in your section, so the last digit is 1.0 An example decimal would be 10 acres at 3/16ths. 10/640 x .1875 x 1.0= .00292969

Ms. Barnes can you tell me how you determine what mineral rights was worth at the time you inherited it compared to say now if you wanted to sell. And with that in mind and since this is a producing old well with 4 new wells about to be drilled if they were to do well is there any guidelines as to how to determine if someone wanted to sell. Some tell me it would never produce what I might be offered if I sold even in long term. Any thoughts on this. I only have 13 of the 65 acres. They are shared with 4 other siblings who think they should sell. Me not so much. Thank you for your knowledge.

Ms.Barnes this comment is also in regards to the previous questions an offer of $150,000 for each of our 13 acres total 65 acres came in, I’m still thinking considering the 4 wells that are going to be drilled Why would anyone offer that kind of money for the 13 acres if they don’t think it could be good wells. Am I silly to believe these wells could produce a better pay off in my life time lol I’m 66, or is that even possible. Thanks again.

An example would be grandpa buying mineral rights for $1 an acre back in the 1950’s. The child inherits when there were minimal vertical wells. The child then wills the minerals to the grandchild. By now, there may be one horizontal well that makes it worth $10,000/ac. If there is not documentation at each of those events, the IRS just assumes $0 value and any sales might have capital gains tax on the whole amount. If at each probate, the executor had an evaluation done, then that would be part of the estate documents. Would be very important at the last step because if the probate lists the value at $10,000 per acre, then the sales might be at $11,000 an acre. Capital gains would only be in effect for the extra $1000/ac. If you inherited recently, you can get an engineer to do a date of death evaluation. As time goes on, it gets harder and hard to do an accurate evaluation.

A real life example from this week. I have acreage that has one producing horizontal well. Got a call from a buyer that wanted to offer to buy the well. Knowing who the company was, I knew that they really wanted all the acreage and he was deliberately not mentioning that (had offers from them before). We have just finished an engineering evaluation and knew the value of that well. His offer was in the ball park. BUT, I know that there are six more wells planned and had my engineer work up their value based upon the parent well. He did not offer the value of those additional wells, so we are not selling.

That is the answer to your next post. They are offering the lowest amount they think they can get away with in order to get folks to sell. However, they plan to make a tidy profit off of the future wells. Sometimes, it is worth getting an evaluation to know what your minerals were worth as of date of death (in case you do sell and need that step up value) and also what they are worth now (to know if an offer is reasonable or not). I consider that an investment in knowledge in order to make good decisions, not just an expense.

Ms.Barnes do you have any recommendations on an evaluator to do that evaluation on the mineral acres ? Thank you for your knowledge.

The directories tab above has several engineers.

I bought my 10-1/2 acres royalty from my father in the sixties. I actually paid him $50.00 per acre but the deed shows $1.00 more or less. I am deeding my mineral rights to my granddaughter when I pass. Will she need to know the actual price I paid per acre? Thank you!

The $1.00 language is common because the actual amount is not supposed to be on the deed.

I would advise that you contact an attorney about the proper way to pass your mineral rights to your granddaughter in order to not cause a tax issue down the line. Her value will depend upon when you convey it. Before or after death.

While that would good to know, once your granddaughter inherits the property she would be entitled to a stepped-up basis that is the value as the date of your passing. On the other hand, if you gave her the property while living, she would have the same basis as you paid for the property. Basis is used to determine whether capital gains would be due if you (or your granddaughter) sold the property.

This post is not legal, tax or investment advice. Reading or responding to this post does not create an attorney/client relationship.

Can someone explain to me if Section 13 6N 5W is in Grady County why does case # CD 2022-002299 on the Olympia 9605 13-1WH ( I don’t know what WH means) shows McClain County and 89er Energy It’s my understanding the 4 wells are to be in Section 13 -6N 5W are by Casillas and I know they are drilling in different locations in Section 11,12,14,23,and 24 but does that mean anything to Section 13 6N 5W? I know there is 1 old Well the Mowdy 1-13 still producing a little, will we actually see 3 or 4 more in 13?? I am seeing 7,18,and 19 are in McClain County. I really am green about all this, I have had these minerals rights in my family for a long long time Great grandparents so just excited to see something happening. So I guess I’m asking will all these other wells listed have any bearing on the 4 in Section 13? Thank you each for the clarity again.