Has anyone received offers to buy minerals in Dunn county nd around 144-94-21. I received offer not sure if should.

Welcome to the forum.

There has been a good bit of leasing on the east side of the township during the last few years. The main operators are Marathon and Chord. Chord is doing infill drilling in the township to your west. Lots of offers to buy come before infill drilling, so if you do not need to sell, then just sit back and wait and see what happens. Your current well has some years of life left in it.

So what is infill drilling and why are they doing this.

One horizontal well is unable to drain the entire 640 or 1280 acres. Infill wells are lined up in parallel like cigars in a layer to more effectively drain the reservoir. The first well is drilled to test the reservoir and if successful, put on production to save the leases by production. If deemed economically prudent extra wells will be drilled in the section(s).

Many offers to buy come right before drilling. They may be lowball just to see who will bite. Many are worded at 60-75X your current royalties or something along that line. What they are not telling you is that future drilling is about to happen. They intend to make a profit off of you. If you have no need to sell, then don’t. If you do need to sell, then there are more strategic ways to go about that.

What strategic ways are there. I only have I believe 19 mineral acres. They are offering 40000. I guess I’m not sure if that is low balling. I would be thankful for any advice.

The well makes 500 bo a month. You at most get 19/1280*.25 of that or 0.39%. So you are getting $100 a month ballpark give or take. So, yeah a bit more than 60-70 months cash flow. AS IT SHOULD BE.

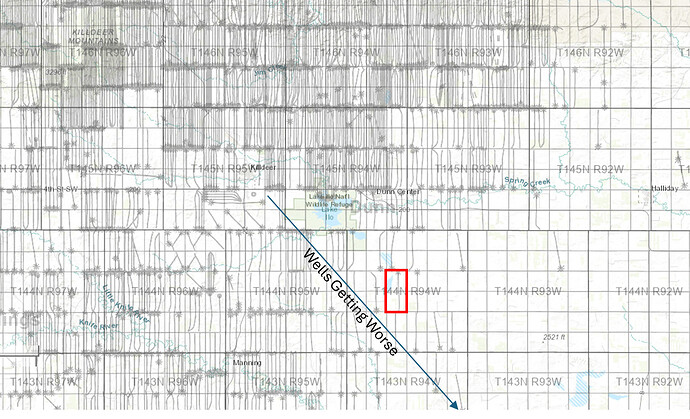

Here is where your acreage is. The red.

The units a good bit north of you are drilled up with 8-10 wells per 1280 acres. Where there are a lot of lines. Where you are, there is only one well per unit. Because the wells have not been very good. The Upper and Lower Bakken Shale are both on the order of 10-15’ thick here, there just isn’t a ton of oil generation. But wells in 144 94 made oil, each averaged about 220,000 bo. Which isn’t enough to drill a new well. BUT…if those wells were drilled and frac’d today, they would be better. If we look at just wells drilled in the last 3 years…

We see that folks are actually drilling some wells not that far from you. See two blue arrows. And those wells are better than the old wells there. However, the old wells in those areas are also about 50% better than the old wells in your area. So…one would guess newer wells in your area may not be as great (economic) and thus might not get drilled.

But…IMO we are running out of places to drill wells in general on a long enough timeline. Barring a complete collapse in oil demand, I (the optimist) would figure that sometime in the next 15-20 years you will end up with 4-5 more wells in this unit. If those 4-5 wells make 250,000 bo each in their first 5 years at $70 oil and you own 19/1280 x .25 of them…then that is 4.5 x 250,000 x $70 x 19/1280 x .25 = $292,000.

This all assumes you are at 25% royalty which is unlikely, its probably 3/16. So it would be 3/4 of these numbers.

But that is the bet. Take $40k today or wait and see if in the success case you get $200-300k in 20 years or whatever. Or nothing may happen and you may get nothing beyond the small current checks. It’s easy to say “never” without giving things a lot of thought, it’s easy to say yes without giving things a lot of thought… it’s hard to say what is fair even after giving things a lot of thought. Right now you make very little and the “success case” has a lot of risk and is kind of just a vision at this point. Maybe fair should be $50k, shrug. There are no permits here, nobody is planning to drill wells here right now. It’s just somebody thinking that its worth it to pay $40k to get 4-5x that way down the road if things work out. That’s all this is.

Sorry, I occasionally get motivated and barf up a lot of posting.

IMO the best “strategic” way to sell is to make sure that multiple people make you an offer. The best offer is unlikely to be the first offer.

That’s a low offer IMO. I personally have worked on projects in the area in the past 3 years. In 144-94 we were paying close to $3K/NRA. Based on that price per NRA I would be asking for pricing around the following ranges.

25% lease= $6K/NMA 20% lease= $4,800/NMA 18.75% lease = $4,500/NMA 17% lease= $4,080/NMA

The well that I have minerals in is declining. I spoke to enerplus and chord who have the well and they have no plans to do any drilling in the area. Not sure why they would want to buy the minerals but I only receive 100 dollars a month. I have 20% royalty on 19 mineral acres. Not sure what to do but thinking bout it.

Wish someone else was interested with higher offer ![]()

I would suggest reaching out to a few buyers in the area if you are seriously considering selling or getting with some broker to help you find the best buyer. Even though a broker may charge 3-10%, there knowledge and ability to find the right buyer would make up for the percentage they charge.

I do know the acreage has switched hands a few times with the operator. When I bought in the Mc Hienert well in the sections beside you, the property was operated by Hess.

We had that part of the Basin classified as Tier 3. The main concern was outlook on future production. I would make sure Enerplus isn’t planning on selling the lease to another operator. There is also the chance that Enerplus throws you into a bigger unit with an adjacent lease. I have started to see units that are 4 sections together, that would heavily dilute your interest and value of your minerals if they do that.

It really just comes down to if you want to wait to collect the cash and see what future production looks like or take a lump sum payment now and move on. I’ve seen people wish they had sold and others who wish they hadn’t.

Yeah, agreed.

If you get “thrown into a bigger unit” it means you would have half of the interest in twice the wells, on average it means nothing. Most of the “bigger units” are just set up to make sure the lease line wells go half to one 1280 and half to the other. Yeah, sure they might eventually respace this as a 1920 to drill 3 miles wells, and then you would get 2/3 of the interest but in theory the wells will be 3/2 as good. In short, I’m 99.9% that’s a non issue.

Yes, its declining. Yes, the current revenue vs $40k or whatever is pretty insignificant. Its just a bet one way or another that there will or won’t be more wells, in a longer timeframe than Chord’s short term plans. That’s it, that’s the deal.

This topic was automatically closed after 90 days. New replies are no longer allowed.