Doesn’t seem like a very cost effective endeavor if my cousin is right, but he is of the opinion production from natural gas wells typically drop dramatically after about 6 months. We have seen about 3 decent royalty payments (representing 5 of 7 wells drilled). The difference between production output and payment is about 3 month. Now in our case the wells came on-line at different times and we still have one well that has not shown up on the reports and a seventh they just finished drilling, with fracking starting this week. I happen to be on-site Saturday when they were lowering the rig and hauling it to their next site. Kind of fun to watch. One other question. Water. While on site this weekend, I observed a tanker truck connected to one of our two tank batteries. I inquired what he was doing. While his English was not great, he seemed to indicate he was hauling water from the site. Would that be right? Also, talked to the gentleman who identified himself as the completion boss for, what is currently the last planned well on our property. While asking about how deep the well was and any other novice question, he said he did not know how deep it was but noted they have planned for a lot more fracking material than some he has seen. For some reason I recall 154 units, but it was windy and noisy at his “house” that had just been drug up by a services firm. Our wells are indicated as Ash and Birch. They drilled 4 well on the same pad at ash and then this final well they built a new pad about 400 yards or more away and drilled the 5th ash well. The three birch wells are drilled in pretty close proximity. Original plans was to only drill 1 birch well.

We have Apache gas wells in the area and they do not die after 6 months. Some produce a little water in the dry gas zones but not much.

Most gas wells don’t “die” after six months, they decline rapidly and then they can continue at lower rates for many, many years. The wells from the shales are dependent upon the fractures that are created by the frac. Think of tree roots-thicker close to the trunk and gradually getting finer with distance, but more numerous. The early months of production come from the large fracs quite close to the well bore. The gas molecules are very small and at high pressure (think soda bottle if you shake it). They come out very fast at high volume. As time goes on, the pressure decreases and the molecules, although tiny, have to come from farther and farther away, so it takes longer. Depending upon the porosity and permeability both natural and by the hydraulic fracturing, gas wells can last a long time. We call it the “hockey stick” shape. The blade is the first two or three years and then the stick is the very long, but lower volume production.

Sounded a little odd as to cousin’s view. I am expecting higher production early on with it stabilizing as time goes on. Our first three payments were pretty much the same. So that makes me feel better (from a pocket book perspective). As to the water - we were told this particular site was wet gas, which I understand to be good (more other stuff that they make money off).

They typically frac these wells with around 50 bbl of water per lateral foot. That’s a lot of water. There probably is little mobile water in the formation, but even if you are only getting 10-20% of your frac load back you are making 50,000 barrels of water. So you will rarely see a hydraulically fracked well that doesn’t have produced water. Particularly early in it’s life.

For instance on the Birch Unit 101BH (API 4238936084), they fracked it with 414,000 barrels of water. IP on the well was 4 bopd, 16mmcfd, and 1057 bwpd.

As far as how deep they are, that one was 11,200’ deep (below surface) and 19,000’ long (8k’ of lateral).

With that kind of potential deliverability it would not surprise me if they keep the well choked back (they may not be able to handle multiple 10mmcfd wells here) thus your production might be pretty flat for a while. Maybe not.

But, sure, these wells should produce for 40 years or something. And unchoked wells should follow the hockey stick shaped decline described prior.

I’d tell your cousin you’d are willing to take the risk and would like to buy him out starting in month 7.

Jeez, never realized that much water was used in these operations. I know roughly how deep the Birch units were, just guessed the ash units were about the same. For the uninformed what is IP. I am guessing pressure. By the way, too all, I do appreciate the insight and the responses. I came from the oil field in a way as my father owned a seismograph drilling company many years ago. They were called doodlebuggers, but I was too young to get much involved in that world (plus dad was adamant about me not working in the oil field, so he sent me and my older brothers to college). I had visions at one point of becoming part of the company, but dad sold out before that was to occur.

A typical SMALL frac job puts 350,000 barrels (42 gallons each) of water and 10,000 cubic yards of sand downhole. Most of the sand does NOT come back…it stays in the formation keeping the hydraulic fracture lines around the well bore propped open to allow channels for natural gas, hydrocarbon liquids, and the water used to hydraulically fracture the producing zone to come back into the low pressure well bore and be flowed by gas pressure to the surface to be collected. The more of this water that returns to the surface, the greater the efficiency of the hydraulically fractured fissures around the well bore to bring hydrocarbons to the surface from the pay long term.

Initially a recently fracked gas well will ‘FLOWBACK’ hundreds or thousands of barrels of saltwater EACH 24 Hours…and if there’s no take away poly pipelines in place to take the water to a disposal well…then there will be a procession of trucks around the clock hauling the water to an SWD facility…for months.

Remember, the operator of the well has to PAY by the barrel to have the

FLOWBACK frack water taken to a disposal and pay the SWD operator

by the barrel to pump it into a dry sand non productive formation.

As the FLOWBACK progresses and comes down that curve from thousands of barrels of saltwater per day down to a few hundred barrels or less, THEN the volume of gas and any liquid hydrocarbons will stabilize

for the long term production…20-40-100 years on a slowly declining, almost flat curve.

, Reeves county, Tx

![]()

![]()

![]()

![]()

![]()

IP : initial production. I think in the old days it might have meant Initial Potential, but it’s basically the same thing. A first test of the well reported to the state.

The two Ash wells that I saw directional surveys on (101CH and 102BH) were 11500 and 11600 deep.

Well we have seen a steady decline in royalties from the five wells in production on our property. The latest payment represents about a 1/4 of our our first full payment about 4 months ago. We are still awaiting word on Birch 103 and Ash 104. The fourth ash well was drilled and fracked in November. Not sure about birch 103. It was prior to that.

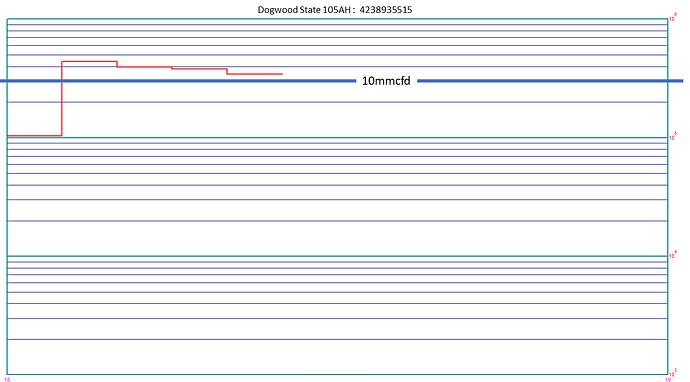

There is no public production info on those wells, at least that I saw. While I’m sure revenues are as you say, I would be shocked if the volumes themselves are down 75% in four months due to reservoir decline. Here is the gas decline on a Dogwood well that is West of you. Its declined from 15mmcfd down to 11mmcfd in 4 months.

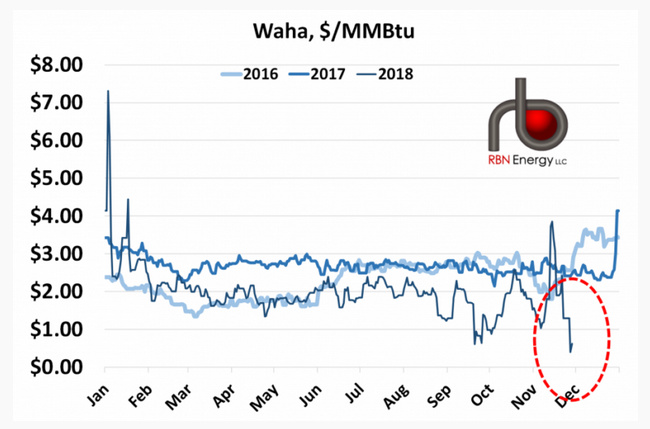

Maybe they are choked. Or maybe your $/mcf has dropped, causing the big drop in revenue. Waha gas prices are terrible, and have been for the last 4 months. Presumably Apache has some plan to guarantee long-term gas deliverability from the Alpine High, as it’s tough to make money if your realized gas price at Waha is $0.50.

Did not realize gas prices had declined to such a level. I seem to recall that our royalties are are about 3 months behind actual production, but not sure about it. We are really novices at the game. Trusting novices as well. I guess production levels have outstripped the days when winter meant higher natural gas prices. I was wrong on one of the Ash wells, it is 401, not 104. The other three are 101, 102, 103 (either AH or BH - not sure of the meaning).

2-3 month lag sounds about right. Your check stubs should have both the gross volume and the unit pricing on them. So should be able to see the realized Apache pricing for gas.

HHub gas prices did have a big Nov-Dec spike up with big winter withdrawals, but Permian is fighting too many bottlenecks to get to the cold weather markets, and oil pipe is ahead of gas pipe…thus more associated gas is coming with the oil and fighting for space in the gas pipe. Thus Waha = poo.

We saw further decline in the next royalty payment. a rough review of the numbers from the statement (I wish those were spreadsheets) indicated production declines or perhaps throttling back. Revenues were approximately 50 percent of our highest payment. I was told that Apache has plans for another well on the family property in early spring and I was told it would be a while before we are likely to see division papers from our most recent wells. Not sure why. They rushed to get it drilled. Just not rushing to get it in production.