Hello All,

I’ve been reading this website for a few years and am impressed with the considerable amount of knowledge this group has. My grandparents grew up on farms near El Reno, OK. I’ve got some great photos from that time, I wish I could upload them here. They left during the dust bowl with two suitcases and a beat-up old car.

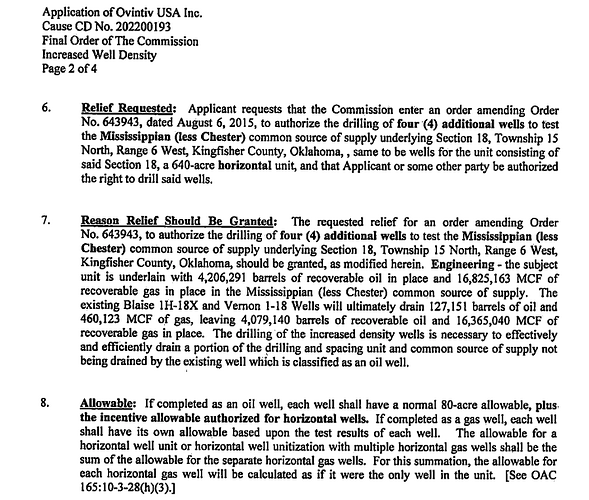

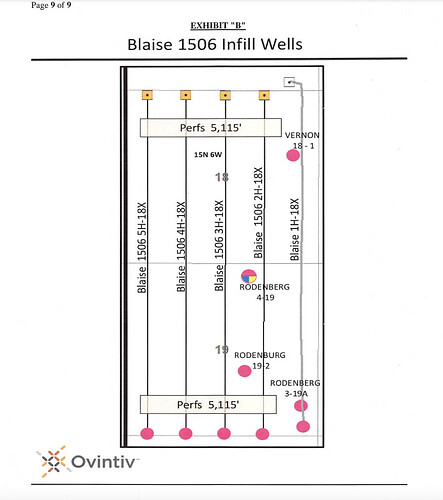

I have kept these mineral rights for sentimental reasons, as I love thinking of my grandparents on that land long ago. But now, for health and life simplification reasons, it is time to sell them. It is Section 18-15N-06W, net acres = 60, Track description = NE/4. Apparently I have a 1/8 interest.

I’ve read several posts on how to figure out valuations and I’m still flummoxed. I used the GIS website (https://gis.occ.ok.gov) and a few others (https://imaging.occ.ok.gov). I actually really enjoy any GIS website, it is such a neat way to view our planet. I also read the other posts on this area. I noticed that member “M_Barnes” is really friendly and helpful, I have read several of her posts.

I have received a cold-call offer to sell. The fellow was nice enough but of course this is all business. What is the best way to determine if what he is offering is a fair offer?

I don’t mind spending the time and doing the work to find answers. I appreciate any help that the folks here at The Mineral Rights Forum can provide.

Thank you in advance!