My suggestions only: If you are getting multiple offers to buy then the buyers know something that you do not know. They fully intend to make a profit off of buying your acreage. They know the perceived value of it but they will not be offering that amount. The offers that I have received have been generally close to the discounted value of the current well(s) production (They discount for the time value of money over the life of the production and apply a certain price deck to the assumption). Sometimes far less. (I have had the engineering done for my wells, so know what the predictions are.) The offers do not include the perceived value of any future drilling. Some buyers buy and hold for the future, some buyers flip, some really know what they are doing and some do not. If I were you, I would look up your area on the TX railroad commission website to see if there are permits nearby or wells that are currently drilling. Most of my offers have been right ahead of the bit and I have been very happy that I did not sell.

Our family holds onto their minerals (so far), but everyone needs to make their own decision based upon their needs. There are possible capital gains taxes associated with a sale and buyers usually do not mention that item. You are taxed if you have royalties which you probably do know about.

Here are some of the steps that I would take if I were to consider an offer and to see if the buyer is legitimate and well funded.

-I would look the buyers up on Bizapedia and see how long they have been in business. No problem in being a new company, but I am looking for the owners to see if they have experience and their BBB rating.

-I would look up the buyers on LinkedIn or other sites to see what their training and background is.

-I would look up their website. Are they willing to say who they are? Who is funding them? What do they do? etc. If they are not willing to reveal who they are and how they are funded, then I would not deal with them.

-I would ask if they are willing to put 10 percent of the purchase price in an escrow account as a good faith measure. What third party is holding that escrow for them? Attorney? Accountant? I would want a PSA (Purchase Sale Agreement) in writing and an agreement that the remainder of the payment will either be paid to the escrow account and my third party who is holding my deed will turn it over when the check clears or it will go to my direct direct deposit account before my third party will be handing over the lease or deed. NEVER hand over a signed deed without getting paid. If anyone wants that, walk away!

I would read the offer very carefully to see if they have added language about other acreage that we had not particularly talked about. I have seen some very bad language in some offers that is very disingenuous.

-I would try to get at least three offers that fit that criteria and then take the best. Or go through an auction site (there will be fees.)

-You can keep the minerals and get the revenue for the first few years. You can sell the minerals. You can sell part and keep part and split the risk. You can put the minerals in your will or give them to a charity, etc. You can enjoy the revenue during your life and then know that others will benefit in the long run.

-I would consult with my attorney and accountant before any sale to determine if there are consequences that I might not have thought of.

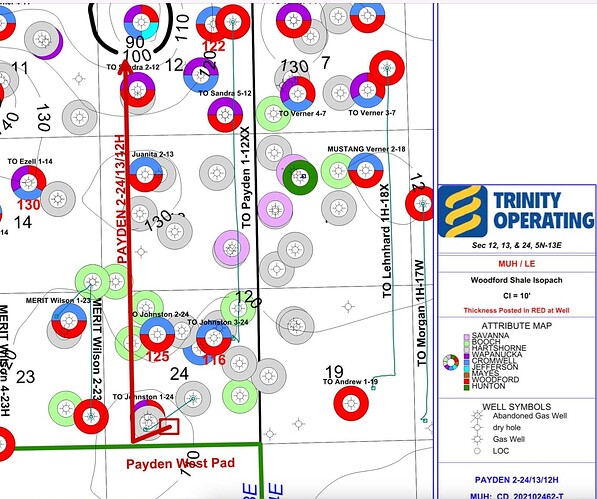

The reason that you are getting offers is that you have two more horizontal wells. You may not get offered value for those wells in your proposals. In my experience, most buyers do not pay for those upcoming wells. That is how they want to make their profit. Those wells have already been drilled and completed and came online in May 2022. Are you currently getting paid on them? The first check will include about six months of production. If you are getting paid on them, then make sure your offer reflects the value of the wells. If you are not, then you might want to consider hanging onto the acreage for a few years and getting a large chunk of royalties on the wells. Some buyers like to tie up purchases right before new wells make their first payments. The mineral owner may miss out on those royalties.