The New Mexico OCD site has the latest production figures of August. That seems a long ways behind, is this normal for them?

That’s a Tap Rock issue not an NMOCD issue. Most operators are updated through Oct by this point.

You may be correct, but Tap Rock has been paying royalties faithfully 45-60 days after the end of the month, so it seems strange that they have the figures for payments, but not to the NM OCD people. I have no idea just how that works.

I would guess that at most producers there is some gnome in a basement who is supposed to make sure that the C-115 loaded gets loaded into ONGARD or whatever at the NMOCD so the production will show up. Gnome performance is notoriously hit and miss.

Tap Rock is two months behind most everyone else on all of their wells.

If you are getting paid you pretty much know all of the up-to-date important stuff for your wells anyhow. Volumes, pricing, revenues. That said, I kind of like to look up wellhead gas volumes at NMOCD and see how that compares to the NGLs and residue volumes in the check stubs (just to kind of get a sense of how much gas become liquids and how much it shrinks into residue).

I think you are correct. I have been monitoring a couple of wells that started production last November. They had to sort out some issues and the first check was over $2100 for 7 months, with one of those months almost no production. Easy, should expect a monthly check for $300+ First check came for $150, second one for $125. I am still trying to figure out why. Production was increased, cost of oil was WAAAY up yet checks were less than half. Are there some production costs that do not start until after 7 months of production?

Don,

You should not have any production costs that really affect you at all.

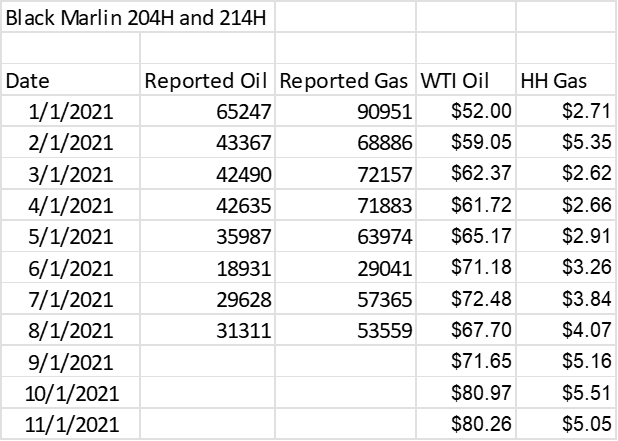

If new wells made $2100 the first 7 months you definitely should not expect to make $300 in the 8th month. Hz well decline rates are no joke. The Black Marlin 214H and 204H have declined from a combined 65kbo in Jan '21 to 31kbo in August '21 (the last data that I can see) and should keep right on declining. Volume is down, but price is up. See table below. Like you said, it doesn’t seem like it should be less than half of the seven months average (since price went up), but it definitely should be less and I don’t know how much volume these wells made in your Sept or Oct checks if that is the last two checks that you are referencing.

You should have all of the details to “figure out why” in your checks. IMO, curious owners should build a spreadsheet/table with a line for each month and do the math themselves.

(that’s not what this is below, this just shows how oil declined and oil price went up in 2021 for those wells)

Thanks so much, I just could not see the forest for the trees! You put in a form I could understand. I knew a well decreased its production with time, but had been led to believe it was a much more gradual reduction. I hope that decline slows down or else we could be thinking of closing them down! The figures seem to me to be wildly fluctuating for some reason. Tap Rock has four more wells permitted on my interests, they may well decide not to make holes in the ground that do not produce much oil!

Don,

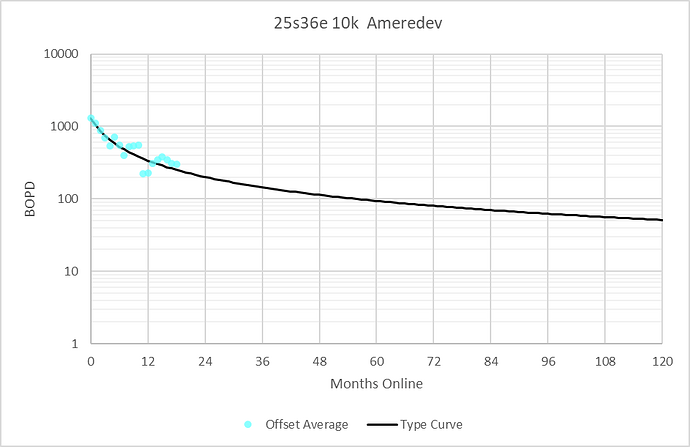

This sort of decline isn’t that big of a deal. This was an old attempted forecast I did for this area, averaged all of the wells production as a function of how long the wells were online. It was I think just the Ameredev wells but should apply to TapRock etc as well.

You’ll notice the well averages over 1000 bopd the first month. By month 12 its making like 300 bopd. Big decline, right?. But the decline flattens out over time. And the black line (a guess at the average well performance over the life of the well) amounts to over 700,000 barrels of oil in 40 years.

I’ve seen an Ameredev AFE they are no joke, like $13M per well. That’s in theory what it costs them to drill, frac, and get each well online. But lets consider that Ameredev gets 75% of the revenue (25% royalty), so they are getting 525,000 barrels of oil at lets say $60 per barrel average. So thats $31M of oil revenue over the life of the well. Plus gas, plus NGLS. With most of the money coming up front (so high rate of return). They should drill more wells

Best of luck. For whatever it’s worth, I think it’s a great thing to be curious and you seem to be a curious fellow.

I appreciate that more than you will ever know! I got dropped into the oil well stuff suddenly at age78, and at 84 I am still trying to get a grasp on just how it all works. Your time and effort has helped a lot by sharing your expertise. I am sure my constant questions about stuff that is stone simple to most can become aggravating and stupid to those in the know about these things. Thanks again for your patience and sharing!

Oil Boy is exceptionally smart, patient to explain and can be very funny. Good guy!

I have used the New Mexico Oil Conservation Division production figures to help understand things, but as of this morning their latest reported figures are for August. Have they stopped reporting or are they actually that far behind?

Don,

Its the operator, not the State. The state just reports/posts what the operator turns in. Yes, ideally there are repercussions for failure to report…but the state has a zillion wells and in my experience it takes a while (or maybe a complaint) before the NMOCD sends a notice to the operator about missing logs or completion reports or C-115s (production data) etc.

I check on 100s of wells every month for an owner and right now two of them don’t have updated info, and I don’t even know why, the remainder are all up through Oct 2021 production. I see check stubs for the ones that are missing so I know what the operator thinks the wells sold/made, so I’m not sweating it. If you are (since these are your only wells) then call up TapRock or Ameredev or whomever and ask them why they aren’t reporting volumes on your wells to the state. Presumably you have gotten checks for the missing months which have the volume info on them.

This topic was automatically closed after 90 days. New replies are no longer allowed.