I am about to tear my hair out! I am trying to clear up mess left by Chesapeake. We had around 30 wells/leases that Chesapeake sold on to various operators - Phillips, Territory, and Tapstone. Phillips and Territory we have figured out, Tapstone sold off to Diversified Energy. I am having a hay of a time getting Diversified to get us division orders. Anyone out there had any dealings with them? Most of our wells are in Nobel, Stephens, Lincoln, Beaver counties.

In Oklahoma a company must pay even it a mineral owner refuses to sign a division order. Send all companies your W-9 form and your contact information. Gently remind them that you will be due interest on your royalties.

This post is not legal, tax or investment advice. Reading or responding to this post does not create an attorney/client relationship.

Letter in lieu of Division Order.docx (13.1 KB)

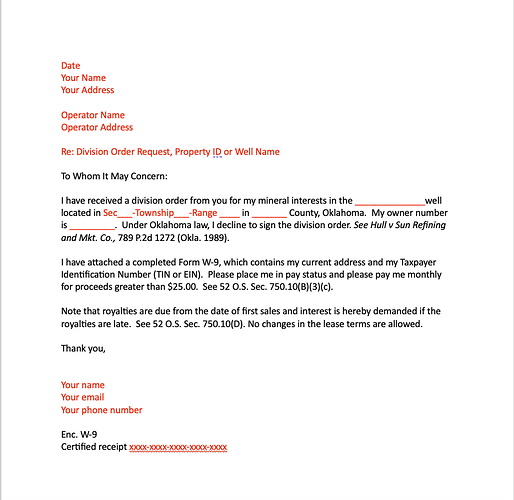

Many of you have asked about a letter to send in lieu of a Division Order in Oklahoma. Division Orders are not required in OK, but you probably want to get paid without having Federal Income Tax taken out. In light of recent court cases and OK statute 52, this is the letter template that I am using. (I am not giving legal or accounting advice.)

Fill in the items marked in red with those that pertain to your well and situation-use the Division Order information as a guide. The Property ID, wellname and the Owner number are on the Division Order. (Then turn them black) Be sure and give your address and send the most recent version of the IRS W-9. IRS form W-9 OCT 2018 blank.pdf (129.0 KB) You may give your email and phone number on the letter so that the Division Order Analyst can contact you if there is a question.

Send the letter by certified mail (fill in the numbers of Certified Mail receipt on the letter so you can track it) and keep a copy of the letter, the green card that is returned and a copy of the original Division Order for your files. Mark your calendar for when to send a second request for payment and interest if needed if the 180 days past first sales passes. You can look up the date of first sales on completion report at the OCC well records site (Test . Form 1002A) or the OK tax site. (https://oktap.tax.ok.gov/oktap/web/_/ . Use the HELP Public PUN Search option).

This topic was automatically closed after 90 days. New replies are no longer allowed.