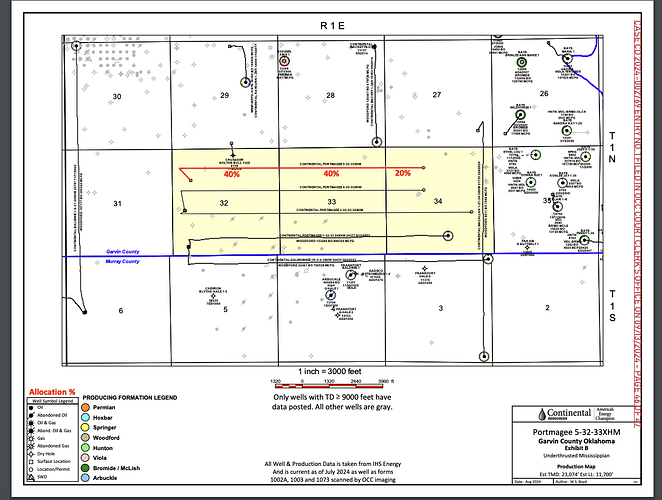

We received an offer from Dry Creek Energy to purchase our interest in 32-01N-01E Garvin County Ok. My sister and I have 8.2 acre interest each. The leases have been producing since May of this year. Our royalties are modest, less than 1K each per month. They have offered to purchase for 90k for each of us. Sections 32,33 and 34 are pooled together. I believe that is 1,920 acres.

It appears that may be new activity although I don’t know what or where.

The kicker is our ages, especially my sister, about to turn 75. Is it a good idea to accept such an offer?

Rick Rowe

Personally, I would not be inclined to sell in that section. Continental has the Portmagee 1-32-33-34XHW well which as about 12BCF for gas left to produce. You should be getting paid on it already. It has decades of life left in it although the volumes will decline. Natural gas prices are expected to rise in the next year, so that is good for your continuing income from the first well.

Continental has filed for at least three more infill wells (which is why you got the offers). You both should receive the OCC paperwork. I see your name on the respondents list. If you have not moved, you should get it shortly. It was filed on 9/13/24.

Offers to buy frequently go out just before infill drilling. They are rarely the value of the coming wells, usually just the value of the first well. If you both are of “seasoned” age, then these mineral rights are valuable to both you and to your heirs. These wells can last decades and should be included in your estate planning. The majority of the value of horizontal wells comes in the first four years and then tapers off for many years after that. So you and your sister should see raised income in the next year of so from the new wells.

Thanks so much. We have been getting paid from initial production. And Trust has been updated.

If you have a new trust name, make sure Continental is notified so you get all the mailings.

I would sell if I were you. That is a really great offer and considering your age I would sell. I doubt you will make that money in royalties and prices probably will never get that high again to purchase. A bird in the hand is worth two in the bush.

M_Barnes tells everyone not to sell ever and that is terrible advice in my opinion.

I’ve seen people pass up similar offers and prices never got back to those levels. She has some agenda that selling is bad. Taking the risk that all new wells drilled are going to make money for years is a foolish risk

What are the technical/engineering/geological/economic merits behind your stating this is a “really great offer”? I’d be interested.

Actually, there are times to sell for the right reasons. And not all wells are successful. Perhaps you have not read all of my posts. My advice is based upon over 40 years of professional experience as a geologist. Each owner has to base their decision on what is best for them. My advice for this area is just my own opinion based on my wells which are very close by. You are welcome to your own opinion.

Good idea. I believe because its an amendment it should be done. Thanks

If you really want to sell them, find some family members who could buy some or all of it. That way you get the cash and the long term profits stay in your family.

@M_Barnes provides solid advice to forum members. All professionals have their personal biases, but those are modified as to the situation. A general note on the half life of the typical horizontal well (if such a beast exists) is 2.5 to 3 years. That is when half of the commercial production has been produced. Something else for your consideration process. Good luck.

This topic was automatically closed after 90 days. New replies are no longer allowed.