Hi. I have been approached to sell my mineral interests in sections 271, blk.13, h & gn and section 38 blk. 52 t7s, t & p Reeves County, Texas. Both mineral interests are currently under lease with an expiration date late this year. The offer is considerable, 173,000.00. Tempted but wanted to ask if there is any activity in these sections or perhaps wells drilled? Thanks for any and all help.

That’s mineral interests not internal interests.

Rick -- first, how many acres are involved in each. Might I ask, ' How were you approached?' Later -- Buzz

Just out of curiosity, what are they offering per acre?

Rick that's significant money. Leasing it out, you might be able to get half of that purchase price in bonus rentals alone. And they wouldn't buy it if they didn't think they could turn around and lease or develop it. Am I making sense? I don't think "activity" today means there won't be activity tomorrow. You ought to see if properties around you have been leased. Some here may have links to maps showing what is leased and what is not.

Buzz - offer is a letter in the mail followed by 2 emails. Have to look for acres for each section.

Casey - it appears 6,000 per net mineral acre.

Rick,

You're sitting in a great area for future production. Numerous Horizontal wells to the south and southwest of your Section 271. Link to completion report on well API 389-33656 next door to the Southeast:

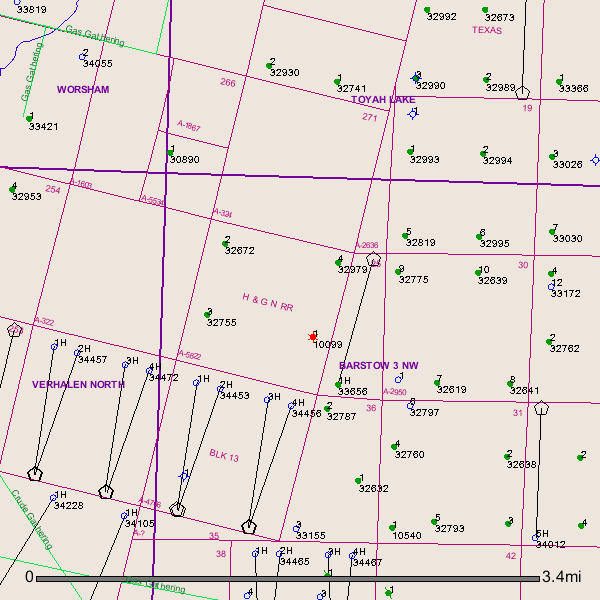

GIS Map of Reeves County Section 271/Block 13/A-324 and surrounding area:

Clint Liles

Rick -- in the areas you describe, the unanimous answer to your question on this forum is 'NEVER SELL YOIUR MINERALS'... unless you're going to file for bankruptcy tomorrow... Hope this helps. Later -- Buzz

PS - also, there is 'activity' all around you.

Rick - there is a lot of activity in the area. Your Section 38, Block 52 T7S acreage is pretty much surrounded by permitted wells of Clayton Williams Energy and Atlantic Exploration. Section 271, Block 13 isn't surrounded but there are some wells permitted nearby. You don't have any wells permitted on your sections yet but it's probably just a matter of time.

That looks like a great area. I've also heard that people are currently getting offers for $9000/acre. Unless your minerals are burdened by some non-participating royalty interest, I'd say that $6000 is a low ball offer.

If Casey's right, you can get the whole offer in bonus rentals and still own the mineral interest with a 25% + royalty if you hold and lease it out. Buzz and Clint are right on, don't sell.

Sounds good guys. Thanks. Won’t sell, but will wait for a lease offer. Anyone know a good Texas attorney or landman that would negotiate leases and review Division Orders for me? For a reasonable fee of-course.

I am in blk 13 and we have 3 very active wells going. If they want it that bad there is a reason!!!!

The hydrocarbon bearing column of all the different thicknesses of the oil bearing portions of the rock layers beneath the surface is anywhere from 1200 ' to 3500' in this area of the Delaware Basin due to the many layers, the stacked layers (plays) of oil and gas bearing rock strata.

Just one acre has the potential to produce royalties of 173,000 dollars over the life of production, at just the current level of extraction efficiency.

Now think how much it would be at improved levels of extraction or recovery from the oil fields beneath the acreage you hold.

There is a lot of hydrocarbons down there. They will keep coming back to lease with royalty cut for you as the technology improves and more oil will be extracted.

Put it this way, your acreage is like owning an oil tank that is 12 to 35 feet high if you base oil content of the rock at one percent. Current technology allows an extraction of one percent of the oil in place, if we calculate by square foot, so 12 cubic feet of oil is 12 x 7.4gallons which is 88.8 gallons. 88.8 gallons divided by 42 gallons is 2.11 barrels. 2.11 barrels times .01 ,is .02114 barrels. Royalty rate is 25%, .02114 x .25 is .00528 barrels,

.00528 barrels times 43,560 square feet of an acre is 230.24 barrels. 230.24 barrels times 100 dollars is $23,024.oo an acre in royalties.

So 29.7741 times 23,024, $685,535.oo

And this estimate is the most conservative at just a recovery rate of 1% of oil content of just !% in the rock. Recovery rates of 10% are predicted for the near future techniques and oil content of the rock varies from 1% to 5%

Rick, we have been using Martin Gibson with Locke Lord in Austin, Texas, and we've been impressed with his attention to detail and his quick responses.

Thanks everybody for your responses.

Whatever money you would get now pales in comparison to what the buyer will get. Even if you have to wait, the infrastructure in Reeves will be significantly better next year, 2015, and with pipeline takeaway getting better drilling will only increase. There are huge reserves per net mineral acre with a recover per net mineral acre of an estimated 3-20 million barrels of oil per acre recoverable with current technology. Never, repeat, Never sell.

A friend of mine got offered $75K to purchase his 3.0 nma spread over two sections. This happened last week.

Buddy CottenBuddy, according to my not so good math that is $25K/NMA.

Seriously???

Sarah? May I ask you what the source of your information is?

If you cannot disclose because it is a confidential source I will accept that.

And, please understand, you are under no obligation to reply to my request.

Sarah Moran said:

Whatever money you would get now pales in comparison to what the buyer will get. Even if you have to wait, the infrastructure in Reeves will be significantly better next year, 2015, and with pipeline takeaway getting better drilling will only increase. There are huge reserves per net mineral acre with a recover per net mineral acre of an estimated 3-20 million barrels of oil per acre recoverable with current technology. Never, repeat, Never sell.