Hello!

We own 53 acres in Culberson County (43 and 10 acre parcels), which on one parcel sets a gas well operated by Cimarex. The legal descriptions are:

AB 2297 BLK 59 SE/4SE/4 SEC 40 TWP 1 T AND P RY (Street Sense 40 Unit No. 1H sit on our property)

AB 2293 BLK 59 NE/4SW/4SW/4 SEC 46 TWP 1 T AND P RY (I believe we’re pooled into Stone Street 46 Unit No. 3H)

We have always received unsolicited inquiries to purchase our mineral rights (26.34 NMA), but over the past two years, the offers have climbed dramatically. They started out at about $250,000 and now range over $600,000.

The last “high end” offer was bumped up about $100,000 after I turned them down and the agent conferred with the energy company’s petroleum engineer.

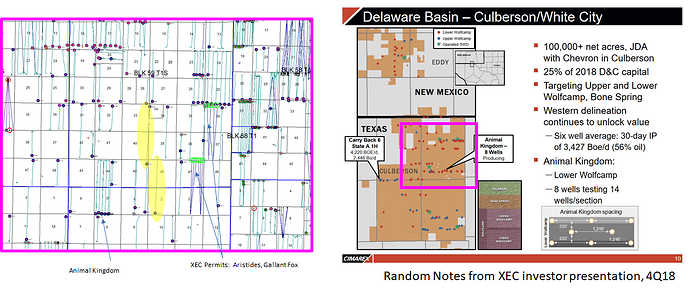

According to the GIS maps, BLK 59 SEC 40 and SEC 46 look relatively barren of activity, compared to the other SECs and BLKs around them.

Does anyone have any idea what is going on in BLK 59? It definitely feels like the “experts” know what is going on out there and we don’t have a clue, hence the ever-climbing offers. Getting ready to put in more wells? Lay more pipeline? Build a water facility? We haven’t been contacted by Cimarex or Chevron.

Any input would be greatly appreciated.

Traveler

Traveler,

I am in your exact same area, so howdy Neighbor!!! I am seeing the exact offers you are referring to, I have 10.75 acres of minerals I own and have offers above 250,000.00 to purchase them. I also have no feedback or idea of what activity is expected, but receive approx 10 offers per month average from either phone calls of mailings. I am very interested in the future plans as well, the monthly checks have been gradually decreasing, yet the offers to purchase have been gradually increasing, and obviously the hundreds of companies or individuals making these offers have some sort of knowledge to justify approximate offers, so what is this that is allowing for the increases? Can anyone enlighten us as to what might be the driving forces behind this?

Any feedback is greatly appreciated!!!

Chuck

Traveler and Chuck…

Clayton Williams new venture is acquiring mineral rights all over

Culberson and Hudspeth counties. They have a plan, but it’s not

being divulged. Rumor I’ve heard is that Clayton may drill as many as 20,000 wells over a 4 year time frame. Culberson is going to

become THE hottest area of the Delaware and OroGrande basins.

They can compete with Chevron and other multinational conglomerates because Clayton has NO Debt and 7.5 $Billion to work with. But, Clayton, et al, are cagey about their plans…and they

are mercurial, subject to rapid changes.

:stuck_out_tongue_closed_eyes:

1 Like

Lawrence, I thought Clayton Williams Energy was sold to Noble in 2017. Are you saying that Clayton Williams is starting a new company with the billions gained from the sale to Noble?

And do you have any idea of where in Hudspeth the interest is? I have property there as well, but have never had any interest generated.

Thanks,

Traveler

That’s what I’m saying,as plain as I can say it. What the name of the

new Clayton Williams E&P company is…I dunno.

Look back in the MRF archives and read up on the Orogrande basin

strike in Hudspeth. I think it was just NE of Sierra Blanca mountain,

but I understand that part of the Delaware covers ALL of Hudspeth

county. And they are buying up mineral rights all over Culberson county…Clayton intends to make $15 to $20 Billion this time around, especially since the stacked shale plays continue down below 22,000 feet in Culberson.

I expect the IH10/20 corridor to sprout a bunch of polypropylene pipe and tank extrusion/manufacturing plants from just the gas in

the area. Liquified methane will become THE propellant of choice

for the space exploration industry by independent development

companies…and natural gas is 89% methane.

2 Likes

Lawrence,

I’m no expert on these shale play maps, but the available stuff suggests the Orogrande is limited to far NW Hudspeth and Delaware is limited to far NE Culberson.

I’m on the “Diablo Platform” 12 miles NE of Van Horn in Culberson and getting low-ball offers on minerals I’ve always assumed were worthless. Not a chance I would accept them, FWIW.

But what’s up in that region?

Thanks for your insight.

Lawrence,

I assume that you have the research / or personal relationships necessary to state that “liquified methane will become the propellant of choice for the space exploration industry by independent development companies…”?

I appreciate you weighing in on my question, but I agree with the maps Robert has seen. Your information seems to be quite optimistic for the entire region, while predicting even for the space industry.

Thanks for answering, and not meaning to be offensive, but I’m not sure, without knowing who you represent, that I quite believe your prognostication.

Thanks,

Traveler

The liquid methane assertion doesn’t require any special relationships or personal bench research. Anyone with an internet connection can verify that for themselves.

Blue origin and SpaceX are both laser focused on developing rockets for liquid methane, rather than hydrogen. SpaceX’s recent hydrogen fuel explosion is a ready example of why.

I should add, however, that these rocket projects will add a fraction of One percent to the total demand for methane. Whether rockets use methane or hydrogen is basically a rounding error in regards to future natty gas demand.

The replies so far are optimistic, obviously something is driving the offers up. Certainly would like to have some sort of firm information, something has got to be going on, this many people do not drive up offers without some sort of solid data to back it up.

Still hoping for some others to jump into this conversation…

Chuck

And for oxidizer, they aren’t using Liquid Oxygen (LOX), they

are liquifying Ozone (0-three not 0-two) So it is half again as

effective as liquid oxygen burning liquid methane…that gives

the SpaceX and Blue Origin rockets a lot more ‘throw weight’ or

payload as a similar booster using liquid hydrogen and liquid oxygen.

I’m only interested because the oil and gas industry of the Delaware

basin can supply endless amounts of liquid methane and liquid ozone at cheap rates that no other place on Earth can match…a real boon for us!!

ol’ Lawrence in Verhalen

2 Likes

Traveler…I don’t represent anyone but …myself.

1 Like

A post was split to a new topic: Surface Rights

A post was merged into an existing topic: Surface Rights

Lawrence,

20,000 wells over 4 years is quite a few wells. That’s basically 450 rigs running, churning through $50B a year. Clayty was doing less drilling than that at those bordertown brothels back in the day. Maybe we got a few extra zeroes running around in there somewhere.

As far as Block 59 goes, I could see somebody who is going to hold that long term, and knows nothing special, going up to mid-teens per NRA for that. So say $14k time 52NRA = a bit over $700k. Maybe. I don’t think there is anything crazy or mysterious going on here. At some point somebody will put in more Deep Wolfcamp condensate wells on your acreage. There is no indication that is happening soon. I guess if you have a Cimarex drill schedule in hand you could be more aggressive. But I would say “over 600k” is a pretty fair offer. If the units are covered in wells in 2 years, then it was a low offer. But lord knows, there are far far too many wells to be drilled by Cimarex across their portfolio to say that with any confidence at all, might still have nothing else in 5-10 years. You’d think near-term they are going to be pretty obligated to pour wells into the Resolute acquisition, which should limit things elsewhere.

Will freely admit that I don’t know what kind of realized gas pricing Cimarex is getting, that would seem to drive the attractiveness of drilling more wells here.

Clayton Williams did not get good results with their big Block 13 position. Maybe they were just early but others seem to have figured it out.