There is nothing currently happening there.

I mean Matador has approval to force pool the N2 of Sec 25 and 26, but that is it. If you are not leased I would get leased to Matador, first and foremost. I assume you are leased and held by the EOG deep vertical well, but maybe not. If you are, your royalty rate probably is less than 25% as it’s an older lease. But let’s assume its 1/4, the best case.

Other operators in the area are Mewbourne and Devon. Like you say, not much current royalty there, I assume you are getting paid small amounts on Carson City 25 by EOG. You don’t have any horizontal wells, there is very little correlation between what you are currently getting paid and the value of this.

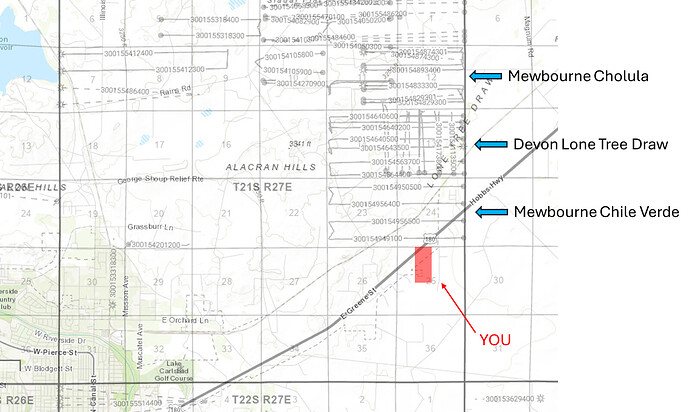

Here is a map of the horizontal wells drilled in this area.

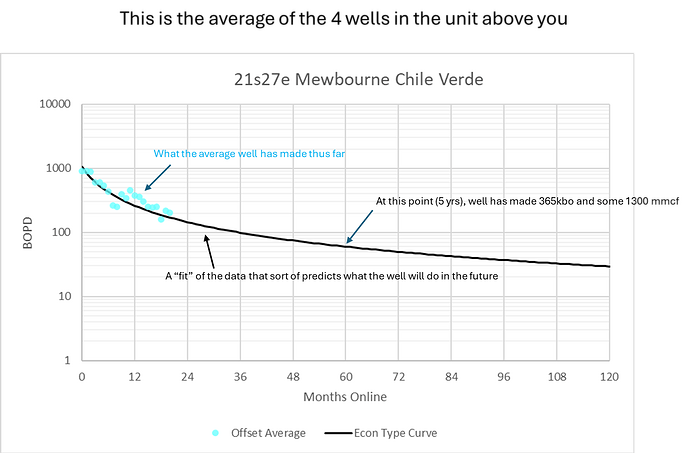

Note the 4 Mewbourne wells just north of you, called Chile Verde. They have been online since 2023. Here is how the average of those wells has produced and a guess at how they will continue to produce.

Let’s say hypothetically Matador drills 2 wells in the N2 of Sec 25 and 26 (in your acreage), they drill them in 2 years from now. If they produce like the Mewbourne wells, in 5 more years they will have made a total of 730,000 barrels of oil and 2.6 BCF of gas. If you own 40 acres at 25% royalty, you will get 40/640 x .25 = .015625 (1.5625%) of the revenue from that. IF these wells are drilled. At $70 oil and $2 gas, that means your share would be like $880k, from 2027-2032. Then you’d get more revenue in years 6+, plus even more if other wells get drilled. BUT, IMO, that is a reasonable total amount to expect to get paid for 40 acres leased at 25% today.

Just as some perspective. If your lease is less than 25%, just ratio it accordingly. You may have gotten offered more, maybe less, but this is a general description of how someone might value the wells on your property that do not currently exist (and might never exist, in fairness).

If your predecessor in title is leased you can find that in the Eddy County courthouse records. There were a whole bunch of leases signed in Sec 25 in the late 90s prior the vertical well being drilled, I didn’t look through them all to find your tract, but the ones I saw were 3/16 royalty (so 75% of the $ numbers I said above).