Curious if anyone knows which companies are currently operating in section 27 of Grady County. So far, I’m only getting lease offers from brokerage companies. Looking to bypass the middle man.

There are lots of Section 27’s. You need to supply the township & range. Brokerage companies are not middlemen. They are hired to do the work they are doing.

Section 27-9N-8W. Took me forever to find the paperwork! We leased it 6 years ago, and finally received another offer from Dutton Resources. Unfortunately, the offer ($650 per net acre & 1/5 royalty, we own 6.66 net acres) is 1/3 our previous lease offer. I don’t know how to go about figuring out if this is a reasonable offer. The landman said he is currently leasing around 500 acres around us. Does that impact offers we might receive?

Bonus amounts are driven by competition. In general, my offers all over OK have been down over the last year.

As far as “reasonable”, I look at the pooling orders within the last year in the contiguous sections. Citizen pooled section 22 just to the north of you in October 2022 for $1600 1/8 or $1000 3/16 or $500 1/5th, so yours is a bit better.

If you are new to leasing, it would be advisable to get a good oil and gas attorney to look at the draft lease by any leasing agent. Most of them need significant edits to be more fair for the mineral owner. You can also wait for pooling as that has its own advantages.

This does not pertain to leasing but an offer to buy.

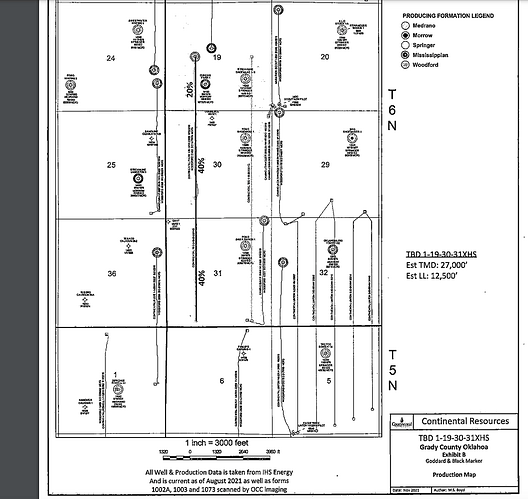

Grady County. Section 19 and 30 T6N R6W.

If you owned in these sections, what amount NMA would you consider to sell today?

I do not know about selling numbers, but Continental has filed for increased density in 19/30/3-6N-6W. You may be getting offers due to that case. Sections 32 & 5 already have six wells, so there may be more in the future.

In your opinion, what would be a reasonable price nma to sell. I appreciate your honesty and opinion

Since you asked for numbers…let’s say they drill five wells like they did in 32 & 5, the original Woodford Linton well there has done 3 BCF in 8 years. The five new wells have averaged 125 MMCF/month in the first thirteen months, two in the Mississippian and three Woodford. You can see that they come on strong and fall off the proverbial cliff. One acre leased at .1875 gets .001171875 of revenue, which is about $8MM in eight years based on historical nat gas prices = $10,000. Discount that at 20% for PV and it’s worth about 1/4 of that although that’s not accurate because you’re getting more money back early as shown. Say 2500/well with room maybe for a couple more in the Mississippian and Woodford down the road…or a refrac, or other formations, and 15,000/acre seems about right for not knowing anything.

I appreciate your knowledge…THANK YOU!

God Bless you and all on this forum.

I own a small percentage in 10 acres of undivided family surface and mineral rights in 30-3N-6W (currently signed with Continental in 20-4N-5W). Just hoping for an offer; should i contavt Continental or figure out exact gps location in relevance to exact well permits for that section? I can’t thank you enough for your wonderful community of informstion, patience and loyalty. Watching the Kem Ranch wells come to life has been fun!

30-3N-6W is outside of the main drilling area of interest right now. It is VERY deep gas if anyone ever gets interested. The OCC has no wells listed for that section.

Very unlikely to have any interest in the mineral rights in that area at this time. Surface acreage is a real estate question and the forum does not deal with real estate.

Thank you, Martha! I keep trying ![]()

This topic was automatically closed after 90 days. New replies are no longer allowed.