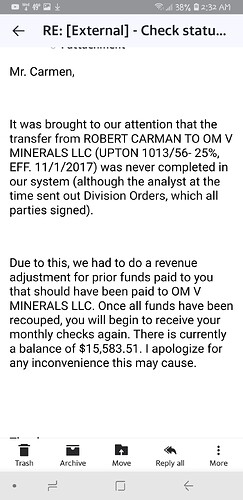

This email raises several serious questions for me.

First, as a division order analyst with more than 40 years of experience, it has been decades since I worked with any database system that will print transfer orders (division order issued when ownership goes from one owner to a new owner) unless the account losing part of its interest is reduced to what they were supposed to receive all along. That prevents continuing to pay the removed portion to the wrong owner. Is the company involved here still using antiquated Microsoft Excel to manage ownership records, instead of a modern database system? I doubt it.

Second, even if the 25% portion remained in the name of Robert Carman, why was the 25% at the very least not suspended using the code for “transfer pending”, leaving only the remaining 75% in pay status to receive payments? This, too, would have prevented overpaying you anything.

Third, the company record shows that the transfer of the 25% was effective 11/1/2017. Was that the effective date in the deed (or other conveyance), or is that the date that is the “first of the month following 30 days after receipt of proper documentation”? If it’s the 30-days-after date, it’s a correct date, but if it’s the effective date stated in the deed the company went too far back in their recoupment–you don’t owe that much back to the oil company. The analyst is not properly trained, and thinks they must recoup from you when they are not supposed to automatically recoup from the effective date in the deed forward. The recoupment should be from the production months beginning from the 30-days-after date, forward.

Fourth, the question about the correct effective date aside, the email says the remaining balance to be recouped is $15,583.51. That means the overpayment amount maybe started out higher than that. The original amount should be only 25% of what was originally paid to you for months of production from 11/1/2017 forward (at the most). Do your records show you were paid more than $62,334.04 (remaining $15,583.51 divided by 25%) for all of those months of production combined?

If this were my situation, I would question whether the analyst even worked the ownership transfer correctly from the beginning. This email indicates to me, as an experienced division order analyst, that there is a possibility that it was worked incorrectly. That means you may, or may not, owe as much as $15,583.51 remaining, if you ever owed anything at all. Do you have a copy of the deed (or other conveyance) that takes 25% away from your interest and gives it to OM V Minerals LLC? Or was this an automatic reversion of interest provided for in a previous deed, a reversion that occurred in September or October 2017 and effective 11/1/2017 (either by date or by production revenues volume)?

Like I said, I have lots of questions about this transaction.