Below is an excerpt from a transcript of Oxy’s 2018 Q2 earnings call which may shed some light on the company’s mysterious leasing program in Gaines county.

"Brian Singer - Goldman Sachs Group Inc., Research Division - MD & Senior Equity Research Analyst It does. And then just kind of going back a little bit to the capital allocation and then thinking even more strategically, kind of two follow-ups. The first is, you talked about your flexibility to pull back on CapEx in the event of unfavorable commodity prices. What, if anything, would you need to see to pull back to allocate more towards share repurchase? And then, from a use of excess capital perspective, given that you’re increasing activity in the Permian, does the potential increase to your decline rate increase your interest in low decline rate M&A or new projects on the EOR side?

Vicki A. Hollub - Occidental Petroleum Corporation - President, CEO & Director Over time, we do want to pick up more conventional activity and projects. We actually have – some of the incremental in our capital allocation is going to the Central Basin Platform and EOR to drill horizontal wells in conventional reservoirs. So we’ll do some things to work on mitigating the decline of the Permian Resources business. Some of our work in international, which I’ll let Ken describe here in a minute, is also going to address that same thing. So we’ll let Ken address that, and then we’ll come back to the share buyback issue."

Ken Dillon - Occidental Petroleum Corporation - Senior VP & President International Oil & Gas As I mentioned in a previous call, one of the projects we’re working on is the TECA steamflood in Colombia. So far, the pilot appraisal’s performing above expectations, and it’s a classical Oxy International project implementing EOR techniques to an existing field discovered in 1963. We expect the green light before year-end and expect to reach about 30,000 barrels a day gross in phase 1. Initial response shows wells going from 6 barrels a day to 58 barrels a day with the impact of the steamflood.’

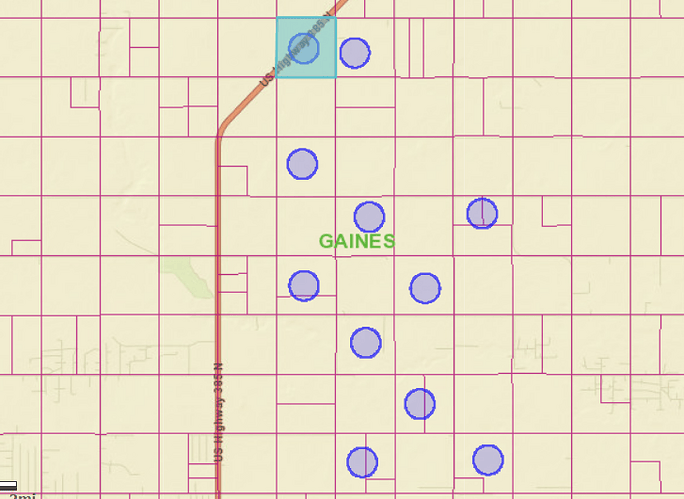

In replies to this post, I will share blocks and sections in which land companies have assigned recently acquired leases to Oxy. As of this writing, it appears some of the targeted sections have been only partially leased.

**Byrd Land Services, Inc., Sterling Land Company,Tacoma Energy Corporation, and NRG Land Resources, Inc. are four which have leased a good bit of acreage. ** If you know of other land companies leasing for Oxy, or if you have an idea what the company might be targeting in Gaines county, please reply.

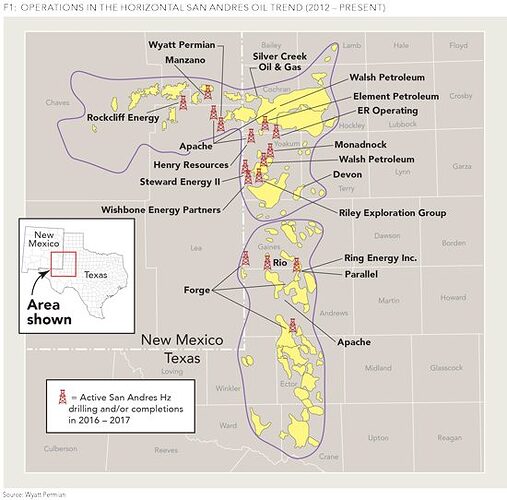

I wonder if Oxy may be considering something like this with the Clearfork in Gaines county:

Horizontal Injection and Production Wells for EOR or Waterflooding

“Our results show that a very favorable configuration occurs when two opposed horizontal wells are drilled from injection and production wells so that the opposed laterals are parallel in the patterns, and extended until the horizontal parallel in the patterns, and extended until the horizontal segments almost meet midway between the like wells. Compared to five-spot patterns with vertical wells, opposed horizontal wells can increase injectivity (injection rate per applied pressure drop) by as much as a factor of ten, depending on well spacing and formation thickness. Areal sweep efficiency can be increased by 25% to 40%. The horizontal-well advantages are greatest for thin formations with wide spacing, and decline significantly for thick formations and/or close spacing…Because of the better sweep efficiencies, faster flooding rates, and/or lower injection pressures that are possible with horizontal wells, all EOR methods should benefit by their use…”