contact the DMR and ask them for the active cases and exhibits for the location of your mineral rights.

it may be a drilling/spacing unit of 2 sections.

and on top of that a pooled drilling/spacing unit of 4 sections.

i think your request will be taken care of within the week, that you will receive the exhibits and they may also send you the audio files of these cases.

when 4 sections (2 drilling/spacing units) are pooled together, they are likely drilling on the boundaries. they may be drilling into 2 or more oil-bearing soil layers. they do not take away from the current drilling/spacing unit. rather, they are able to drill on a border of drilling/spacing units to “avoid waste”. if they did not drilling on the border, that oil would not be accessed and therefore they are arguing that it wastes oil because it is not exploited. when they drill on the border, they will pay all mineral rights owners in the 4 sections.

after you get the docket cases (pooled 4 sections, and your sections), you could ask for a copy of the permits of the wells involved. that tells you depth, etc.

bear in mind that the current way to drill is to establish an ecopad, usually on a border of a drilling spacing unit, which is used for several wells. the laterals may go into other drilling spacing units or the laterals may go into this drilling/spacing unit or mixed because the laterals may go into this drilling/spacing AND the laterals go into another drilling/spacing unit (like along the border or like the drilling/spacing unit just north or just south or just east or just west).

DMR has a map and i think you should look up your mineral rights and keep enlarging it until you isolate your drilling/spacing unit and nearby drilling/spacing units. it’s called GIS. you can click on find section and put in your section, township and range, then 5 miles so that you can see it closely. maybe take a picture of that so you have it to refer to in all of this. the exhibits will contain maps also.

i do not know if you received these mineral rights through homesteading, but this might be fun to research. Home - BLM GLO Records

take search documents tab, click on state of north dakota, county, then township range and section and find the homesteader documents.

then there are these historical maps:

North Dakota Antique Maps and Historical Atlases - Historic Map Works

the State of ND DMR will want people to be paid one way. you need to discover what is the current method.

there are not 2 ways.

the company that submitted the docket for your 2 section drilling/spacing unit is the oil producer, the majority drilling interest or the significant interest that others agree is the oil producer. that 2 section drilling/spacing unit governs.

from there, they take your acreage/acreage in the drilling/spacing unit. that is your mineral interest.

formula goes: month volume of oil x your mineral interest in this drilling/spacing unit x price of oil (is this an averaged price, probably) in the runs x your royalty%.

in this example, i am supposing you have 160 net mineral acres and your royalty is 18.75%.

you may know your well had 200 barrels of oil per day for 30 days or you may know you had 6,000 barrels of oil for that month. 200 barrels of oil x 30 days=6,000 barrels of oil

as an example, say you had 200 barrels of oil/day x 30 days x (160/1280) x $52 x 0.1875=$7,312.50.

and 160 acres /1280 acres is 0.125

they do the same formula for natural gas but price of natural gas is very low.

runs are what they haul out of there or the volume of oil from your well into the oil pipeline. runs are what is sold.

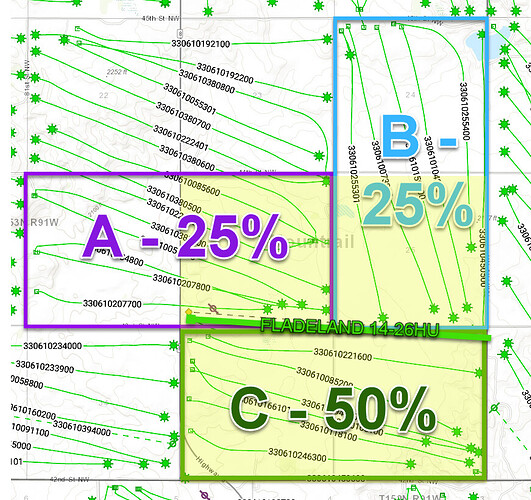

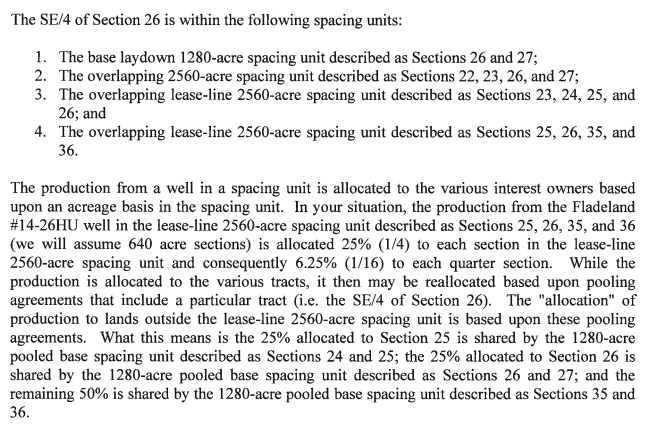

but with the 4 section drilling/spacing unit, the one that was combined on the border, there is a different formula. the difference is in the mineral interest portion. now they are using 2,560 acres as the drilling/spacing unit for those that are on the border. so i am using everything the same EXCEPT changing the drilling/spacing unit. i assume you have 160 acres again.

200 barrels of oil/day x 30 days x (160/2560) x $52 x royalty 0.1875=$3,656.25

see, 160/2560 is 0.0625 now

and if they put 4 drilling/spacing units together, then you have 5,120 acres in that drilling/spacing unit.

see, 160 acres /5120 acres =

200 barrels of oil/day x 30 days x (160/5120) x $52 x royalty 0.1875=$1,828.13 because i rounded up half a cent.

if you have property in 1 drilling/spacing unit, you get paid on that.

if you have property that is in 2 drilling/spacing units because they are put together and they are drilling on the border of those, you get paid on that.

if you have property that is in 4 drilling/spacing units because they are put together and they are drilling on the border of those, you get paid on that.

so each time they put drilling/spacing units together, they are drilling on borders and that oil money is in addition to the money you get from your original drilling/spacing unit.

it does not matter if you are not getting as much $ as someone in an adjoining drilling/spacing unit. that is because their well might be newer so the volume of oil coming out of it might be larger than your older well. you can’t get their $ anyway because it is from their drilling/spacing unit. just remember, average amount of oil that comes out of a well is a little north of 1 million barrels total volume, whether the oil came gushing out right at the start or whether the oil just flowed out with a lower but more stable volume. some wells that produced more than 10,000 barrels/day were producing 150-300 barrels/day by the end of the year and might stabilize around 100 barrels/day for a while, declining more slowly.

so yes, you could be included in 3 types of drilling/spacing units that all have different calculations depending on the size of the drilling/spacing unit. putting 2 or 4 or more drilling/spacing units together does not change the original drilling/spacing unit, and only increases your volume for your royalty for those laterals that were drilled on the border between the drilling/spacing units put together.

your lease will be active until all the wells in your drilling/spacing unit become inactive. they have to lose $ on the oil wells in your drilling/spacing unit for the lease to become inactive. that point is usually around 12-20 barrels of oil per day x the average of the price of oil that month to be around breakeven price to operate the well. if all wells get to that point in your drilling/spacing unit, and they drill one more well and it produces, that will still keep your lease alive. this is a likely situation when your wells stop producing as much oil as today.

i am hoping this all makes sense to you.

i would want the exhibits submitted of the docket cases of all of the drilling/spacing units where my mineral rights were located. you might want a copy of the permits so you know the target soil layers of each. the audios of those docket cases would have the expert witnesses for your case, the judge, the DMR person at the hearing, the company engineers.

the audio and docket case information is available in the premium subscription of the DMR. you can ask for the exhibits and audio of a particular drilling/spacing unit and they will send it to you, if you only need a few of the cases. the scouting tickets are available on the basic subscription, which give you a historical record of what they turned in for runs for your wells.

you can contact your landman to explain things to you. this is their job. do not be afraid to ask them questions. they are not your “friend” but they can be helpful.

suzanne hamlet shatto