Permian Players.pdf (348.7 KB)

Roy, Do you look at free cash flow?

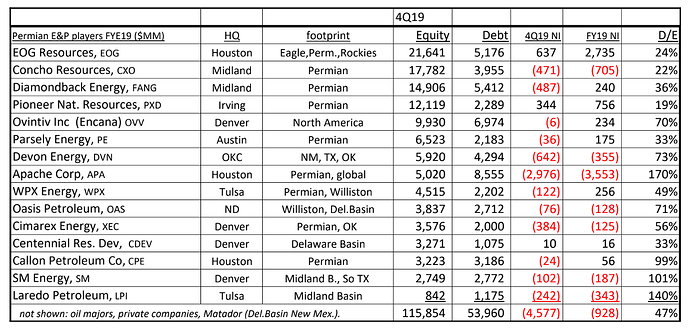

I was tempted to capture FCF, but decided against it for two reasons. First, to keep the chart pretty simple and uncluttered.

Secondly, I consider GAAP income very important, and the companies want shareholders and Wall Street to focus on cash flow and not the huge impairments and GAAP losses. Most of these 15 companies bragged about having good or solid quarters, yet they lost $4.7 billion as a group in one quarter, and their shareholders equity declined 13% in 4Q19 despite their positive FCF.

In fact, most of them never mentioned impairments in their earnings calls or quarterly presentations, but went to great details about FCF, capex, dividends etc

This topic was automatically closed after 90 days. New replies are no longer allowed.