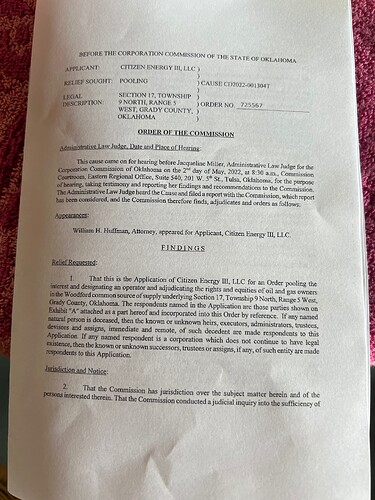

I just received the pooling order dated 5/16/22. Any advice will be more than welcome!! Here are my options. Thank you in advance ![]()

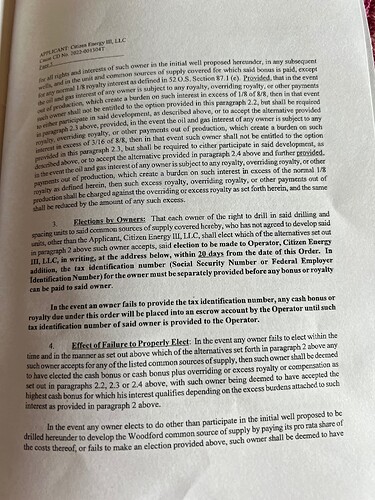

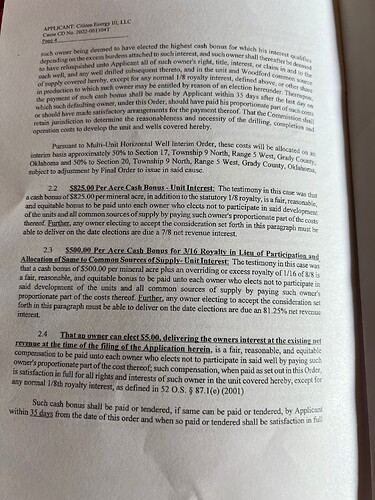

Many of us take the highest royalty since that usually pays off in the long run, especially if there are additional wells. In this case, there is an increased density case, so that is good to know up front, so 3/16ths looks good here. You only have 20 days from the date of the order in which to reply. Send a letter with your name, address, description of acres, Case Number and Order number and be clear about your selection. I send mine by certified mail, return receipt so you you have evidence of the mail date. Many folks also send a copy to the Corporation Commission.

Ok 3/16 is the second option listed correct? Thank you so much!

YES, Also send in a W-9 or you will have fed tax taken out.

I don’t have to pay federal taxes on this??? Thank you again!!

You may have to pay taxes on the bonus and the royalties depending upon your tax bracket, but they will not withhold them for you if you turn in the W-9. Some people want them to withhold the taxes. Some companies will not pay the bonus if you don’t turn in a W-9. Some companies balk at paying royalties if you don’t turn in a W-9.

Wow good to know! Thank you

My practice is to file a copy of the election with the OCC within the 20 day time limit in addition to mailing as instructed.

This post is not legal, investment or tax advice, it is for discussion purposes only. Reading or responding to this post does not create an attorney-client relationship.

This topic was automatically closed after 90 days. New replies are no longer allowed.