Exxon is a major player in one of the hottest oil plays in the world right now: the Permian Basin.

Right now, nearly 3 million barrels of oil is extracted from the Permian Basin on a daily basis, making up almost one-third of our total output.

So the fact that Exxon doubled its Permian acreage in 2017 and plans on boosting output in the play by 600,000 boepd makes that temptation to buy grow a little more.

That is, until you look at the rest of the field.

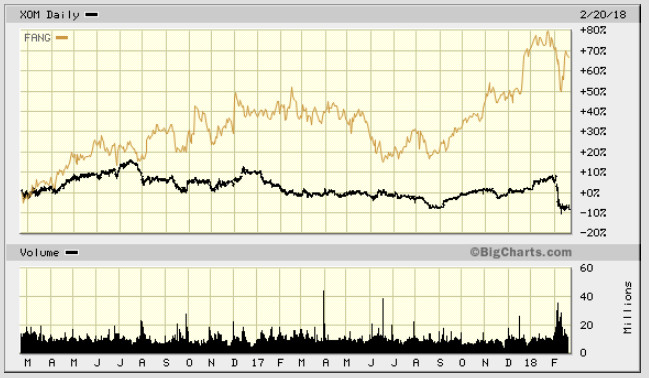

Take a closer look at Diamondback Energy (NASDAQ: FANG), for example.

Not only has it outperformed analyst expectations quarter after quarter for last two years, but it’s also trading at a fraction of Exxon’s market cap.

And it’s one of several smaller players that will put Exxon’s performance to shame. Since the last major bottom in oil in February of 2016, the returns haven’t even been close:

This is the kind of buy-and-hold investment that still has enormous growth potential.

Over the next few weeks, we’re going to shine the spotlight on a few other oil stocks worth a second look.

//////////////////////////////////////////////////////////////////

Lots of interest in ‘upstart’ oil and gas companies in the Permian and Delaware basins. The situation in the southern and western Delaware will only get hotter.

BTW, in Reeves and Loving counties near Orla, another ‘upstart’ oil company is drilling wells…BlackMountain. And, their stablemate Eclipse Midstream Svcs is running infrastructure pipelines all over that area.