Recap. Thx for educational thread. Big picture: I was puzzled by no production from 3 of 8 new wells … 2 of them are child wells, 1 evidently failed during drilling.

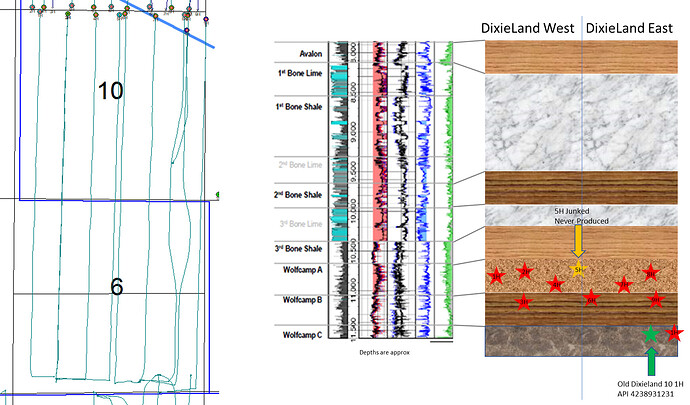

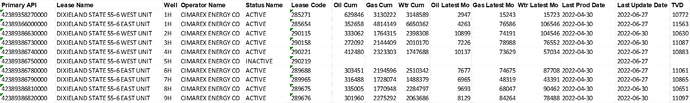

This development Dixieland State 55-6 by Cimarex (nka Coterra) 1280 acres Reeves County … 2-mile laterals, all categorized as gas wells (for tax benefit). Operator had 3 old wells, applied for 8 new wells Nov-2019. Covid pandemic exploded 3/2020. 1 of the 8 new wells evidently failed (5H, API 389 38675) in Feb-2020 as shut-in producer, w1 code Z “unperfed completion”. Commenters opine 1%-3% of laterals fail. The other 7 new wells commenced production Nov-2020.

CEO lauded Dixieland as improved productivity, fewer wells produce same as past tighter spacing, called it a “triple stack” (Earnings call transcript 8/5/21). PowerPoint slide describes “Dixieland 7-well project, spacing implies 9 wells/section”, superior production per foot than legacy 12-14 wells/section. No mention in earnings call that 5H apparently failed, or if Dixieland was intended to be an 8-well project. You wonder if operator will return to drill the aborted 5H path, because 5H leaves a void in the lucrative 10,600’ Wolfcamp A sweet spot.

“Triple stacked” = new wells 220’, 450’, 650’ below top of Wolfcamp 10,419’.

General rule: gas wells report production individually on separate leases, not combined. However, 2H is parent to 3H child, 8H is parent to 9H child, so 3H & 9H do not report production on TRRC GIS drop-down panel. The parent/child wells are vertically separated by 450’. TRRC emailed me 2-3H & 8-9H “are part of a stacked lateral set. All production are filed to the ‘reporting’ wellbore. The production on the child wells are reported to and combine with the parent well’s production.”

Parent/child wells do report separate production on the state Comptroller CONG website.

Not sure how to identify or link parent-child relationships. RRC drop down panel for child well 9H (API38938682) completion: type well “Not eligible for allowable”.

Spacing continues to evolve. Possibly, onshore multilateral well drilling may be deployed more in the future, especially when Permian tier-1 acreage is depleted. Multilaterals, laterals sharing a common vertical shaft like tree branches, are established technology, but uncommon onshore. Dixieland is not multilateral wellbores.